Representatives from Verizon, SaskTel and Bell Mobility note mobile data demand points towards small cell and DAS, though challenges remain

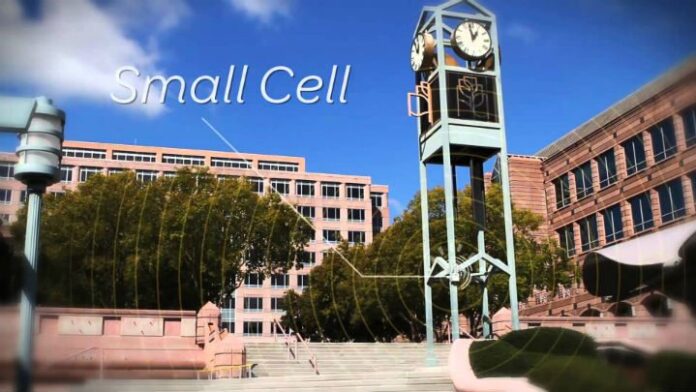

LAS VEGAS – The distributed antenna systems and small cell market has been one of the many “it’s coming next year” segments of the mobile telecom market that always seem to be just out of reach. Analysts and industry proponents have for years been predicting big things from the use of smaller antenna solutions, predictions bolstered by carriers themselves touting their own support for such deployment models.

Well, that time could indeed be nigh as representatives from a trio of wireless carriers speaking during a keynote address at this week’s DAS & Small Cell Congress indicated that while challenges still remain, growing demand from consumers and enterprises is forcing the issue. And, it’s that enterprise need that looks to be pressuring at least one carrier from the panel to act.

Dennis McColl, principal member of the technical staff for maintenance engineering at Verizon Wireless, noted the enterprise market has a lot of untapped potential, but was more complicated than many might realize. Looking to tame some of those complications, McColl said the carrier was about to release a formal process designed to better manage enterprises interested in purchasing their own DAS or small cell equipment.

The move is seen as a way for wireless carriers and their enterprise customers to tackle the challenging business model environment still circling the small cell and DAS market. The enterprise market for in-building mobile infrastructure has tripled within the last two years, and is set to grow to $3 billion by 2021, according to the analysts at Mobile Experts.

Edward Stewart, who works in RF support and optimization for Canadian operator SaskTel’s technology division, added the financial model issue was even more severe for smaller enterprises, which lack the clout to even get on the radar of larger carriers for such a deployment partnership.

“Small business owners are also in this boat in that they can’t pay for these systems,” Stewart explained, adding that for SaskTel to be able to support potentially thousands of DAS deployments on its network, end users would need to find ways to share deployment costs.

One potential sticking point for enterprise-based small cell and DAS deployments reliant on licensed spectrum is the growing use of Wi-Fi networks by companies that can in turn support various Voice-over-Internet Protocol technologies. Samuel Domingues, senior manager for network, wireless access and in-building engineering and operations at Bell Mobility, said he viewed Wi-Fi as complementary at this point “as a back up for DAS and even aggregating licensed and unlicensed channels” as expected from various unlicensed spectrum models tied to LTE deployments.

McColl recommend DAS vendors should embrace Wi-Fi models in their plans, though said Verizon Wireless was still challenged by the quality of service models attached to greater reliance on VoIP solutions using Wi-Fi networks not controlled by the carrier.

“If customers try it and it’s not a good experience they think its Verizon’s fault,” McColl said. “Handing it over to someone else is scary.”

In terms of outdoor deployments, panel members cited significant, localized events like the Super Bowl as an example of how quickly consumers can overpower a traditional network model, with small cell and DAS the only way in which to meet demand. However, Stewart harkened back to the business model challenges

As for some of the other remaining challenges, McColl noted ideally there would be some sharing of small cell sites in order to cut down on operating costs and potentially reduce push back from venue owners and cities averse to supporting what could be hundreds of thousands of localized antennas.

“There are vendor specific issues with small cell vendors at this point,” McColl said, adding those vendors are still struggling to gain market share and are not yet looking to share that market with rivals.

Stewart added these challenges in turn feed into the scale model needed to garner greater cost efficiencies for the small cell and DAS market, noting “small cells don’t work in small deployments.”

“We have played in the space for about 3 years, but have not really been able to get it off the ground,” Stewart explained. “We need scale to make them work.”

Bored? Why not follow me on Twitter