Does Sprint have a Ferrari in the garage? Iain Gillott looks at Sprint’s options in terms of its 2.5 GHz spectrum holdings

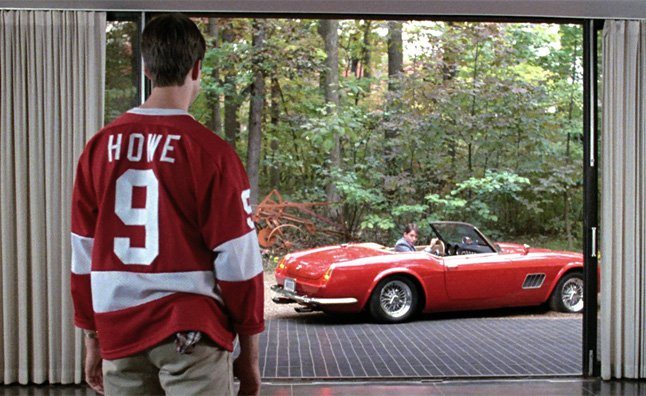

For the second installment on the outlook for Sprint, let’s start with a little fantasizing. Imagine you own a Ferrari. A really nice, old, classic Ferrari in rosso corsa (red!). It is a valuable machine and you keep it in a nice, heated garage under its own cover. It is beautiful and you tell everyone about your Ferrari at every chance you get. A friend asks how you are? You are great and the Ferrari is beautiful. How are the kids? Still living and the Ferrari is gorgeous. Work/career going well? Sure, but the Ferrari is better.

You get the idea: you are obsessed. So much so that you cannot see that you need to sell the Ferrari; you need the money to remodel the rest of your house and survive day to day; you have other debts that are swamping your lifestyle. To make things worse, you can never drive the Ferrari because you have no money for gas and the car needs new tires before it will run.

But, you know that your Ferrari is valuable and in a few years’ time, will be even more so. Your Ferrari is a normally aspirated V8 with a manual gearbox. New Ferraris are turbocharged with flappy paddle automatics. So, wait a few years and it will be worth even more and may, in fact, come close to what you think it is worth.

This, folks, is an analogy for Sprint’s spectrum position. Sprint’s execs seem obsessed at times with telling everyone and anyone who will listen that they have great spectrum (2.5 GHz) and it is valuable. The world is going to need more high-band spectrum in future years, they say (true – IGR has a report on this coming out shortly). They will also tell you that their spectrum is the envy of other mobile operators.

But, just like the Ferrari sitting in the garage with no gas in it, Sprint’s spectrum does the company no good on an operational, day-to-day basis. Need to go to the grocery store for milk? A Ferrari with no gas and in need of tires is useless. Need to expand your mobile network capacity or coverage? You need to invest in radios, antennas and towers in order to use that spectrum. Unused spectrum is simply an asset on the books.

So, what do you do with your Ferrari, and what does Sprint need to do with its spectrum? There are three simple choices:

Wait

Stay as you are, leave the Ferrari in the garage and the spectrum unused. Later this decade, other operators will need more high-band spectrum. Sprint will have an asset they need, but so does Dish and the government may also make other high-band spectrum available for auction by then. You are gambling on the future value of the spectrum if you let it sit idle and do not leverage it.

Invest

Buy some tires for the Ferrari, put some gas in it and start using it for Uber. An Uber driver in a Ferrari? Guaranteed hit! In Sprint’s case, they would need to invest in radios, antennas and locations in order to use their 2.5 GHz spectrum to benefit the subscriber base. This will take capital, which, of course, Sprint is short of right now. The counter to this argument is that Sprint is adding few net new subscribers so why do they need more capacity? Simple – build it, price it and market it and they will come. A great example is T-Mobile US: they invested in an upgraded LTE network without having the subscriber base at the time. Then they got edgy and aggressive on the marketing side, as well as offering innovative video service with Binge On. The result has been a complete turn around in their fortunes.

Sprint will likely argue that they are using some of their 2.5 GHz spectrum with their new wireless backhaul strategy. The problem here is the engineering time required to realize this vision; it appears Sprint could take up to two years to move away from fiber backhaul and onto wireless. Hardly a short-term cost reduction. And very questionable long-term strategy.

Sell

Sell or sell and lease back, as Sprint is starting to do with its network equipment. The company has also stated spectrum is likely to be part of the next sale/lease of network equipment. While this is akin to selling the crown jewels, we believe Sprint has little choice. If you do not have the money to put tires on the Ferrari and gas in the tank, and your house has big holes in the roof, it is time to sell the Ferrari and fix the holes. No operator likes to sell spectrum (they will usually try and swap it for more favorable bands or sell as part of a transaction that involves buying other bands). Mobile operators need licensed spectrum to succeed. Spectrum is the key asset. But, Sprint has little choice at present than to sell some of its spectrum asset.

The problem is one of value: how much is spectrum worth? And specifically for Sprint, how much is high-band 2.5 GHz spectrum worth? Unfortunately, the Federal Communications Commission auctioned off the AWS-3 spectrum last year (you may have heard?) and the prices paid were high. While this may indicate good valuations for Sprint’s spectrum, it also means the major operators are a little short of funds at present. And they are currently in the latest 600 MHz FCC auction. So, the likelihood of the other major operators wanting to buy high-band spectrum from Sprint is low. This limits the number of potential bidders.

Which means Sprint essentially has to sell some spectrum to investors, hence the network sale/lease back structure. Any investor in this is likely to look at the long-term potential value of the 2.5 GHz spectrum, discount it and then make Sprint an offer. And unfortunately, Sprint has little negotiating room at present. In a year, there may be more demand for the 2.5 GHz band. The longer Sprint can wait to sell, the higher the demand is likely to be and the higher the subsequent valuations.

The question, therefore, is how long can Sprint wait? Just like the Ferrari owner with holes in the roof, how long can he really wait to sell before the holes have to be fixed? The good news is Sprint has a Ferrari sitting in the garage. The bad news is they cannot afford to keep it, or at least all of it. But, wait too long to sell and someone like me may be able to buy a really nice red Ferrari V8 from a bankruptcy judge.

Iain Gillott, founder and president of iGR, is an acknowledged wireless and mobile industry authority and an accomplished presenter. Gillott has been involved in the wireless industry, as both a vendor and analyst, for more than 20 years. The company was founded in 2000 as iGillottResearch in order to provide in-depth market analysis and data focused exclusively on the wireless and mobile industry. Before founding iGR, Gillott was a group VP in IDC’s telecommunications practice, managing IDC’s worldwide research on wireless and mobile communications and Internet access, telecom brands, residential and small business telecommunications and telecom billing services. Prior to joining IDC, Gillott was in various technical roles and a proposal manager at EDS (now Hewlett-Packard), responsible for preparing new business proposals to wireless and mobile operators.

Editor’s Note: Welcome to Analyst Angle. We’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.

Image courtesy of autoguide.com.