Google’s Android platform is a powerhouse around the world, which Jim Patterson said could be set for even more growth at the expense of Apple

Back when we wrote the first “Android World” column a few years ago, the thesis was that Google’s commitment to an open architecture was spawning a shakeup in the smartphone manufacturing world, and Android represented a far greater threat to Apple’s market leadership than anyone anticipated. We also talked about the damaging effects of Android on BlackBerry and Nokia (now Microsoft).

What we did not anticipate was how significant the changes would be. The HTC Dream (aka, the T-Mobile G1), announced in September 2008, seemed exactly like that – a dream, ready to be dashed by Apple as they rode iOS into consumer smartphone dominance.

Had Apple played their exclusivity hand differently with Verizon Wireless, Sprint and T-Mobile US the outcome might have been domination. But Verizon Wireless dove in head first with Android, announcing the first Droid lineup in September 2009. When it came time to introduce their first LTE phone (the HTC Thunderbolt) in 2011, it was not introduced on an iPhone, but on Android (For those of you who do not follow the industry closely, Verizon Wireless introduced the iPhone 4 in February 2011, and the Thunderbolt the following month).

And Verizon Wireless was not the only U.S. wireless carrier to announce a flagship Android phone. In March 2010, Sprint announced the HTC Evo (still one of their all-time best sellers), which featured support for 2.5 GHz-based WiMAX services through their Clearwire partnership. It was launched three months after the original announcement and put Sprint on the map ahead of Verizon Wireless’ Thunderbolt launch. Sprint would not receive iPhone access until October 2011, and only then with a 30 million-device commitment.

Android steadily became known as the platform for innovation, flexibility, speed and sugary sweet operating system names. The ecosystem was developing nicely. Then came the Samsung Galaxy S III in 2012. Prior to this time, Samsung was just another player in the Android ecosystem with HTC, Motorola, LG and Kyocera. After the release of the S III, Samsung assumed the mantle of smartphone leader, launching the Note II and Mini product versions by that fall.

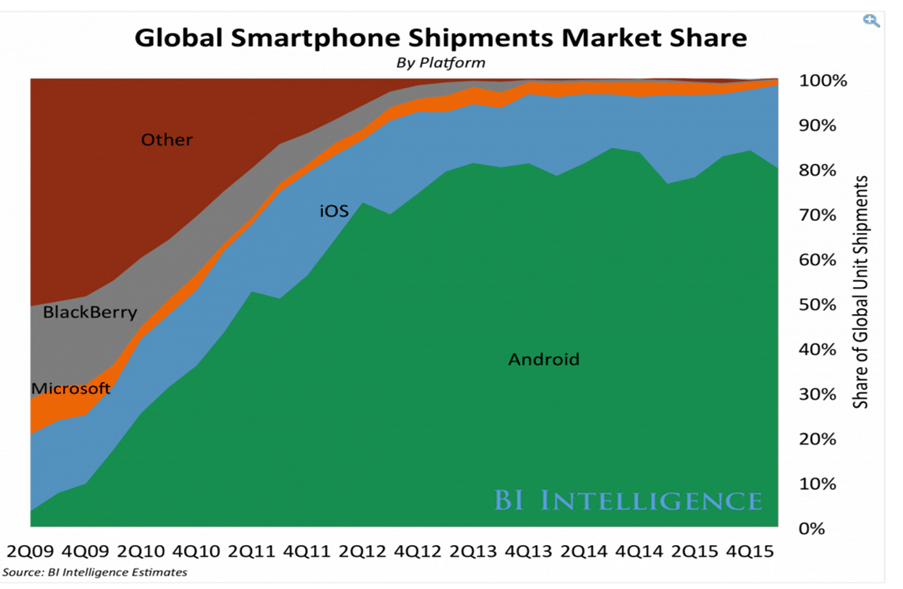

The nearby chart tells the rest of the story – Android, led by Samsung, began to grow – quickly. China, and then India, emerged as the largest addressable market opportunities (in 2012/2013, neither was a large Apple market). Android suppliers such as Micromax, Spice and Karbonn in India filled the nearly insatiable demand for smartphones, so much so that the Android One reference platform was announced in 2014.

Bottom Line: From nothing, Android assumed an 80% market share in about just over five years. Nokia/Microsoft Windows OS are reduced to a few stock keeping units in the back of the store or the bottom of the website; Palm and Symbian vanished; and BlackBerry has been clinging since 2012. Google continues to be focused on Android interoperability with VR, Chrome, Android Wear, Nest and other platforms. In response, Apple released the iPhone SE, which out of the gate was categorized as “not for the U.S., but for the developing world.”

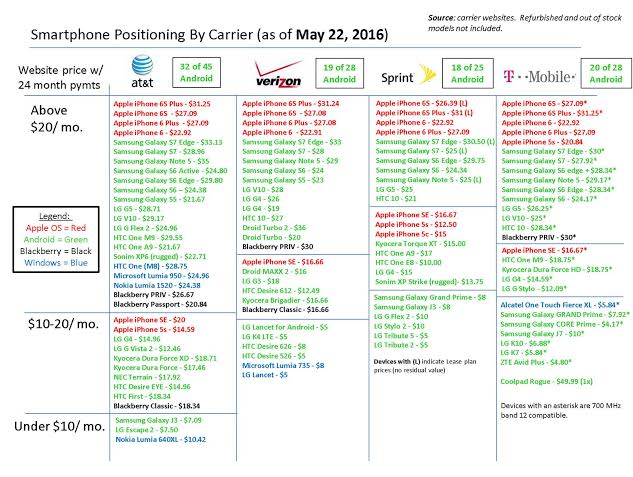

Where does this leave us today? Here’s the latest Android World matrix:

For those of you who are not familiar with the format, a few notes. Represented are 24-month pricing from each of the major carriers’ websites (research undertaken from May 19-21). The underlying operating system is color-coded. No refurbished or out of stock models are shown, and for the purposes of comparison we have used AT&T’s Next 18 month rates (which require 24 payments despite the name). Where needed, we have also indicated Sprint’s leased (as opposed to equipment installment plan) as well as T-Mobile US’ “extended” LTE equipped devices.

There are several interesting developments. First, the iPhone SE is currently out of stock on most carrier websites with phones ordered today not expected to be delivered until late June/early July. The extent to which this has been a deliberate move by Apple (some going so far as to call it a bait-and-switch) is debated; we side with the camp that it’s driven by supply constraints as Apple readies an even less expensive version.

Second, Sprint isn’t leasing as many models as they have in the past. Currently, the models covered by the iPhone Forever and Galaxy Forever lease constructs are the Samsung Galaxy S7, S7 Edge and Note 5 as well as the iPhone 6s and 6s Plus. Everything else is EIP-based. This is half of the 10 models offered for lease in October. Sprint’s crazy deals on iPhone 6s devices with trade-in ($15/$19 monthly lease rates for 24 months) are now a thing of the past – you will now shell out a similar amount as for an EIP, but receive the right to automatically upgrade as soon as the next generation is released.

Net-net, this is a positive for Sprint because they get out of the residual value estimation business. While the upgrade process is slowing down (implying there might be a supply driven residual opportunity), the risk of being stuck with a large number of off-lease devices still exists. It also will help financial analysts more accurately ascertain a comparable earnings before interest, taxes, depreciation and amortization rate for Sprint.

It’s also interesting to note Sprint has thrown out both Windows and BlackBerry by design. No BlackBerry Classic, Priv or Passport. No Lumia anything. Keeping it simple for the customer (as well as customer service reps) – smart move.

Finally, one cannot help but notice the shrinking bottom layer (less than $10 per month EIP) of this chart, which will likely continue to shrink in future years. AT&T Mobility really has two offered devices below $10, and it would not be surprising to see Verizon Wireless at this level shortly. Driving this is the growth of “bring-your-own-devices” strategies, something quite common in the mobile virtual network operator/wholesale world and now beginning to show up with each of the big four.

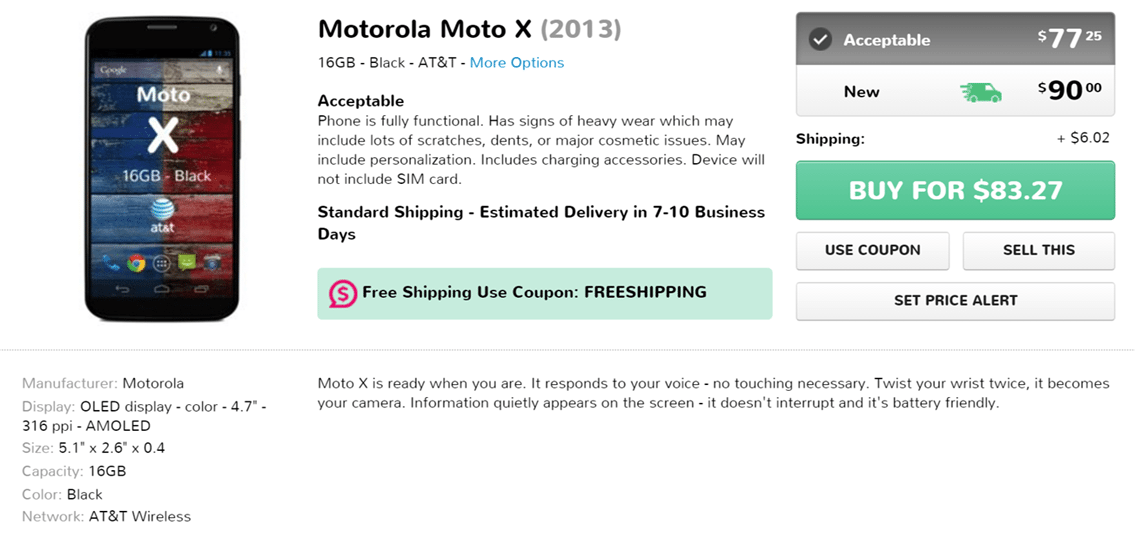

Have a look at the Motorola X for sale on Glyde (16 gigabytes of memory, works on AT&T Mobility and sells for $77.25 refurbished or $90 new with $6 shipping). It’s a good deal for a “4.5-star rated” phone on PhoneArena. All for $80 with shipping, and fully compatible (except for Band 12) with the T-Mobile US network if things don’t work out with AT&T Mobility.

This story is repeated hourly within the Android world (Apple iPhones tend to hold their value better). Like we saw with free phones in the subsidy days, the prospect of a gently used model with complete freedom to move between (some) carriers is enticing for bargain shoppers. And this is going to get even easier with the rise of soft SIM devices (see the latest Apple iPhone carrier compatibility chart here or the Google Nexus LTE network specifications here). For many, a device is simply going to be a means to access a network full of applications. Until the value proposition of faster networks catches up, customers are more than content than to postpone upgrades.

Bottom line: Android is big – really big. From last week’s Google I/O conference it’s about to get even bigger and more integrated into the full Google product line. Google excels at software development, but not necessarily software integration. Android’s future depends on its most complex challenge: an integrated end state.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.