One of the world’s largest telcos promises a major step change in its IoT capabilities

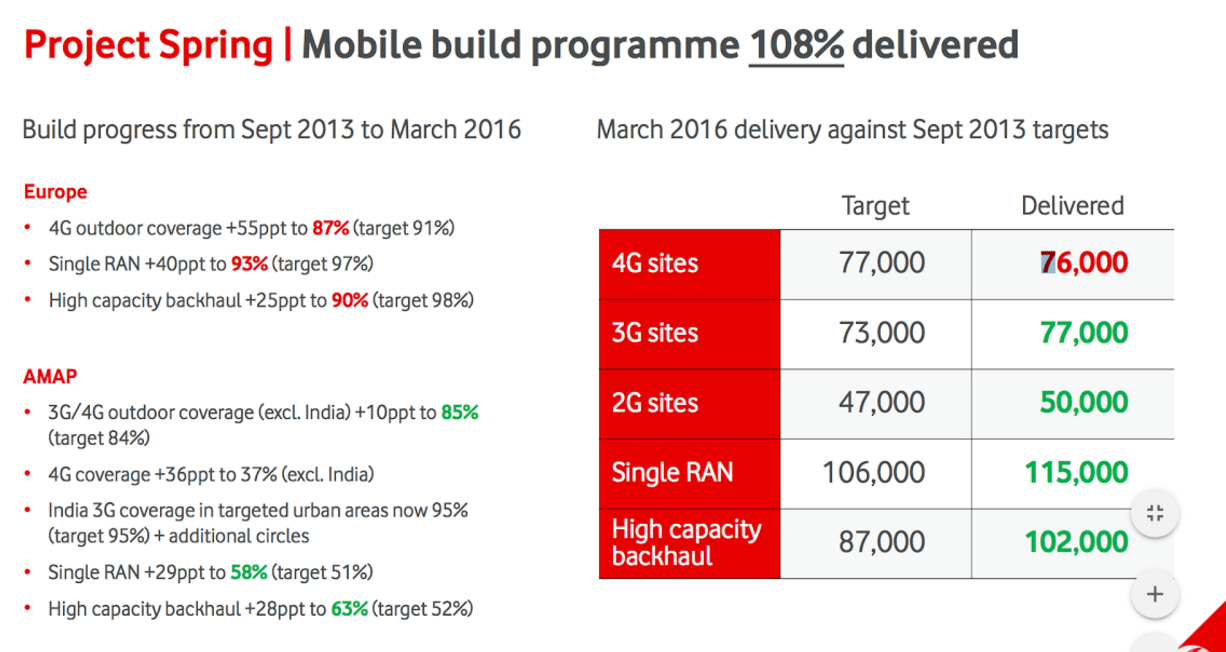

Last week, Vodafone Group gave its enterprise customers key insights into how fast the “Internet of Things” is likely to develop. By 2020, Vodafone pledged all of its LTE base stations would support narrowband IoT — a technology designed specifically to support industrial IoT applications. Vodafone, which has operations in parts of Europe, Africa and India, claims 76,000 LTE base stations today.

“There are new technologies coming out enabling billions of devices to communicate at a much lower cost point than what is currently available in the market,” said Johan Wibergh, group CTO for Vodafone, during Vodafone’s annual results presentation. “[NB-IoT] has six-times stronger signal, which means that with the existing site grid that we have, we are going to have extremely good indoor penetration and rural coverage. And it’s a very cost effective way for us to add on this technology.”

One of a new breed of low-power, wide-area technologies, NB-IoT is designed to support large numbers of connections in a single cell with very low power requirements. Wibergh said 85% of its 4G base stations could be adapted to support NB-IoT through a software upgrade, implying Vodafone can quickly roll out the technology.

Wibergh also flagged ESIM technology, which enables a device to be remotely provisioned onto a mobile operator’s network, as an important enabler of the IoT. “If you add those things together you have a lot of new business opportunities for the company to go after,” he said.

Step change in responsiveness

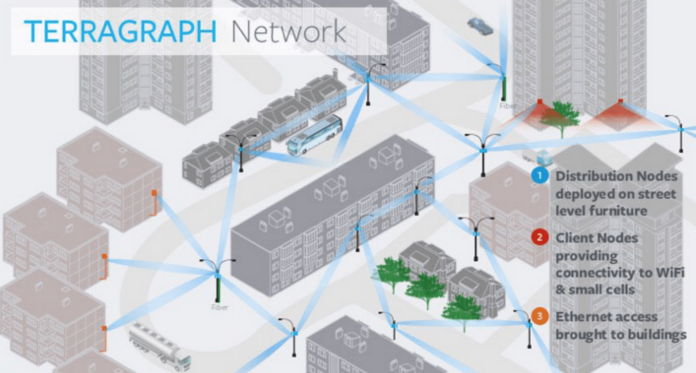

To support some of the most ambitious IoT applications — such as autonomous cars and remote surgery — wireless networks will also need to be more responsive. Wibergh forecast the 40- and 50-millisecond latency in today’s LTE networks will come down to sub-10 milliseconds. To help it achieve that target, Vodafone is considering using microwave links to provide the backhaul for “5G” base stations, claiming the latency on the microwave leg would be less than 0.3 milliseconds.

Vodafone pledged to have 5G networks up and running by 2020, by which point it intends to turn off its 3G networks in Europe.

“We are planning to shut down 3G, because it doesn’t make sense to have 2G, 3G, 4G and 5G running at the same time,” Wibergh explained. The decision to shut down 3G, rather than the older 2G networks, is an interesting one. It is probably driven by the need to use existing 3G spectrum for 4G and 5G, as well as the fact some longstanding enterprise machine-to-machine applications continue to rely on 2G.

Vodafone also revealed it has been testing network function virtualization technology for the past 18 months, which enables a telco to simplify and streamline its networks.

“It works really well,” said Wibergh. “We’re now scaling it up, so by 2020, we will have modernized more than 50% of our core networks. And this is supported by something called software-defined networking, which creates more agility in our internal network.”

Vodafone is aiming to have 50% of network functions virtualized by 2020, and also wants to reduce the end-to-end service provisioning time to less than one week.

The technological advances outlined by Wibergh build on the major network upgrades implemented by Vodafone (see graphic) following the sale of its stake in Verizon Wireless for approximately $130 billion in early 2014.

Proprietary platform fuels Industrial IoT growth

In the annual results presentation, Vodafone reported IoT revenue rose 29% in the financial year ended March 31, boosted by a 37% increase in connections to 38 million units. Overall enterprise revenue rose 2.1%, after being flat the previous year.

“I think we have the leading [IoT] platform in the world,” claimed Vodafone CEO Vittorio Colao, on the earnings call. “There are essentially three, but we have the leading platform in the world. … The original choice of focusing on enterprise and having a proprietary platform, actually is very important. … If I look at the rumored price that the other platform has been transferred to Cisco for, I mean, we have for much less created a bigger, better and more successful platform. So it’s a strong, strong, strong basis for future growth.”

Nick Jeffery, CEO of Vodafone Group Enterprise, believes Vodafone’s IoT business can continue to grow by 20% to 30% year-over-year into the future, noting the company is seeing the most traction in the automotive, consumer electronics, smart metering, health care and agriculture sectors.

“Our IoT business is something we’ve grown up over the last six years,” Jeffery said. “It’s founded on a set of technologies, which Johan and his team have built, which are unique to Vodafone, which give us the ability to have a single SIM that works on any network, anywhere in the world, and that platform … is already deployed in 30 countries around the world.”

Once a highly mobile-centric company, Vodafone is now investing heavily in fixed-line networks both to backhaul its wireless networks and to provide direct connectivity to customers. Vodafone plans to build out its fiber network to reach 95% penetration in European cities with more than 100,000 inhabitants by 2020. Today, that figure is 69% in the four largest European countries.

“We have an ambitious roadmap for the future, but I believe it is a very realistic roadmap,” Wibergh concluded.