In his last column, Jim Patterson looks at the benefits of cash, the growing Android vs. iPhone pricing chasm and the T-Mobile Un-carrier 11 move

Editor’s Note: To check out all of Jim Patterson’s past contributed articles, click here.

This is the last edition of my column – a tough sentence for me to write, yet I am encouraged and overwhelmed by hundreds of you who have taken time to send congratulatory notes and reflect on how valuable this column has been each week.

A few parting thoughts

Rather than dive into a wish list or other litany of things that need to be changed, I’ll leave you with some interesting data points:

Cash is king

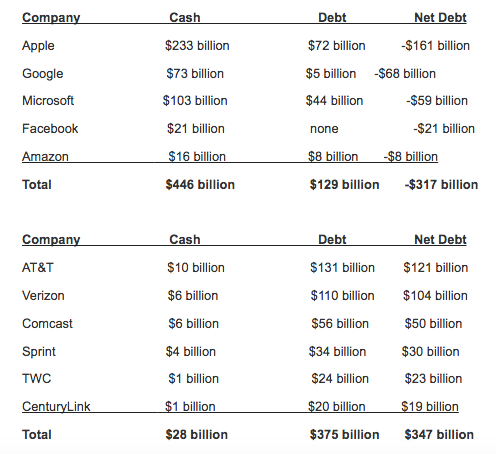

It’s a trite statement many of us learned in business school, but here’s the economic reality for some in our industry (figures are pulled from each company’s most recent earnings releases and do not include off balance sheet items. Debt also does not include post-retirement benefit obligations or deferred tax liabilities which would add tens of billions in “debt” to the lower section):

Many of you commented that the value creation updates we did throughout the years helped keep things in perspective. The “Four Horsemen” (which became five after Facebook went public in May 2012) have created hundreds of billions of dollars of market capitalization over the past seven years. While that number is staggering, what is more telling is how, despite the efforts of investment banking and shareholder activist professionals, each of the “Five Horsemen” has been able to keep a strong negative net debt position.

Some of this cash is stranded overseas and would be taxed if repatriated. But, for comparative purposes, the balance sheets of non-network participants in the internet economy clearly have more liquidity and leverage opportunities than traditional players.

The average selling price of a new Android device is plummeting while Apple is flat

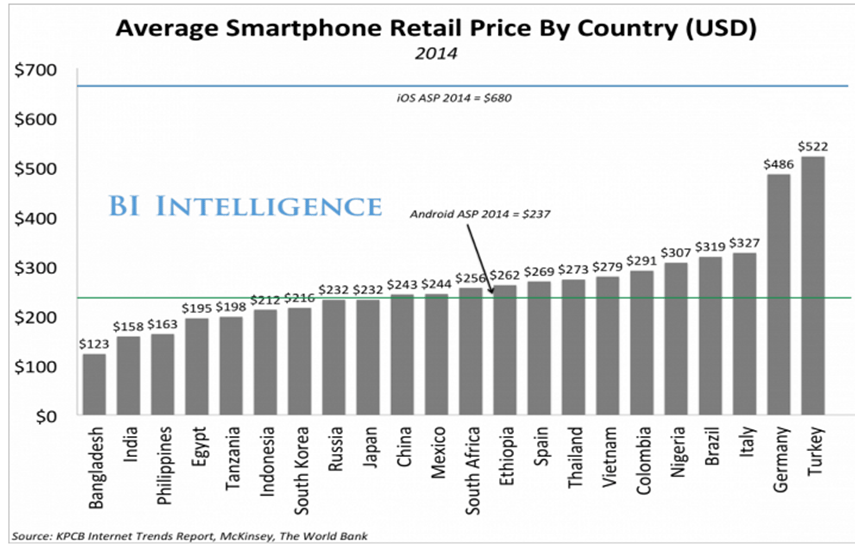

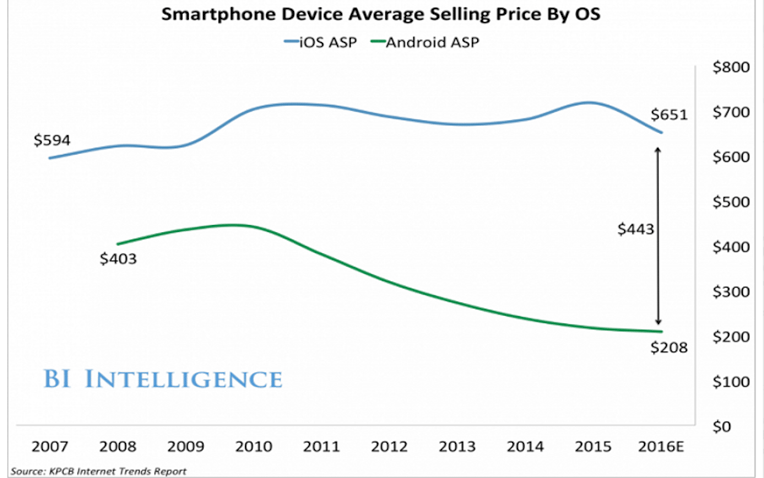

Here are two charts released last week from the Business Intelligence folks:

Since the blossoming of the Android ecosystem in 2010, the gap between the ASP of a new Apple and Android smartphone as ballooned to $443. This gap had been less than $200 as late as 2011. With the advent of less expensive devices in Bangladesh, China, Indonesia, India, Japan, Mexico, the Philippines and Russia (roughly 3.6 billion total population), Android has established a “default user experience” position with smartphone users in these countries.

This is not to say that Apple faces an imminent danger. Plenty of used iPhones from other countries will make their way in to India and other places, and will still carry the cache of the Apple brand. However, this infiltration can only occur as smartphone changeover continues and the latest earnings report from Apple shows that upgrades are slowing down. As go upgrades, so go refurbished devices. This result may be pleasing to some, but it was clearly on Apple CEO Tim Cook’s mind as he traveled throughout Asia last month (see this Forbes summary for more details on Cook’s India trip).

Could Apple institute a program in the developing world like Android One without compromising quality? Do they have any choice, especially with an alliance forming between China’s Apple wannabe Xiaomi and Microsoft (see more here)?

T-Mobile’s Un-carrier 11: time to stock up?

If the rumors are to be believed, T-Mobile US will launch a loyalty app on Monday that will offer free stock to customers who refer others to T-Mobile US. This on top of pizza, movie rentals and other items that likely come with any loyalty program (I have not heard that one of the loyalty items would be $100 off a smartphone, but hoping that is among the options).

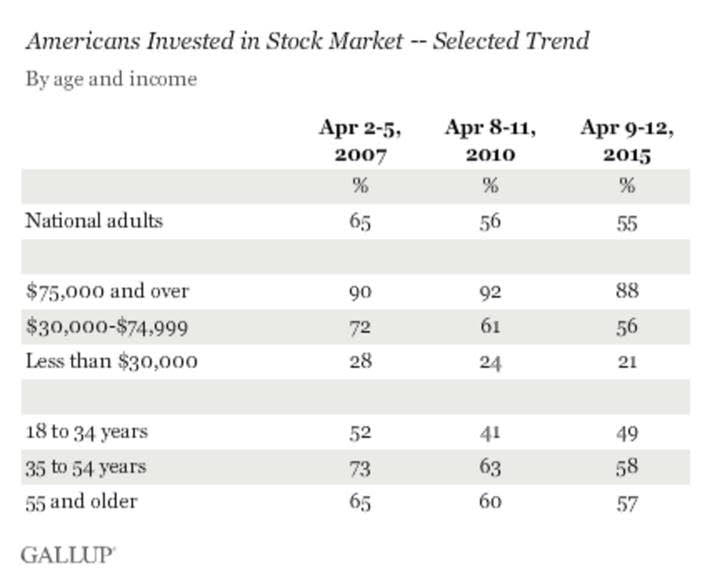

Offering stock to customers is unique and different. A few will see the inherent long-term financial opportunity it represents. Last year, Gallup updated their poll on investment trends (full report here and summary chart nearby). What they found was unsurprising: since the economic collapse of 2008-2009, fewer Americans are invested in the stock market, especially if their annual income level is less than $75,000.

Stock does not taste as good as pizza and certainly does not provide the entertainment value of “The Revenant” or “Star Wars.” A chance to earn my way to a free iPhone 7 with 10 new T-Mobile US referrals? Sign me up. A free Samsung fast charging system for being a customer for five years? Count me in. Company stock for being a customer and signing up for an app? Too hard and too much of a hassle for many who distrust the market and whose last memory of a financial investment was a losing one.

There’s a lot more to talk about (see AT&T’s transcript from the Cowen & Company conference last week here, or Cricket’s large outage here or the full report of Apple’s outage here), but I’ll close by simply saying that I will continue to have opinions over coffee, lunch or dinner in Charlotte, North Carolina – come see me and let’s talk. The pen is taking a break, but I am not.

Jim Patterson is CEO of Patterson Advisory Group, a tactical consulting and advisory services firm dedicated to the telecommunications industry. Previously, he was EVP – business development for Infotel Broadband Services Ltd., the 4G service provider for Reliance Industries Ltd. Patterson also co-founded Mobile Symmetry, an identity-focused applications platform for wireless broadband carriers that was acquired by Infotel in 2011. Prior to Mobile Symmetry, Patterson was president – wholesale services for Sprint and has a career that spans over 20 years in telecom and technology. Patterson welcomes your comments at jim@pattersonadvice.com and you can follow him on Twitter @pattersonadvice. Also, check out more columns and insight from Jim Patterson at mysundaybrief.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.

Photo copyright: stuartphoto / 123RF Stock Photo