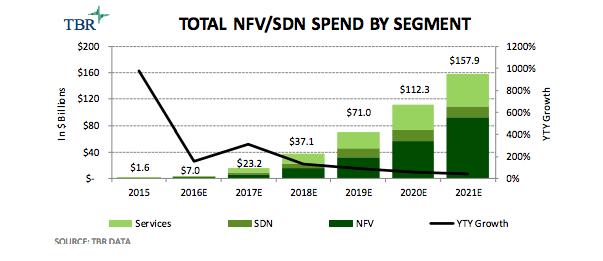

Technology Business Research report cites boost from early adopters like AT&T in driving 116% CAGR for NFV and SDN market through 2021

The network functions virtualization and software-defined networking markets are expected to hit $158 billion by 2021, boosted by early adopters such as AT&T beginning to ramp investments into the NFV and SDN ecosystems.

The prediction comes from a recent Technology Business Research report, which claims the 116% compound annual growth rate will be supported by the redistribution of legacy infrastructure capital expense as operators implement virtualized environments and gradually decommission legacy infrastructure platforms. TBR noted operators could see some external operating expense tied to vendors for maintenance and managed services to “support, integrate and operate software-mediated environments.”

“A growing group of tier-one operators is leading the charge in implementing NFV and SDN. This group is driving a significant amount of development in the NFV and SDN ecosystem and is pushing the vendor community to rapidly adapt to this new architectural approach to networks,” explained Chris Antlitz, telecom senior analyst at TBR. “NFV- and SDN-related spend volume is forecast to ramp up in 2017, at which time use cases will be more defined and the cost benefits of using NFV and SDN will be more apparent. This will prompt holdout operators to jump on the bandwagon and aggressively pursue transformation with these technologies to avoid being left behind.”

The report predicts U.S. and European operators will drive three-fourths of the NFV and SDN spend each year through the forecast period, with Asia-Pacific operators expected to increase spending beginning in 2019.

“Though most Japan-, South Korea- and China-based operators are implementing NFV and SDN, spend will be eclipsed by what select operators, namely AT&T, Verizon, CenturyLink, BT, DT, Orange, Vodafone and Telefonica, invest in in the U.S. and European markets,” TBR noted, with other regions expected to lag. “America Movil, Telefonica, Etisalat and MTN are exceptions in these developing regions.”

Bored? Why not follow me on Twitter