Telecom workforce management is changing as the so-called “gig economy” continues to penetrate the industry. An increasingly “hybrid” workforce of contract and full-time workers is emerging as operators put more focus on reducing their costs to deploy network infrastructure.

Field Nation, which provides a software platform for connecting field technicians and employers for contract work on telecom networks, says the increasing role of small cell infrastructure is a contributing factor to this shift. Operators are more focused on controlling costs of site development and deployment for small cells, which must be rolled out at a fraction of the cost of a macro site in order for the economics to work.

“More and more telecom organizations are taking a much more aggressive blended workforce approach to getting work done in the field with small cell technology and even within the traditional work within the telecom sector that requires boots on the ground,” said Jeff Parris, EVP sales and marketplace for Field Nation.

Field Nation lets potential employers search for field techs based on background, ratings by previous employees and skill sets, but does not set the rates at which work is done (unlike the approach taken by ride-hailing platform Uber). Parris said in addition to overall growth, Field Nation is seeing requests for increasingly sophisticated work, in a small cell context in particular.

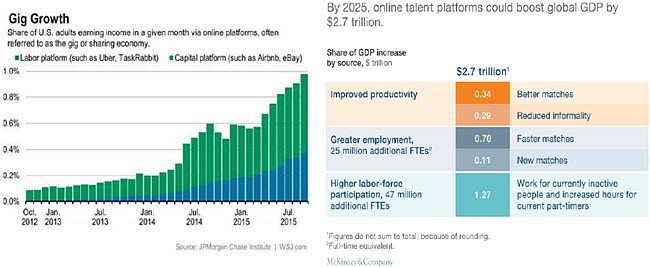

Online platforms for talent management could contribute as much as $2.7 trillion to global gross domestic product by 2025, according to research by McKinsey and Company.

With more focus on small cell deployments and revenues not keeping pace with the explosion of mobile data traffic, operators are looking to trim workforce costs. Deployment-related technologies are also keeping pace. Test vendors, for example, have spent the last several years bringing more instruments to market that have combined capabilities and are also designed for ease of use so that field techs can conduct some work that used to be carried out by engineers.

“All of the carriers are spending a percentage of [capital expense] with small cells, from what we’re seeing,” said Ron Deese, president and CEO of TelForce Group, adding the the skill sets currently in demand for small cell installations are outdoor plant-type of skills with a heavy emphasis on fiber cable.

Deese said a hybrid workforce is the new reality for telecom.

“People are going to use a hybrid model, whether that’s 80/20 or 70/30 – they do not want 100 full-time employees,” he said. This allows a company flexibility based on whether projects are in full swing and the ability to easily let employees go once projects are complete, he added.

Telecom is far from the only industry being changed by a gig economy. The U.S. Bureau of Labor Statistics reports that since the end of the 2009 recession, the number of temporary employees in the workforce is up by more than 65%. A recent survey by staffing company Addison Group found 94% of U.S. employees responsible for hiring are more willing to hire a temporary contractor than they were just five years ago. Addison Group found the three main reasons managers hire contractors are to provide a fast solution to understaffing, to find someone with a dedicated focus on short-term projects and to reduce costs associated with a full-time hire.

Forbes named the rise of gigs as one of the top 10 workforce trends for this year for the economy overall. The magazine said trends driving the gig economy include an increase in freelancing; access to technology and smartphones in particular; the lingering impact of the Great Recession and the implementation of the Affordable Health Care Act; and “the desire to have ‘side-gigs'” and flexibility.

“For employers, the gig economy allows them to hire on-demand, lower costs and have more competition for talent,” Forbes concluded.

Telecom workforce management and the 'gig economy'

ABOUT AUTHOR