With Verizon acquiring the operating business of Yahoo, the final chapter in the life of a past internet superstar as an independent company has been completed

Back in the late ’90s, I started and chaired a company called PortableLife, which was headed by Lou Panetta. The mission of the company was to provide technology to help other web portals deliver content in a pleasing visual manner to a coming vast number of mobile devices. Steve Cox was in charge of the technology strategy, and I can say he got it right: We were going to be a technology company. Realize, this was eight years before Apple created the iPhone and before Google created Android.

In order to demonstrate our technology to help other websites deliver their content in a pleasing manner to mobile devices, we had to have some content about mobile to share on portable devices like BlackBerry. So we hired Mike Elgan, who was one of the best editors of mobile content, and asked him to get the content produced. Eventually, PortableLife was not only going to distribute information and sell advertising, but it was going to figure out how to best present information on disparate mobile devices. We knew that everyone was eventually going to have powerful mobile devices.

Our first funding round went well with $2 million primarily from Monarch Ventures in Atlanta. We pulled together a solid team, started to provide solid information about mobile and wireless, and designed the technology to deliver web content in a pleasing way to mobile devices. However, when we went out for a second round of capital in 2000 – when the dot-com market imploded – we couldn’t find a single venture capitalist willing to put in any additional funding. We almost made it long term: The strategy was right but the funding wasn’t available, so we had to close the company.

Yahoo also was growing at this time as the best one-stop shop for content. Everyone loved Yahoo. It seems we all had a Yahoo account at one time – either for access to its content or to sign up for Yahoo Mail. The company was valued at more than $125 billion in 2000, and had 2,000 employees. It was one of the first to invent online advertising (remember the preponderance of banner ads?). The company began its long fall from grace as it invested more in content than technology. In 2008, Yahoo turned down an offer of $45 billion from Microsoft. What a terrible mistake. And, further down it went.

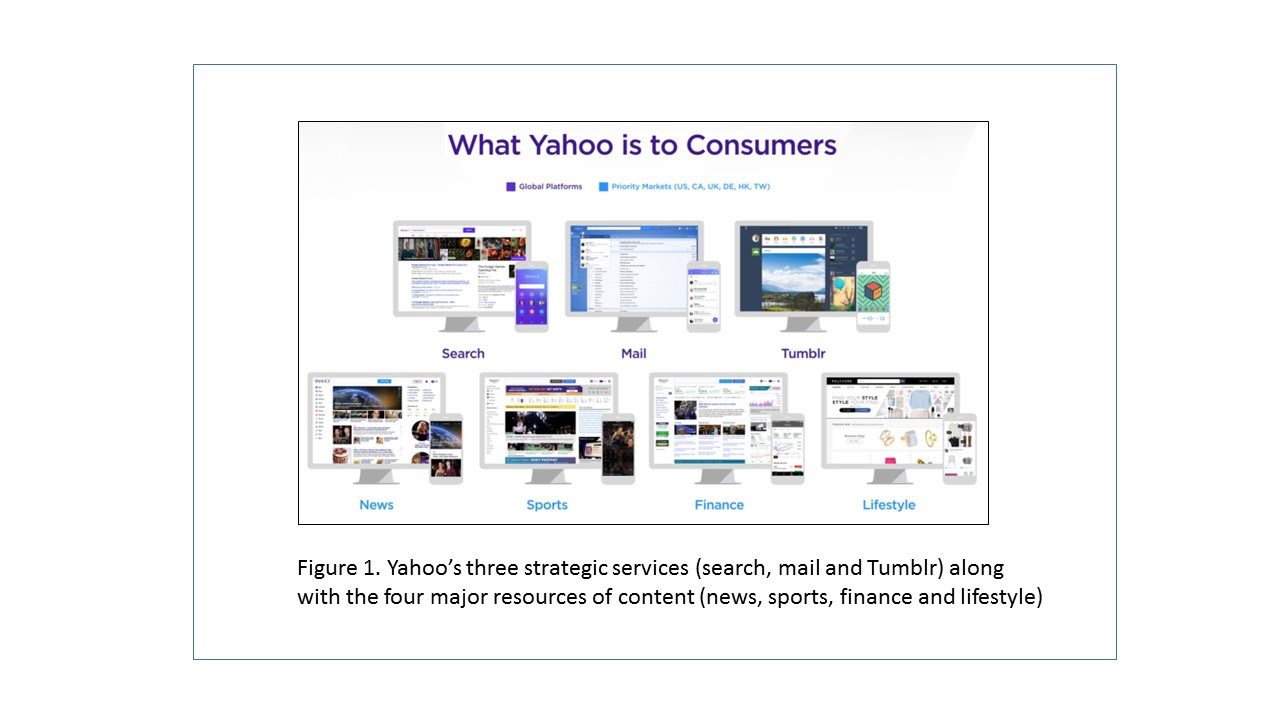

In 2012, Melissa Mayer, a top executive at Google, became the company’s final CEO. She invested more in content by buying Tumblr and hiring Katie Couric to head up the video editorial. They hired a friend of mine, David Pogue, to head up “technology” content. They rebuilt their mobile products for email, news, sports, finance and lifestyle.

If they were thinking of changing strategy toward being a technology company, it never showed. Yahoo did have a lot of technology, particularly in ad platforms, but it wasn’t sold to others to use. Rather, it was retained to be applied to its own content.

So, here we are in 2016, with the value of the company now down to $4.8 billion as it was sold and never to be heard from again (in its present form) to Verizon Communications, which will put it under Tim Armstrong, who currently runs AOL.

What’s going to happen to Yahoo now? It’s likely Verizon Communications will use the Yahoo brand as a handle in the short term, just as they have continued to use AOL. However, since both Yahoo and AOL have a lot of content, it would seem most likely Verizon will end up creating a large content engine from which it can leverage each piece – from advertising as well as co-marketing through other Verizon divisions. One example could be preferred content on mobile devices if the user switches to Verizon Wireless.

Just walking in the door, Yahoo and AOL advertising is estimated to be $3.9 billion, but that’s only 2.9% of a digital ad world of $124.1 billion. Yahoo and AOL will undergo an internal strategic review to determine which ad platform technologies will help the combined venture best deliver a good experience to advertisers (one that makes the ads most relevant).

Also, the combined venture has Verizon Communications marketing assets to reach its 100 million-plus mobile subscribers. As a result, Armstrong should be able to significantly increase both ad revenue and digital ad market share. It wouldn’t surprise me if the Yahoo and AOL brands slowly die away as the content brands become more important. And, if ad revenue increases significantly, Verizon will have self-funded the acquisition of both AOL and Yahoo, a merger and acquisition perfect outcome.

The lesson: Yahoo could have taken the new ad platform and sold it to other websites along with its search engine. It could have acquired Facebook. It could have acquired Google. No telling what Yahoo would be today if it had acquired all those assets. But we can see what has happened to those companies that focused on a strategy of building technology solutions that are used by others. Just look at the value of Google and Facebook today.

I wonder what would have happened if we had been able to get additional capital at PortableLife back in 2000? We could have sold the technology we built to websites to enable them to present content to mobile devices and include ads. If that happened, I would be off playing golf in the Caribbean with my wife and holding up two glasses of Champagne saying “cheers.”

Rest in peace Yahoo.

J. Gerry Purdy, Ph.D., is the principal analyst with Mobilocity and a research affiliate with Frost & Sullivan. He is a nationally recognized industry authority who focuses on monitoring and analyzing emerging trends, technologies and market behavior in mobile computing and wireless data communications devices, software and services. Purdy is an “edge of network” analyst looking at devices, applications and services as well as wireless connectivity to those devices. He provides critical insights regarding mobile and wireless devices, wireless data communications and connection to the infrastructure that powers the data in wireless handheld devices. Purdy continues to be affiliated with the venture capital industry as well. He spent five years as a venture adviser for Diamondhead Ventures in Menlo Park, California, where he identified, attracted and recommended investments in emerging companies in the mobile and wireless industry. Purdy had a prior affiliation with East Peak Advisors and, subsequently, following its acquisition, with FBR Capital Markets. Purdy advises young companies that are preparing to raise venture capital, and has been a member of the program advisory board of the Consumer Electronics Association that produces CES, one of the largest trade shows in the world. He is a frequent moderator at CTIA conferences and GSM Mobile World Congress. Prior to funding Mobilocity, Purdy was chief mobility analyst with Compass Intelligence. Prior to that, he owned MobileTrax LLC and enjoyed successful stints at Frost & Sullivan and Dataquest (a division of Gartner) among other companies.

Editor’s Note: Welcome to Analyst Angle. We’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.