New and evolving digital video models are set to change the market and require a new mindset to succeed

Remember in recent years when technology disruption upended the music and publishing industries?

A slightly different – yet potentially more seismic – upheaval is happening now in the home entertainment, advertising-funded broadcast TV and pay-TV markets.

Traditional cable TV and TV network broadcasters are finding they need to position themselves differently to capture new growth in the digital video market. They are becoming digital providers using their own streaming platforms to better compete against new super platform providers such as Netflix and Amazon.com who have the advantage of leveraging webscale digital platforms.

By collaborating in new ways, broadcasters and TV operators can achieve success. One provider cannot offer all the content and technologies needed to deliver competitive digital offerings. By working together it is possible, as consumer demands shift, to create compelling comprehensive experiences while generating growth opportunities for both types of companies.

Who are the players?

A new Accenture report titled “Bringing TV to Life: The Digital Video Business,” examines the coalescence of two business models: digital content distributors and digital content aggregators.

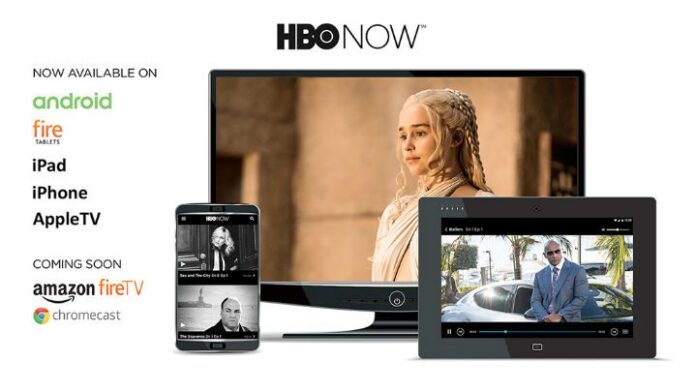

Traditional content distributors, such as NBC and HBO, produce original content and acquire content for distribution on several platforms, many of them pay TV. These companies are transitioning into digital content distributors. HBO Now, Showtime and CBS All Access, CanalPlay, and Mediaset Live represent traditional distributors embracing digital through standalone streaming services.

Traditional aggregators, such as cable TV (Comcast) and telecom (Verizon Communications) service providers, offer the pipes for linear distribution and now digital services. Traditional linear technology provides scheduled programs throughout the day across a limited amount of devices using mass-distribution mechanisms. By contrast, digitized content is available through numerous devices and distribution mechanisms using more two-way communications and delivering more unique consumers experiences.

By offering a platform for broadcast and cable network channels to broadcast their content over the air, these aggregators own the customer relationships, packaging and viewing mediums. Through their own networks they can market, sell and offer video services and channels to consumers.

Lines blurring between distributors and aggregators

With companies transitioning from one role to the other in this digitally disrupted ecosystem, lines continue to blur between digital distributors and aggregators. YouTube Red, for example, represents Google’s move into subscription video on demand from a digital aggregation play of nonpremium content. Amazon Prime’s “Streaming Partners Program” represents the reverse, a distributor-to-aggregator model. By paying an additional fee, Prime members can add to their Prime video programming service while digital content distributors are able to reach a targeted audience in addition to traditional Prime services such as Amazon’s original and acquired content.

As traditional TV companies such as NBC seek to capture growth in digital business-to-consumer markets, they will need to invest more in digital technologies and capabilities as well as adjust their product and content delivery operating models to provide their services at speed and at scale. But this can increase capital and operating expenses especially as content inflation continues to increase. Some companies will diversify by continuing to drive towards both direct distributor and syndicator roles. Ultimately, each must decide which business they intend to operate and start building the capabilities required to support them. With all of that in mind, a new type of collaboration between aggregators and distributors will be key to creating the appropriate synergies that will drive new growth for these new partnerships.

To better serve consumers’ needs and promote loyalty across digital and traditional businesses, TV networks need to provide a consistent, yet personalized, content experience for consumers across all digital platforms, thereby bolstering consumer confidence and positive brand awareness.

Scale is the challenge

In traditional business models, broadcasters and cable networks depend heavily on ad revenue derived from multiple linear platforms. This creates a significant scaled footprint for generating carriage agreement and advertising revenues. Linear footprints may have the scale, but digital footprints can potentially have the premiums. Balancing these two is paramount for traditional distributors to maintain profits.

The emerging role of the digital aggregator

With these distributor digital needs in mind, Accenture has identified strategies traditional aggregators aspiring to be digital content aggregators can use to evolve their businesses, attract more digital distributors, increase customer loyalty, pursue new markets, and drive growth.

Treat content as king

It remains as true as ever: content is king. It is the most decisive factor in a customer’s choice of provider. Consequently, the quality and relevance of an aggregator’s digital content will continue to be paramount. Strong content propositions will depend on aggregators establishing broader content collaborative relationships with traditional providers and multi-channel networks. As consumption trends continue to diversify, becoming the gateway that consolidates a wide range of content together in a consistent, easy-to-use experience will attract and engage customers.

Scaling up to succeed

Aggregators should scale digital services. This underpins advertising- and subscription-based business models. A large viewer base attracts content providers. But in the digital world with the potential for global scale, it also enhances an aggregator’s ability to segment its customers accurately and deliver more relevant content while monetizing the growing digital footprint. An internet protocol-enabled distribution platform is only as good as the number of users that consistently use it. Webscale providers such as Amazon, Facebook and Google offer outstanding scale and agility to quickly respond to viewer behavior rapidly and broadly. This threatens traditional aggregators.

Aggregating insights

To maximize the value of their analytics, aggregators will need to drill down further, penetrating beyond a household view to an individual view. Better insights into distribution channels drive more relevant and engaging business services, such as content targeting and more personalized ads that generate higher revenues for distributors and aggregators.

Satellite provider Sky, with the launch of AdSmart in the U.K., is an early adopter in this field. As dynamic targeting services for the purposes of advertising, marketing or promotion become a priority for digital content providers, digital content aggregators will need to make sure they have appropriate data-enabled platforms to serve that need.

Final thoughts

It is time for traditional distributors and aggregators to re-engineer themselves into digital providers. To succeed, they need to work together more than ever. Executed effectively, expect a wave of innovative digital products and services that will please more digital video consumers. This, in turn, will generate more revenues and profits for companies that create and deliver these compelling content products and services.

Youssef Tuma is a managing director for Accenture’s Media and Entertainment group. He can be reached at Youssef.d.tuma@accenture.com.

Editor’s Note: The RCR Wireless News Reality Check section is where C-level executives and advisory firms from across the mobile industry share unique insights and experiences.