Ericsson highlighted a number of industry trends at its latest Capital Markets Day, including expectations of broad 5G deployments.

From a mobile broadband industry perspective, there were several key takeaways from Ericsson’s Capital Markets Day held today in New York including:

• Mobile broadband market conditions remain more challenging than expected.

• Services growth expected to outperform network equipment growth.

• “5G” is not just slides anymore.

• Despite challenging conditions, there are opportunities.

Ericsson acknowledged market conditions for mobile broadband remains challenging and the company issued a forecast suggesting overall mobile broadband radio infrastructure investments are on pace to decline between 10% and 15% in 2016, followed by a 2% to 6% slide in 2017, before 4G deployments in emerging markets such as India and Brazil stabilize the market in 2018/2019. In contrast to previous Capital Markets Day projections, which tend to be more optimistic than our own internal forecasts, the latest were more in agreement with our own projections, even if we are perhaps on the low-end of its 2017 outlook.

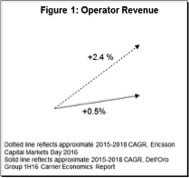

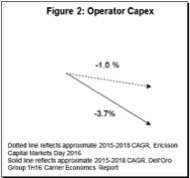

In addition, Ericsson also issued operator revenue and capital expense projections, and we were pleased to see the high level trends were in line with our own internal projections (Figure 1 and Figure 2).

While the natural instinct as an analyst is to immediately assume one’s projections might be too optimistic if the forecast is in line with that of a supplier, Ericsson presented several compelling arguments suggesting they are doing their best to issue more realistic projections. Of particular interest was Ericsson’s acknowledgement that 4G systems came with a lot more upfront capacity than 3G base stations and the lower than expected uptake in mobile data devices and data traffic has delayed the need for operators to add incremental capacity. This is consistent with our third-quarter findings as well suggesting macro base station shipments are on track with expectations and remain elevated, even if they are down from 2015 levels, but the revenue per base station is trending at a weaker pace than anticipated, which likely is a result of both a challenging pricing environment and weaker than expected demand for capacity upgrades. However given the trends in mobile data traffic, sooner or later operators will need to invest more in capacity upgrades.

The other interesting takeaway from Ericsson’s overall Networks forecast is the expected divergence between mobile radio equipment and networks services revenue. In both the more pessimistic and optimistic scenarios, Ericsson’s projections imply the 2016 to 2018 compound annual growth rate of the combined revenues of the non-radio access network components including services, rollout, support and transport equipment is expected to outperform RAN equipment growth by approximately 2x. Given that we estimate R2 to be greater than 0.5 between Ericsson’s network rollout business and its RAN macro base station shipments, it is very likely network managed services is expected to drive the delta. Taking into account year-to-date network managed services performance of the top network vendors and the underlying trends with the outsourcing component of managed services, these projections imply the company expects transformational managed services to compensate for the downward pressure in outsourcing.

Source: Ericsson Capital Markets Day 2016.

Ericsson also shared several interesting 5G data points. First, the company reported material progress in the overall 5G agenda with the “internet of things” and 5G increasingly driving customer conversations, partly a result of operator revenue trends. The vendor confirmed it expects pre-5G/5G deployments to begin in the 2018 to 2019 time period.

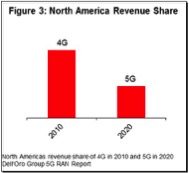

And in contrast to the uptake of 3G and 4G, the company believes 5G deployments will be distributed across multiple countries and regions from the start, reducing the typical lag between leaders and laggards in previous technology shifts. This is consistent with our own internal projections suggesting that North America’s 5G share in 2020 will be roughly half the size of its 4G share in 2010 – driven by increased operator interest in 5G across the world (Figure 3).

In short, the company has been dealing with both internal and industry specific challenges lately, so it was encouraging to see Ericsson acknowledging these challenges while at the same time reaffirming its commitment to be one of the leading mobile broadband vendors in the 4G and 5G era, capitalizing on both existing and new opportunities with IoT, public safety and fixed-wireless, among other things.

Editor’s Note: In the Analyst Angle section, we’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.