Now that nearly every new smartphone sold in the U.S., Japan, South Korea and much of Europe includes an LTE modem, one might think all modems are pretty much the same. After all, “5G” smartphones are still a few years away and LTE is good enough for now. Except when it isn’t.

Chipmakers continue to innovate their LTE modem technology, adding new features and capabilities to improve performance. At the same time, operators are racing to upgrade the capacity and performance of their networks. To demonstrate these upgrades the operators need phones that support the latest features, driving demand for the most powerful modem chips.

For example, T-Mobile US recently upgraded its entire LTE network to support 4×4 multiple-input/multiple-output antenna technology and 256 quadrature amplitude modulation. These two technologies go beyond carrier aggregation to actually improve the spectral efficiency of each channel. Together, they boost the peak throughput of a single 20-megahertz channel from 150 megabits per second to 400 Mbps, a 167% increase. These channels can then be aggregated to achieve even greater data rates. By deploying these advanced features, T-Mobile US could claim it has the fastest network in the U.S., but it needed a phone that could support them.

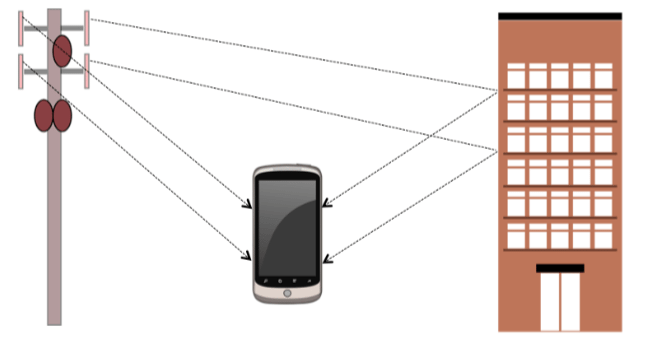

A cellular network implements 4×4 MIMO by transmitting four independent signals to the phone. The phone must have four internal antennas to receive these signals as well as a modem chip that can decode them.

In announcing the new network, T-Mobile US CTO Neville Ray specifically called out the Samsung Galaxy S7 and S7 Edge as the only phones that would immediately support the new capabilities. The company is promoting these phones because they include a modem chip that supports both 4×4 MIMO and 256QAM. In particular, the Galaxy S7 models sold in the U.S. feature the Snapdragon 820 processor, which integrates Qualcomm’s powerful X12 modem.

In addition to the right modem chip, a phone must include additional components to implement the 4×4 MIMO mode. As the name suggests, 4×4 mode enables the phone and base station to exchange four simultaneous signals instead of the standard two. Each of the extra signals requires an antenna and RF front-end components, although in some cases the antenna can be shared with, for example, an existing Wi-Fi antenna. Because of the extra space and cost required for these components, not all phones that include the X12 modem can support its full capability, but the Galaxy S7 does.

When Sprint upgraded its LTE network to support three-carrier aggregation the company partnered with HTC to develop a smartphone to showcase the new technology. The operator announced the exclusive HTC Bolt as its “fastest smartphone ever” in a marketing campaign featuring sprinter Usain Bolt, driving sales of the new phone. The Bolt uses an older Snapdragon 810 processor that was the first modem chip on the market to support 3CA.

These examples show how operators will actually promote specific smartphones on the basis of their leading-edge modem capabilities. T-Mobile US and Sprint, among others, directly compete for U.S. customers and network speed and reliability are important factors to many customers. This type of operator competition is common in other countries and regions as well.

For operators, a fast network doesn’t matter without fast phones that can take advantage of new features and capabilities. Therefore, leading operators are seeking out leading-edge phones that support their newest networks. Implementing a leading-edge modem allows OEMs to stand out from their competitors.

In a world where every black slab of glass starts to look the same, modem speed offers a vector for differentiation. Choosing the right modem attracts interest not only from end users but also from operators themselves, who may lavish marketing funds on a phone that highlights their network capabilities. Basic LTE is no longer good enough.

Linley Gwennap is principal analyst for mobile at The Linley Group and editor-in-chief of Microprocessor Report. Development of this article is funded by Qualcomm, but all opinions are the author’s.

Editor’s Note: In the Analyst Angle section, we’ve collected a group of the industry’s leading analysts to give their outlook on the hot topics in the wireless industry.