Makers of wireless infrastructure are often careful about naming the semiconductor companies that supply their chipsets, creating a tension between chip vendors who want to promote their customer wins and manufacturers who want to maintain a competitive advantage by disclosing as little as possible. However, several deals have been publicly announced in the small cell space.

Indoor solutions from SpiderCloud Wireless, which are gaining tremendous traction with Verizon, have traditionally used Broadcom’s integrated baseband processors. However, Broadcom has significantly reduced its commitment to the small cell chip market since becoming part of Avago (the combined company is called Broadcom Ltd.). SpiderCloud turned to Qualcomm for LTE small cells that will support licensed and unlicensed spectrum bands.

Alcatel-Lucent was a small cell market leader and now that business is part of Nokia, following Nokia’s $16.5 billion purchase of Alcatel-Lucent. Qualcomm was a small cell chip supplier to Alcatel-Lucent, and Nokia has typically sourced chips for its Flexi Zone product from Freescale or used its own technology, according to analyst Earl Lum of EJL Wireless Research.

Qualcomm is the chipset supplier for the femtocell developed by Nokia for T-Mobile’s U.S. network. Qualcomm has also supplied chips for the S1000, the solution from CommScope’s Airvana that Sprint is using for some in-building deployments. Airspan, the vendor that has worked with SoftBank and is thought to be supplying many of the outdoor small cells for Sprint’s current network densification effort, is also a Qualcomm customer.

Intel is a relative newcomer to this market. The chip giant purchased Mindspeed, which owned the intellectual property of Picochip. Picochip was a supplier to ip.access, a company which started with a focus on the indoor market but is now exploring outdoor solutions as well.

Ericsson, which makes both indoor small cells and remote radio heads used in outdoor deployments, does not usually disclose information about chipset suppliers. The company is thought to develop many of its own chipset solutions.

“The amount of intellectual property they own in house around chip design is phenomenal,” said Lum. “But you never hear about it.” Lum said that Ericsson typically uses application specific integrated circuits (ASICS) for its small cell designs.

Huawei is likely to use ASICS for its small cell equipment as well, Lum said. He said Samsung typically has not used ASICS. The Korean company is a small cell manufacturer but has not publicly announced its chipset supplier.

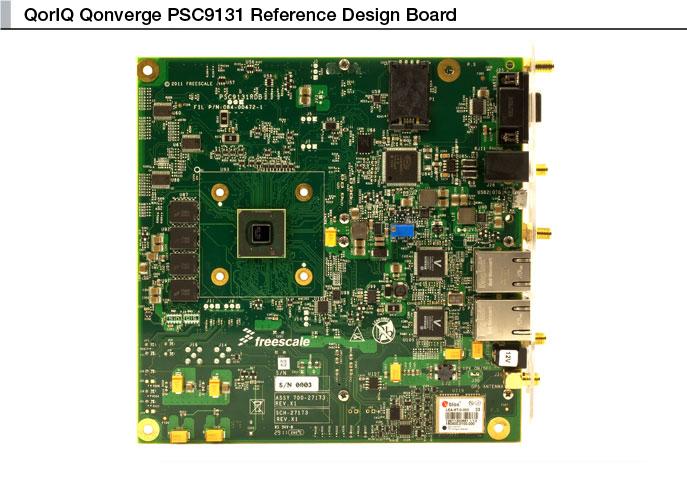

Freescale, which is now part of NXP Semiconductor, has at least two major small cell customers: ZTE and CommScope’s Airvana OneCell. Nokia is said to be a Freescale customer as well. But Freescale’s small cell chip business is likely to be absorbed by rival Qualcomm within the coming months, since Qualcomm is set to buy NXP.

Image source: NXP Semiconductor

See also Small cell chip technology update.

Follow me on Twitter.