Mobile network operators need data centers that can scale with their networks, and the providers that have the most control over their hardware may ultimately be the ones who can best serve operators as they migrate to “5G.” P4 is a programming language designed to give data center owners like AT&T and Google more control by opening up the chips that route traffic through the network.

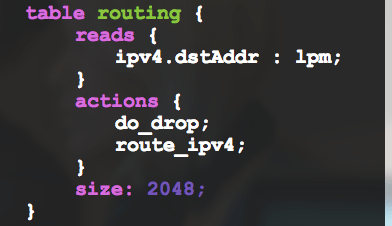

Ethernet switches that move data packets through a network can be configured in the field when they are powered by chips that can be programmed using P4. More than 60 companies and universities have joined an industry consortium to support P4.

The P4 language was developed by a group of engineers that includes Stanford professor Nick McKeown, co-founder of Nicira and Barefoot Networks. Barefoot Networks is a startup founded to commercialize programmable Ethernet switch chips.

Ed Doe, VP of marketing at Barefoot Networks, said his company’s Tofino chipset is the first Ethernet switch chip to combine high performance with field programmability. Gate arrays and network processors are already programmable, but the Barefoot team said it’s the first to bring this technology to Ethernet switches. Doe said the target customers are data center owners and original equipment manufacturers. Currently, OEMs may create their own application specific integrated circuits or can purchase Ethernet switches from a third party. Broadcom is currently the leading provider of Ethernet switches.

“Ideally, more OEMs would experiment with fully programmable data planes, but we expect many to stick with Broadcom for architectural familiarity,” said Loring Wirbel, senior analyst at The Linley Group, late last year. “We look forward to seeing radical [software-defined networking] platforms in 2017 that can take advantage of a Barefoot architecture thereby preventing a Broadcom top-of-rack monopoly and popularizing such programming tools as P4. For the time being, however, adherence to the familiar may define data center rack aggregation, giving Broadcom the upper hand in scaling network performance.”

Several executives on the Barefoot team came from Broadcom and they see customizable switch chips as the future. Doe said open architectures are likely to appeal to companies already trying to take control of their silicon resources.

“The large cloud companies are very secretive,” Doe said. “Google is starting to build its own processor, like the [picture processing unit], and trying to get control over programmable work loads. If you look at what Amazon talked about at their last event, they talked about how they’re trying to customize the network connectivity on the servers so they’re very proud of their new custom network interface controller that they built themselves. … They’re trying to customize every aspect of what they’re doing to get additional efficiencies and scale.”

Doe said the P4 language means these giants won’t need to develop their own Ethernet switch chips, noting it takes two years to develop an Ethernet switch chip. With the Barefoot solution, Doe said customers can add a new feature to an existing switch in minutes.

Analysts say the Ethernet switch market is worth more than $20 billion. IHS foresees the market growing 1.2% this year and 2.1% in 2018. The internet of things is expected to fuel the market for Ethernet switches as network operators connect more devices with disparate data transmission requirements.