Interoperability, architecture and framework for Wi-Fi roaming

The global mobile workforce is set to increase from 1.3 billion in 2014, accounting for 37.4% of the global workforce, to 1.75 billion in 2020, according to various sources. Globalization will continue to drive the growth of mobile office workers in all regions as executives, consultants, sales & field professionals, and other mobile professionals of multinational corporations proliferate. For those billions of mobile users, working both inside and outside of the traditional office, mobility has become synonymous with productivity.

In a data-driven world, mobile workers need high-speed, high-quality Internet connectivity for a host of business tasks, including downloading presentations, sharing large files, and accessing cloud-based applications and Unified Communications tools. And when it comes to getting connected, mobile workers have already shown a clear preference for Wi-Fi over cellular networks, which are more expensive. In fact, Wi-Fi, now carries more than half of all mobile data.

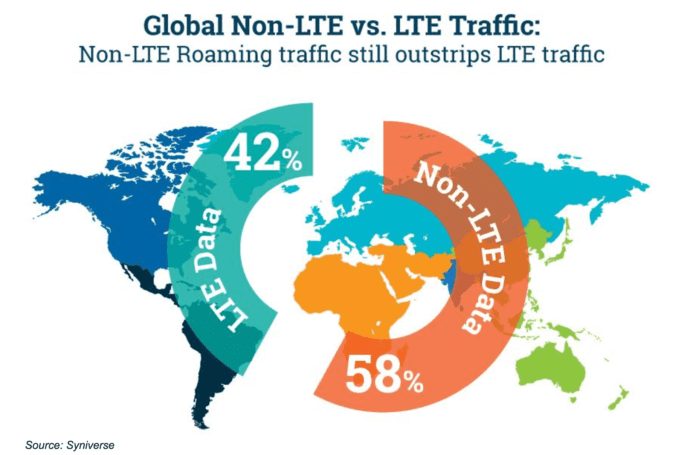

As mobile operators have learned over the last 25 years of operating mobile networks, roaming is an excellent solution to obtaining coverage, since it is not feasible to construct your own network everywhere that your subscribers may wish to obtain service. Roaming, in contrast, multiplies the home operator’s coverage outside of their home market, without requiring capital investment in the build-out. Only 42 percent of inter-regional data roaming taking place around the globe is LTE while non-LTE roaming traffic represents 58 percent according to a study by Syniverse.

Many mobile network operators have adapted to this reality and decided to tap into the opportunity to better serve their customers by including international Wi-Fi roaming to their cellular offering.

Wi-Fi roaming framework

The Wireless Broadband Alliance (WBA) defines roaming set-up best practices for service providers and outlines the reasons for providing roaming services as well as suitable strategies to adopt. Standards are provided for the type of information needed from the Wi-Fi network, together with guidelines on how to exchange relevant information between involved parties.

Such best practices and technologies are grouped under the umbrella of Next Generation Hotspot (NGH) driven by WBA which is the stepping stone for Wi-Fi Roaming. Nowadays it already led to more than 10 global deployments from top tier operators.

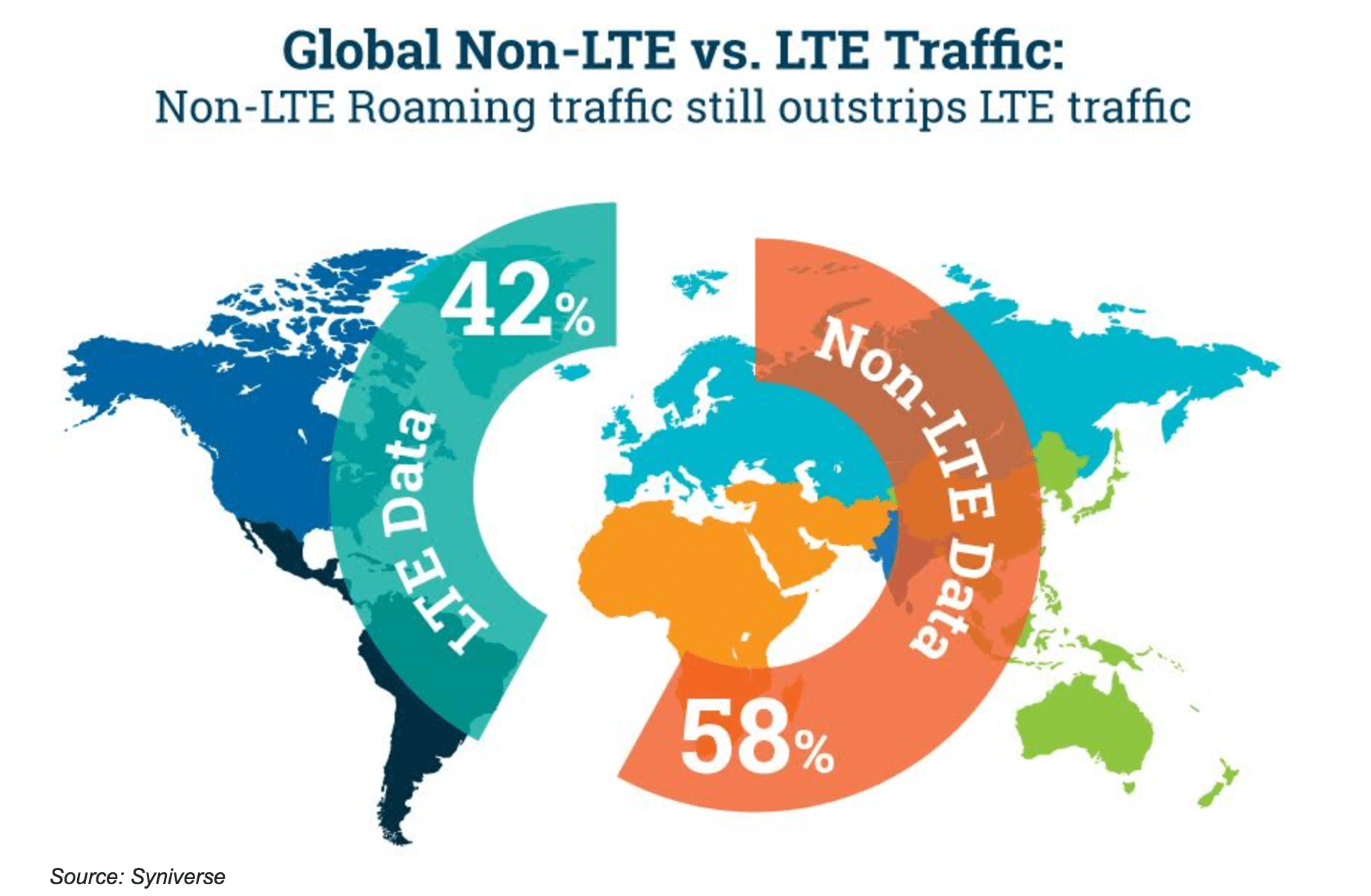

There are three primary stakeholders in the Wi-Fi roaming ecosystem:

- The Visited Wi-Fi Network Provider (VN)

- The Home Service Provider (HSP)

- Hub & Clearing House

Visited Wi-Fi network operators – perhaps the most complex group, a Wi-Fi network is made up of one or more Wi-Fi access points. The owner/operator of a Wi-Fi network may wish to join a Wi-Fi Roaming hub and enable inbound roaming traffic, thereby monetising traffic on the network.

Wi-Fi network owners/operators come in all shapes and sizes – for example single site locations like a venue, to multi-site like hotel chains. There are service providers who have built Wi-Fi networks to complement fixed networks such as BT or Comcast, and mobile providers who’ve added Wi-Fi to augment mobile capacity like AT&T. There are also aggregators like iPass and Boingo who have established relationships with third party Wi-Fi networks under a unique umbrella.

The Wi-Fi hub – modelled on GSM Roaming, the Wi-Fi hub provides a central connectivity point between the visited Wi-Fi networks and the home subscriber networks. Within the hub, there are two general functions: Inter-connectivity and Settlement and clearing.

Subscribers – these are the end customers who roam and ultimately use Wi-Fi managed by a Visited Network Provider (VNP). To facilitate access, the subscribers may have a downloadable app or have functionality embedded in their device, which helps find appropriate Wi-Fi access points and can manage the connection process. The subscribers will also have an existing billing relationship from their Home Service Provider (HSP), and likely be assigned to service plan that includes Wi-Fi Roaming

The WBA has two major initiatives to simplify roaming – streamlining the process via roaming frameworks, notably the ICP (Interoperability Compliance Program); and standardizing hotspots and devices so they can work together automatically. The latter is being driven by Next Generation Hotspot and by the Wi-Fi Alliance’s Passpoint program, which allow for transparent access to access points from any vendor and operator – crucial for effective roaming.

WRIX sandards

WRIX (Wireless Roaming Intermediary Exchange) is a set of service specifications published by the Wireless Broadband Alliance to provide a framework for Wi-Fi interconnection, data clearing, financial clearing and the exchange of Wi-Fi location information between operators. The purpose of the service specification is to standardize both technical and business processes between Wi-Fi Roaming Partners.

Interoperability Compliance Program

Traditionally, there have been different methods for implementing Wi-Fi roaming across the industry. In order to clarify and standardize these requirements, the WBA created the Interoperability Compliancy Program (ICP). This program provides operators with a common technical and commercial framework for Wi-Fi roaming by utilizing the best practices as defined by the WBA’s WRIX guidelines. The ICP outlines a framework which defines the basic requirements for roaming and settlement to more advanced models. By doing this the WBA’s Interoperability Compliance Program facilitates and simplifies the implementation and deployment of Wi-Fi Roaming.

Wi-Fi roaming architecture

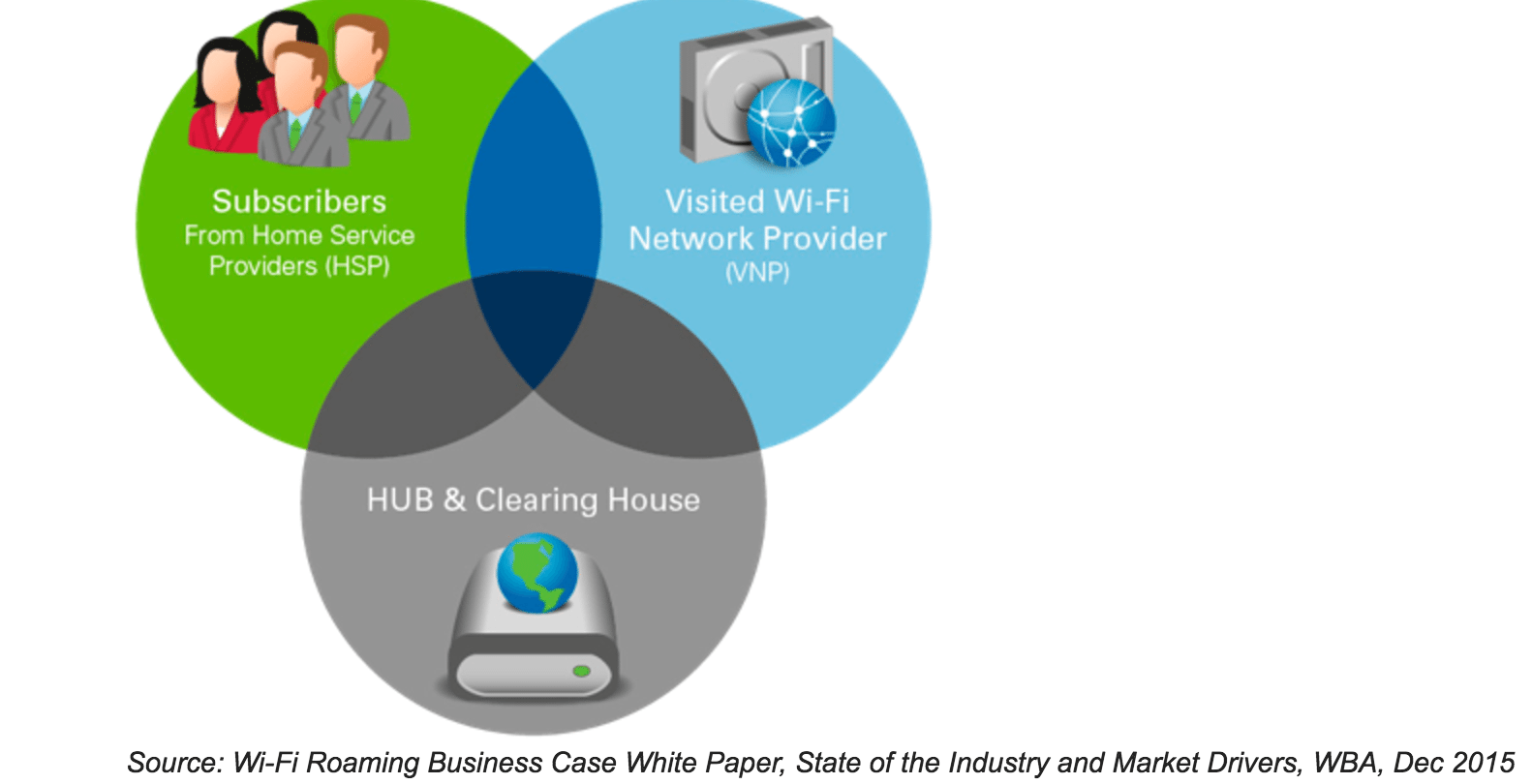

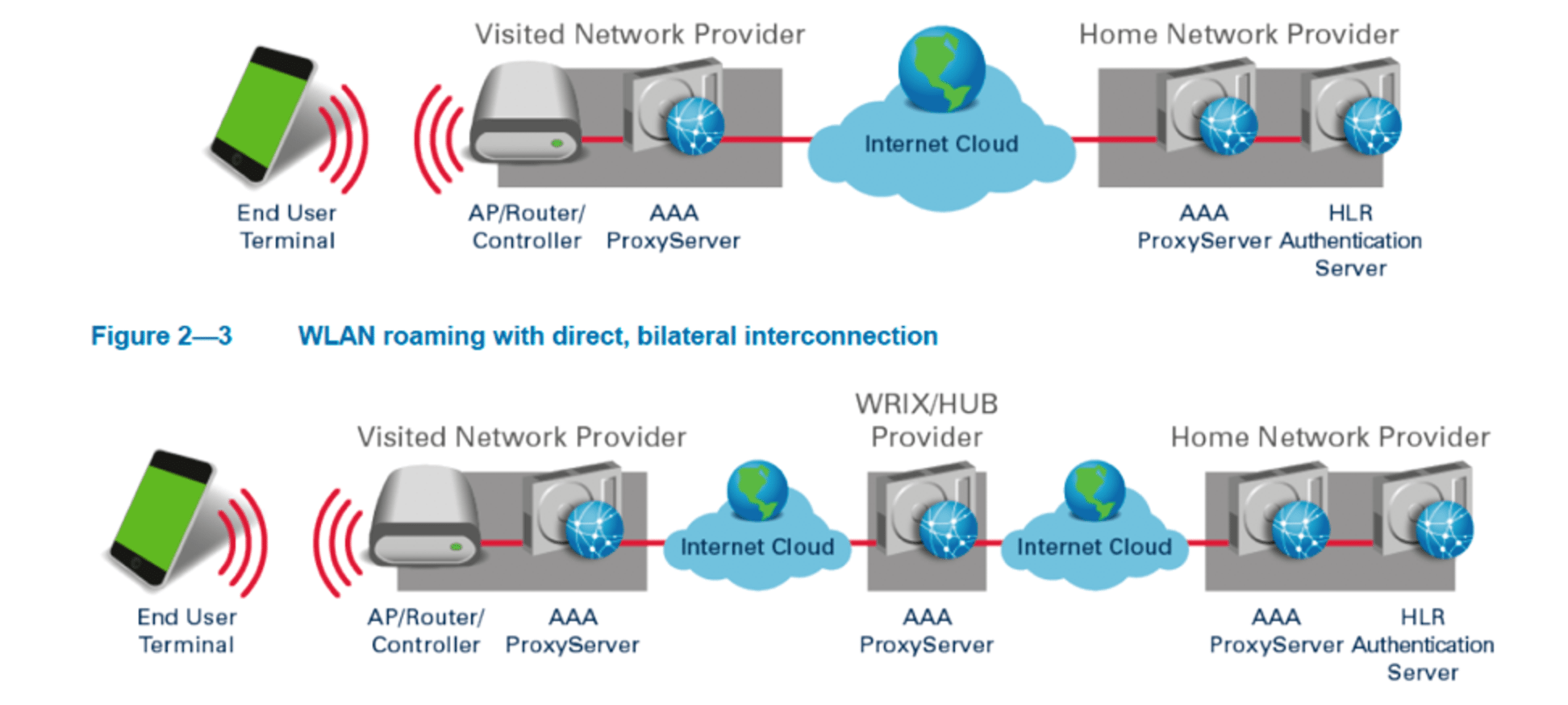

Operators may have different approaches when developing a roaming strategy. There are two main scenarios available to operators to interconnect their networks, either through a direct connection or by using a third party to facilitate that interconnection as shown in the next figure:

Passpoint

The Passpoint program from the WFA on the device and equipment complements well the work done by the WBA on the end-to-end side. The two complementary systems support seamless authentication, giving users a single log-in and a cellular-like convenience for both SIM and non-SIM devices whether they are just on Wi-Fi or also roaming onto cellular. As of April 2017, the WFA has certified 1700 devices (both access points and mobile devices) .Using Passpoint, the device can automatically query Hotspot 2.0 access points as to whether there is a roaming agreement between its network provider and the venue, and log on automatically if so with no intervention required from the user. Support for 802.11u in the access point means the AP can broadcast its capabilities to devices. NGH focuses on service capabilities, standardizing the billing, provisioning and policy aspects.

This combination is a key enabler of seamless Wi-Fi offload, and of evolving multi-network business models which require a more intelligent balance. It also greatly enhances the quality of experience for Wi-Fi hotspot users, with the potential to boost usage especially among high value consumers such as business travelers.

According to the WFA, the remaining challenges slowing down the adoption of hotspots 2.0 includes the fact that online sign-ups have not reached critical mass. In a situation where there is no WIFI roaming agreement, the onboarding can be quite tedious for those SIM-less users.

Integration time frames remain a challenge due to the complexity and unique characteristics of each Wi-Fi Network and the markets they serve. iPass believes the advent of HS2.0 will make a difference in integration challenges as well as connection success but it will take many years before a majority of hotspots are HS2.0 compliant.

ANDSF

Another standard which is important in situations where devices move between Wi-Fi and cellular is the 3GPP’s ANDSF. This has been part of the standards since Release 8 but was initially a static technology and really came into its own in terms of seamless access in Release 11. More capabilities were added in Release 12, which was supported in LTE devices and infrastructure from late 2015. The later releases of ANDSF have seen limited native support on devices, though there are third party client software solutions which comply with the specifications and add further functionality.

Wi-Fi roaming deployments

The most famous example of large-scale Wi-Fi roaming is probably the Cable Wi-Fi alliance in the US, but many Wi-Fi providers, especially in Asia-Pacific, have been steadily signing roaming agreements over the past years, often under the auspices of the WBA.

There has been a steady stream of announcements of Wi-Fi roaming deployments in the past two years, but one of the most striking was in California, where two cities not only upgraded their networks to Hotspot 2.0, but initiated the first roaming deal for the standard. A broad footprint and transparent roaming will be vital to the uptake of the platform, so the move by San Francisco and San Jose was symbolically important.

In another significant roaming announcement, the US’s Comcast and multinational cable group, Liberty Global, entered into a deal which will open up huge numbers of locations to their respective subscribers. The agreement covers a total of about 5.5m locations in the US and Europe including 2.5m hotspots and Community Wi-Fi hotspots run by Liberty under the Wi-Free and Wi-FiSpots brands in Belgium, The Netherlands, Ireland, Poland and Switzerland.

AT&T

AT&T has been one of the most enthusiast adopters of Wi-Fi roaming and has garnered great results from the initiative. AT&T customers with International Packages, in addition to an allowance of cellular minutes, messages and megabytes, enjoy seamless access to over 16 million hotspots in 50+ countries. These include close to a million venue-based hotspots (airports, hotels, cafés, etc) and over 15 million “homespots”. The company also includes in the Wi-Fi finder portion of the AT&T Global Wi-Fi app the location of 1.5 million public hotspots. They have 60+ roaming agreements. Most of the roaming agreements are international but some are domestics too.

The results have been very positive according to AT&T which would not share precise numbers but indicate soaring usage in terms of number of roamers, roaming data consumption (including cellular) and retention rate. As long as the cost of Wi-Fi wholesale remains lower than cellular data, the model works and AT&T plans to expand both their footprint as well as the adoption of Passpoint profiles into client devices especially on iOS. AT&T has their own application needed to discover and authenticate into partner Wi-Fi networks.

Remaining challenges

Establishing a roaming agreement is a long and tedious process still. The Wi-Fi Roaming Revenue is not achieving its full potential according to Dan Klaeren, Director, Product Management at Syniverse . This lost opportunity includes both B2B (Roaming agreements) and B2C offerings. The reasons are many.

Identifying a potential partner who is not an active member of the WBA can be tricky in the first place. Then ensuring the said potential partner abides by the requirements needed to establish a successful bilateral agreement requires also a great of work and time. There are the technical, business, financial then legal steps that have to be overcome which requires a good dose of motivation on the part of both parties which in turn requires a clear view of the potential return on investment of such an endeavor. Syniverse is working on facilitating that marketplace exchange and will provide more details at the upcoming Wireless Congress in London in May 2017. Syniverse has been very active in participating to the WRIX standard and other core activities of the WBA. The final step being setting up accounts payable agreeing to details such as currency of payment.

For Accuris which provides a clearing hub, the biggest challenge is in “old thinking”. The notion that adding Wi-Fi to a roaming offer is a threat to the cellular service and revenues. It can seem counter-intuitive, but giving roamers access to a Wi-Fi package actually increases their 3G/LTE data usage – in some accounts, it has doubled the amount of 3G/LTE data usage as confirmed by the data reported by AT&T.

Putting Wi-Fi into a roaming offer reaches the cost-sensitive silent roamers, the people who travel but get a second SIM, or just use hotel Wi-Fi. “As a result, we’ve seen more people buying roaming packages (and customer satisfaction increase) “ added Steve Shaw, VP Marketing at Accuris.

iPass, which claims 160+ active Wi-Fi Roaming Agreements in 2017 (mostly non MNOs, believes challenges for Wi-Fi roaming deals are economics and speed of integration. In order for Wi-Fi roaming to remain a compelling and attractive proposition, the wholesale roaming rates have to be competitive against cellular networks.

Future developments

The roaming-related work accomplished by the WBA and the collective strengths of its members have been instrumental in the growth of global Wi-Fi Roaming. The WBA facilitates access to a quality global Wi-Fi footprint, a huge subscriber base, unique expertise and track record, and award-winning technical enablers. The WBA also provides opportunities to engage global partners and influence the industry. It offers a significant value proposition to all wireless broadband operators and ecosystem partners interested in enabling a seamless Wi-Fi experience, delivering global Wi-Fi Roaming and integrating Wi-Fi across mobile technologies for the benefit of end-users.

If you are interested in more information, and want to learn how mobile operators are using Wi-Fi roaming to enhance their mobile retail propositions, visit the Wireless Global Congress and attend the Wi-Fi Roaming workshop on May 11th.