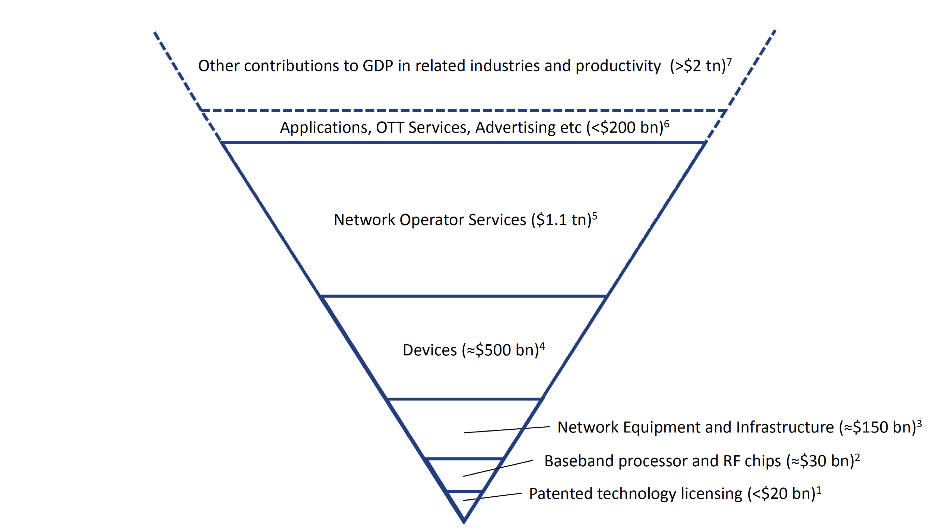

The utility of communications technologies, including those already in 4G and new innovations being developed for upcoming 5G, are increasingly leveraged in the higher levels of the IoT value chain: from technologies, chips and network equipment to devices, operator services and into vertical applications at the top.

My inverted pyramid depicts this value chain and shows that costs in networks, communications chips and technology licensing generate highly-leveraged revenue and productivity gains. These are worth one thousand times more and are predicted to rise to between $3.9 trillion and 11.1 trillion by 2025 with IoT.

Figure 1: Technology Fulcrum Drives Mobile Ecosystem (2015/2016)

Source: WiseHarbor, considering and extrapolating from these market estimates:

1. WiseHarbor published research

2. Strategy Analytics and others

3. GSMA Wireless Intelligence: one third to half of total in mobile network equipment

4. IDC for mobile phones and others for cellular tablets and wearables etc

5. GSMA Wireless Intelligence

6. Emarketer, Apple’s $26bn services revenues

7. GSMA research report on economic value added to North American economy

For a couple of decades until around the turn of the millennium, mobile communications had well-defined bounds because usage was overwhelming in voice and text messaging; but even these capabilities had profound positive effects on the overall economy by making people more productive. Examples of this included major displacement of calls from the office to the car. For example, a 2005 survey I managed at the Yankee Group revealed, for more than 42% of respondents, that more than half of mobile phone usage was in their cars. Mobile communications is still mostly used directly by people, with the addition of predominantly consumer-oriented mobile apps and OTT services on smartphones.

Mobile ecosystem revenues significantly increased due to subscriber growth and as devices morphed from featurephones to much more functional smartphones at somewhat higher prices and as data services supplemented voice. The ecosystem expanded significantly: first with business-oriented BlackBerry messaging and more consumer-oriented Symbian-based applications, and then with a plethora of capabilities on Apple’s iOS and Android devices from the latter part of the decade.

Nevertheless, the vast majority of ecosystem revenues have remained in operator services and mobile phones sales, as bounded by the solid lines in Figure 1. The dotted lines enclose additional revenues in applications and services that are largely monetized by advertising. Value is also significantly generated open-endedly in other industries and in the productivity improvements we all accrue such as the time we save by being able to make and receive calls and exchange messages while on the go.

What’s next?

Upcoming opportunities also significantly include new technological capabilities that are automatically accessed and exploited by “things” in consumer and industrial use. The top of the inverted pyramid is expanding to embrace many new applications and verticals. In some cases, these will be business-to-consumer applications (e.g. for use of a self-driving car) and in other cases they will be business-to-business applications (e.g. in the supply chain manufacturing a car) in the so-called Industrial Internet of Things (IIoT), which is also referred to as Industry 4.0.

Growth is expected to be enormous – including new revenues for ecosystem suppliers, new business models and indirect economic benefits such as energy savings in homes and smart cities, improved healthcare with fewer visits to the doctor’s office and inventory reductions in supply chains. If cars could drive themselves then perhaps we could significantly displace a proportion of our deskwork and sleeping to travel time. As real-time sensor data helps monitor performance and usage, the “as-a-service” business model, for example, with aero-engines, will increasingly be employed. Many of these developments will be dependent upon mobile communications including 5G capabilities.

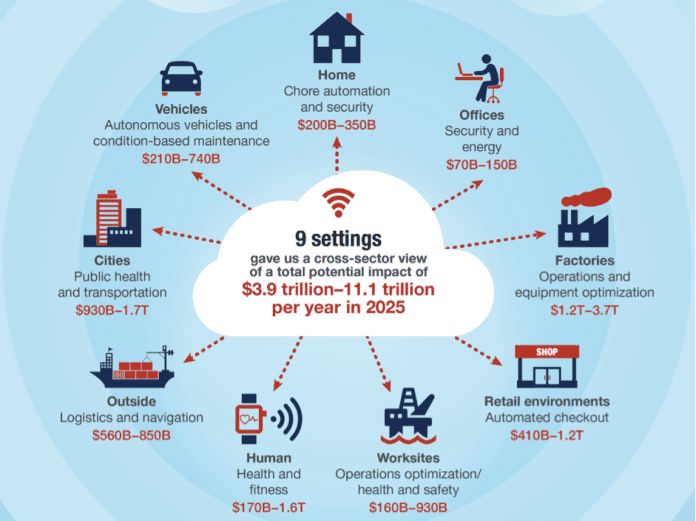

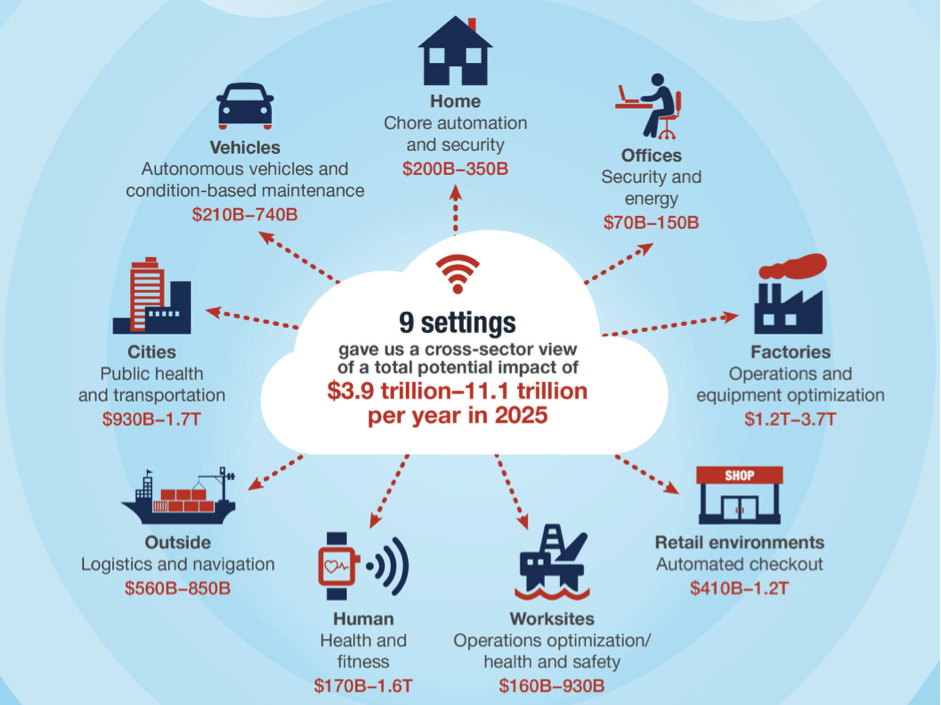

The McKinsey Global Institute forecasts in a report entitled “unlocking the potential of [IoT]” a total potential impact of $3.9 trillion to $11.1 trillion across a variety of different consumer and industrial setting in 2025, as shown in Figure 2. It also reckons that at the high end, the value of this impact—including consumer surplus—would be equivalent to about 11 percent of the world economy in 2025.

Figure 2: Nine Settings for IoT in 2025

Source: McKinsey Global Institute, 2015

A recent report by Professor David Teece of UC Berkley in conjunction with IHS Markit explores automotive opportunities in IoT. IHS forecasts a total of $12.3 trillion in global economic output in the “5G Economy” which will be supported by a global 5G value chain generating $3.5 trillion in output with 22 million jobs in 2035.

As explained by these authors:

“Mobile in the 5G era will transition from being an increasingly significant enabling technology into a true “General Purpose Technology”—that is, a technology that finds economy-wide use, drives complementary innovations in other sectors and becomes a driver of economy-wide innovation and productivity.”

The benefits of the above including interoperability among producers, economies of scale plus “network effects” that standardization provides are clearly enormous and are accrued very widely by many different parties.

Maximum leverage at modest cost

While most of the revenues and social benefits are generated by IoT in the higher layers of my inverted pyramid, the communications functionality is mostly provided and its complexities are increasingly dealt with in the lower layers. This is most technically and economically efficient: the higher layers can leverage the technologically-sophisticated lower layers at relatively low cost, as the figures in Figure 1 revealed. Telecoms network operators no longer have the technology and equipment R&D facilities they did until the 1980s when these (including Bell Labs and Bellcore) in the US were divested, or scaled back dramatically. Mobile network operators’ R&D figures are no longer sufficiently material to be itemized in public accounts and represent less than one percent of revenues. Mobile handset vendors generally spend from less than one percent to around six percent of sales on R&D. For example, Apple’s R&D expenditures have averaged less than five percent over the last five years. Network equipment vendors Ericsson, Huawei and Nokia spend around 15 percent of sales on R&D. Communications chip vendors including Qualcomm and MediaTek spend around 20 percent of sales on R&D. There are few pure-play technology licensing companies publicly reporting figures. One that does is InterDigital spending around 15 percent of its sales over the last 5 years. All the above R&D investments have been spent developing technologies and products with massively increased capabilities such 1,000 times faster data performance and much lower latency in 4G than 15 years ago with 3G. Spectral efficiency and network capacity have also been increased by orders of magnitude.

With the need to support several technology generations and with many protocols and more than 40 radio band bands in one device, the burden of dealing with all this complexity largely falls on standards development work including that in conformance testing and upon baseband chipsets. It enables some devices to work on virtually any network anywhere with various benefits to device manufacturers and mobile operators, and with increased utility to end users.

While improving performance and managing complexity requires large up-front investments in technology development including new algorithms, simulations, field testing, silicon design and supporting software, the benefits are in low marginal costs for production and duplication of chips and software respectively, and with large economies of scale.

It did not used to be like this: the economics has been turned on its head with mass-market digital communications. In the old days of consumer analog radio, amplitude modulation technology (i.e. AM radio) was used to minimise terminal technology costs and thus expand the market, despite significant inefficiencies in the network and in the ether. An AM demodulator can be implemented with only three basic circuit elements – a diode, a capacitor and a resistor. But AM radio modulation is only 25 percent energy efficient: the rest of the transmitted energy is wasted with duplicate sidebands (25 percent waste) and in the carrier frequency (50 percent waste). Half of the spectrum used is also wasted through duplication of the transmitted signal.

Sharing the gains from trade

The emerging broader IoT ecosystem will be built upon the standardised 5G technologies being developed in 3GPP and implemented in baseband chips, network equipment and devices. The regulatory and commercial environment that seeks to maximise benefits for those who ultimately stand to gain most, including vertical industries and consumers, must also adequately incentivise and with success reward those who develop the technologies along with those who implement them in communications products and services throughout the value chain.