Sony’s Altair Semiconductor will supply modem chips for AT&T’s $7.50 Category M1 LTE modules, which the carrier announced late last week. Altair was also an AT&T modem vendor for its Category 1 LTE modules, which were priced at $14.99.

“A&T has been a very strong partner for us in the IoT space,” said Altair co-founder Eran Eshed. He said both the AT&T modules were designed by Taiwan’s Wistron NeWeb Corporation. Eshed said he thinks it will take six to nine months for a Cat M1 ecosystem to develop, and that the lower-cost technology will be appropriate for a range of IoT use cases, including wearables, telematics and deployments in buildings that are hard to penetrate. He said that Cat M1 has a higher link budget than Cat 1 LTE, and is therefore a good choice for places where the cellular signal is highly attenuated. Eshed added that like Cat 1, Cat M1 supports full mobility and handovers.

In early 2016 Sony purchased Altair for $212 million. The Israeli company is now part of Sony’s IoT business, which in turn is part of Sony’s semiconductor business. Eshed said Sony’s chip unit is a “single digit billion” dollar business, and that Altair has been able to leverage Sony’s semiconductor assets.

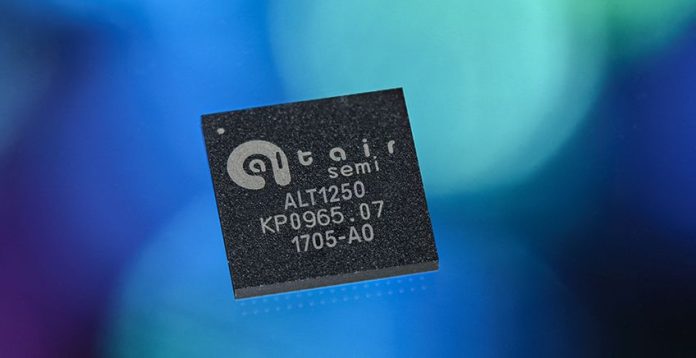

“We have access to a broader portfolio of technology so to our customers this means that we are able to offer more than just the modem,” Eshed said. He said Altair’s ALT1250 chipset integrates Sony’s GPS technology.

The ALT1250 can be configured to support Cat M1 or narrowband IoT, and Eshed said Altair is starting with Cat M1 because that is “what the market wants now.” In addition, the ALT1250 can support any RF band regardless of hardware design, Eshed said.

“One of the things that has hampered the adoption of cellular is LTE has 40 bands,” Eshed said. “The ALT1250 has wideband RF front end such that it is all software configurable and can support any carrier band or band combination, so carriers can keep one SKU and address multiple markets. This is part of our vision of trying to make cellular IoT look very much like Wi-Fi. We are really trying to imitate the model that brought Wi-Fi to the fantastic adoption rates it has today. We believe we’ll see the same, even higher.”

Eshed said that in addition to AT&T, Altair is working closely with Verizon Wireless. Outside the U.S., the chipmaker is working with all three major Japanese carriers and all the major South Korean carriers, as well as with Orange and with one Chinese mobile operator.

Follow me on Twitter.