T-Mobile’s recent announcement that it is targeting 2020 for a nationwide 5G network is by far the most aggressive 5G announcement to date, and it could be a game changer – not in the sense that the event itself will change the mobile infrastructure dynamics and introduce new money into the mix and automatically be the savior for the telecom vendors – but the announcement could spur others to reassess their nationwide 5G plans.

Whether this will be a game changer or a non-event will depend on at least two factors: 1) is this a big deal 2) what is the expected value this event will happen.

Based on where the industry is today and the dynamics that shaped much of the 4G era, we believe a nationwide 5G network by 2020 or 2021 for a country the size of the U.S. is a significant event – even if the expected incremental speed advancements over the existing 4G network in this case will likely be modest initially. The thesis of this argument is predicated on the notion that the marketing power behind the ability to claim the first true nationwide 5G network could carry significant weight – perhaps even more than the actual performance enhancements between 4G and 5G.

The discussions being held today about how 4G and 5G networks will play alongside each other are not all that different from the discussion held ten years ago when carriers were trying to figure out the roles 3G and 4G would play in a 4G world. Many operators believed 3G with its deep roadmap supporting HSPA, HSPA+, and DC-HSDPA would suffice as the default radio technology for the basic macro coverage layer and 4G would be more of an urban and hotspot technology initially. (Shortly after joining the Dell’Oro Group in 2010 I was bombarded with requests to revise our 4G macro eNodeB projections downward while at the same time adjusting our small cell projections upward by 10x to 50x to support this 4G hotspot theory).

And the reality is that in many cases, the spectral efficiency of HSPA+ using higher order QAM was not all that different from the LTE efficiency with 3GPP Release 8 and most likely 3G would have sufficed as the basic coverage layer in most of the markets for some time. In the U.S. market, Verizon was first out the door and paved the way with its 110 M 4G POP coverage by the end of 2010. AT&T was more than a year behind, but the carrier was not worried initially because its 3G network had been upgraded to support 7.2 megabits per second and this foundation of a solid 3G layer coupled with its more moderate pace of 4G deployments would together form the basis for a more compelling offer was the rationale. “The one thing you have to avoid is for customers on a six to seven meg LTE experience to fall back to something sub-meg,” said Stephenson in an AT&T newsletter published in 2010. “It’s very important to have a 3G layer with the 4G on top,” continued Stephenson.

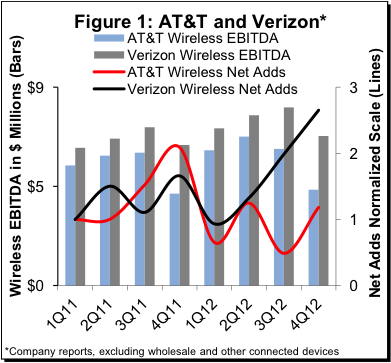

But the HSPA+/4G network combination did not turn out to be as successful as AT&T had expected. Verizon’s 4G coverage lead coupled with a lucrative device portfolio and a successful marketing strategy together laid the foundation for significant EBITDA upside driven partly by mobile subscription net adds growing nearly 3x between the 1Q11 and 4Q12 quarters (Figure 1). Both AT&T and T-Mobile ended up modifying their nationwide strategies resulting in a more accelerated 4G coverage plan. This phenomenon has since then been replicated in countless markets. And based on the preliminary LTE speeds, there is limited data to suggest the performance itself or the perceived performance differential between 3G and 4G was the primary driver behind Verizon’s initial success. While we don’t want to downplay the performance advantages with a superior LTE network, we also need to keep in mind that from a marketing perspective, “a nationwide 4G network” might simply have resonated better with consumers than “a 4G network in some urban areas with a nationwide 7.2 HSPA network which guarantees a nice seamless performance when you move between 7.2 HSPA and LTE”.

Granted data traffic is not growing exponentially anymore and operators are generally at a much better place today from a utilization perspective than they were right after the 3G iPhone was introduced coupled with the fact that there are fewer limitations with todays’ 4G networks that existed with CDMA/EV-DO, it is only logical to question the necessity and urgency of a nationwide 5G network from a capacity and cost savings perspective knowing what we know today. After all, unless some of these new end user drivers such as AR/VR or massive IoT start ramping in the next couple of years, incremental mobile data traffic is expected to grow 4x to 5x over the next five years – a far cry from the 1000s x of traffic growth carriers had to deal with after the smartphone was introduced – implying there are few reasons from a capacity perspective to accelerate the shift towards 5G. In other words, 4G using LTE-Advanced on the macro with a moderate pace towards 5G will in this case make sense from a capacity standpoint assuming one is spreading out the likelihood the ramp from the unknown end user drivers will materialize over a longer period of time.

And while we will refrain from claiming that we know how consumers will respond to the overall 5G smartphone packages including the corresponding marketing messages that come with the impending 5G launches, given what transpired with the shift towards 4G and the role marketing played, we are simply trying to assess if the marketing advantage that comes with “the first true nationwide 5G network” over “a 5G network in some urban areas with a nationwide LTE-Advanced or 5G evolution network which guarantees a nice seamless performance when you move between LTE-Advanced and 5G” will justify an accelerated 5G roadmap. We have not done enough analysis at this point to justify an answer that is more than an opinion, however we simply want to raise the point that the technical aspects are only part of the puzzle. Especially in an environment when median incomes and topline wireless revenues are not growing and the competitive landscape remains extremely fierce.

As much fun as it can be to analyze the pros and cons with an accelerated 5G roadmap, equally if not more important is to assess the likelihood T-Mobile will have a nationwide 5G network by 2020. The reality is that a confluence of factors could delay or change the initial 5G target. 1) The broadcasters have 3.25 years to vacate the premises. If they use up their stay, well then it will be challenging to meet the nationwide objective. 2) The likelihood that T-Mobile could be acquired by Sprint or perhaps a non-mobile player such as Comcast and/or Charter is significant. If Sprint is the buyer, 5G priorities could shift. Regardless who the buyer is, M&A activity will likely result in delays. 3) The suggested pace of 5G deployments leaves little room for surprises. Given that the first phase of the non-standalone 5G NR release is scheduled for completion mid-2018, it can be inferred T-Mobile has roughly two years to deploy around 40K base stations. If our estimates are in the ballpark suggesting T-Mobile upgraded ~37K 4G sites over a ~2.5-year time frame, then history suggests the project is somewhat doable from a radio deployment perspective assuming of course there are minimal changes to the overall architecture and the 3GPP standard is not delayed. 4) After just investing $8 B to acquire the spectrum, it will be imperative that the incremental Capex to deploy 5G will be minimal. Given the historical pricing trends in the equipment market, it goes without saying that the equipment cost will not be the primary driver of any Capex uncertainties, even in the event 4TX/4RX is the default radio configuration. That does not mean the non-equipment related costs will not surprise on the upside. 5) The 600 MHz spectrum is confined to the U.S. market and there could be delays with lucrative device support. Any delays will impact the attractiveness of the overall 5G solution – which is an essential aspect to replicate the early mover advantage carriers enjoyed with 4G. 6) A new device, application, service, or technology could be successfully launched for the mass markets between now and 2020 prompting data traffic growth to rebound and start growing at an exponential pace again. This could trigger network designers to reevaluate their coverage/capacity priorities and deemphasize or delay the priorities of nationwide 600 MHz 5G.

In short, Verizon’s aggressive LTE deployment strategy contributed greatly to the competitive dynamics that have shaped 4G strategies in multiple mobile markets globally. We believe T-Mobile’s 600 MHz nationwide 5G network could also change the competitive dynamics and spur others to reassess not only the pace of the 5G deployment plans but also trigger carriers to reevaluate their 5G spectrum strategies. So we believe the announcement is a big deal. However the likelihood that the impact of T-Mobile’s announcement will be on par with that of Verizon’s 4G deployment is by default lower at this point in time given all the data points discussed above including the uncertainty of a timely completion and the increased likelihood of the company being acquired. But the expected value of this being a game-changer is still greater than zero and material enough to warrant others to revisit their overall 5G strategies.