Demo on T-Mobile US’ network focuses on IoT; Sprint, Rogers RCS interconnect went live on June 1

Rich Communications Services messaging adoption appears to be picking up speed. Sprint and Rogers recently enabled the first North American cross-carrier RCS interconnection, while messaging platform provider OpenMarket and LTE software company Ecrio focused on the intersection of messaging and the internet of things in a demonstration that utilized Rich Communications Services on T-Mobile US’ network.

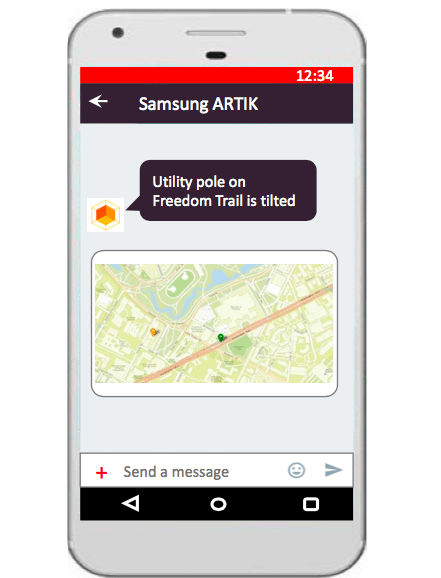

T-Mobile US has the largest domestic base of RCS subscribers, according to OpenMarket, and OpenMarket and Ecrio companies relied on its network for a recent demonstration that utilized Samsung modules: IoT sensors on telephone poles could detect whether the poles were tilted too far

and in need of repair, and the sensors would then trigger an RCS message with a map image of the pole’s location. OpenMarket said that RCS offers a way for cities to utilize IoT and disseminate sensor information without needing to build a specific app that employees need to have on their devices, with more useful information than a text-only SMS.

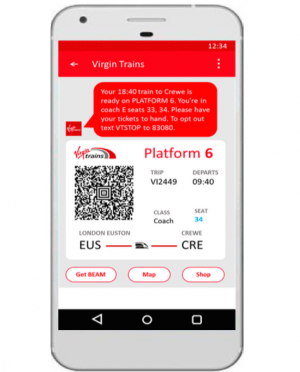

The technology opens up new application-to-person messaging opportunities for businesses as well, according to Tim Fujita-Yuhas, director of product management and new product strategy at OpenMarket. He said that RCS messages are often compared to an app-like interface, with buttons and images that users can interact with in a customer service context — and RCS can also provide location information, branding (so that a message is immediately identified as coming from a company rather than a phone number) and delivery and read-receipts so that companies can track messaging effectiveness. OpenMarket cited numbers which asserted that 90% of SMS are read within three minutes of being received, and the highly coveted Millennial demographic often prefers to communicate via text versus a voice call or email.

Fujita-Yuhas outlined a number of A2P projects that OpenMarket has worked on: fraud detection interactions, customer onboarding for telecom services, and a project with Virgin Trains where some

customers are messaged about a train arrival before an official public announcement in order to prevent a surge of passengers when everyone hears the general announcement at the same time.

OpenMarket is also working with Google, (owner of RCS company Jibe Mobile) which said in February that it is working to expand RCS messaging capabilities for Android to carriers around the globe — some of whom include Sprint, Deutsche Telekom, Rogers and Orange. In terms of competitive advantage, RCS is seen as one of the primary ways for the Android operating system to compete with Apple’s IMessage.

Fujita-Yuhas said that OpenMarket is starting to see more cross-carrier interoperability efforts for RCS messaging, including a North American RCS interconnect between Sprint and Rogers that leverages Google’s RCS platform that went live at the beginning of this month. Nick Fox, Google’s VP for communications products, made note of the launch on Twitter:

First ever cross-carrier RCS interconnect in N Amer is live! Now Sprint and Rogers users can message each other over RCS. Many more to come!

— Nick Fox (@thefox) June 1, 2017

Cross-carrier interoperability has been an ongoing issue for widespread availability and peer-to-peer RCS communications. The GSMA has been trying to combat that with the release of the first version of its RCS messaging standard, the Universal Profile, last November; the second version of the spec is expected to be released shortly and more than 60 telecom companies have signed on as supporters. Fujita-Yuhas said that OpenMarket is working on launching its RCS messaging with some brands and hopes to support a live offering on a Tier One carrier network as soon as the fourth quarter.

According to a recent GSMA report (pdf), messaging-as-a-platform is “expected to go mainstream in the next 6-18 months and represents an opportunity for operators to expand their existing SMS A2P businesses,” including using advanced messaging to enable chatbots, in-chat search and the use of artificial intelligence.

RCS domestically vs. globally

Fujita-Yuhas sees a split between the U.S. and the rest of the world in terms of how their messaging markets have developed and shaped the potential of RCS adoption. Unlimited SMS and multimedia messages are typically included in customers packages in the U.S., and so there hasn’t been quite the same impetus to adopt free over-the-top messaging apps such as WhatsApp that there has been in the rest of the world, he noted. He considers RCS most likely to replace SMS and to cannabalize MMS.

Fujita-Yuhas acknowledged that RCS capabilities have been around for awhile, but thinks that now, with Google behind RCS and pushing carriers to adopt it, the technology is finally going to stick and ramp up.

Still, he noted, pricing strategies for RCS haven’t entirely been worked out yet — and carriers will have to tread carefully.

Most operators consider RCS messaging to be part of a customer’s data package rather than a separate service such as SMS, because it is IP-based, Fujita-Yuhas said. While the RCS equivalent of SMS will be light on data use, he notes that RCS offers the opportunity to support heavier data use such as high-resolution images and video messaging, and carriers will have to figure out how to price such offerings in the context of other consumer data usage and the fact that many messages will come from businesses.

“If the carriers are smart, they won’t price themselves out of the market, relative to what they did with SMS,” Fujita-Yuhas said.