Equipment costs could be major roadblock to 5G, reinforcing need for commoditization and virutalization

5G promises to be many things–an enhanced mobile broadband experience, support for massive internet of things communications and mission critical services based on ultra high throughput and very low latency. But one thing 5G doesn’t promise to be is cheap, particularly given the way network infrastructure is presently built and deployed.

The solution is innovation, or “a new approach,” as Deutsche Telekom VP of Innovation and Research Uwe Janssen put it during a keynote presentation at 5G World in London, according to a report from Mobile World Live.

“We need something really radical to happen,” he’s quoted as saying, noting that the infrastructure market is dominated by a limited number of players–think Ericsson, Nokia, Huawei, ZTE and Samsung. “On the infrastructure side there is limited innovation in infrastructure and it is also very difficult for newcomers to enter. This is despite a lot of good ideas and innovations coming from universities and start-up companies, but it is hard for them to come to market because there are a few big suppliers with their own agendas – we need to see a change here,” Janssen reportedly said.

This criticism of the vendor community came up again in materials published June 14 by ABI Research. The firm conducted a business-to-business survey of 455 U.S. companies representing nine verticals and found that 62% do not plan to deploy 5G technology in the coming years. ABI Research referred to this as “a severe discord between 5G market hype and the commercial industry’s readiness to deploy the technology.”

“The hype of 5G is currently driven by the technology supply chain rather than by demand from the end-markets,” Malik Saadi, managing director and vice president of ABI Research, said. “5G technology suppliers are currently working in a vacuum, often denigrating the rights of technology implementers to influence the 5G development roadmap. The retail, healthcare, and federal government verticals show the highest willingness to deploy 5G technology in the coming years and, as such, need careful attention by 5G technology suppliers to ensure that their individual, varied use case needs will be properly addressed.”

In terms of groups driving innovation, Janssen name-checked the Telecom Infra Project. During Mobile World Congress 2016, Facebook announced its Telecom Infra Project, which is billed as “an engineering-focused initiative driven by operators, equipment providers, system integrators and other technology companies that aims to reimagine the traditional approach to building and deploying telecom network infrastructure.” This is the same model Facebook took with the Open Compute Project, which essentially looks to leverage a similar consortia-approach to hastening innovation and removing cost from data center and network hardware.

For instance, radio-as-a-service provider Phluido is leading the Telecom Infra Project’s working group on open interfaces for virtualized radio access networks with “non-ideal fronthaul.” From the group’s charter, “The project will help the ecosystem to provide low-cost Remote Radio Unit (RRU) for a diversity of deployment scenarios, which can be managed and dynamically reconfigured by a centralized infrastructure over non-ideal transport (i.e. not Common Pubic Radio Interface (CPRI)). Key scenarios for this include high density locations in indoor environments, rural or suburban/urban broadband connectivity, and multioperator/neutral host deployments.”

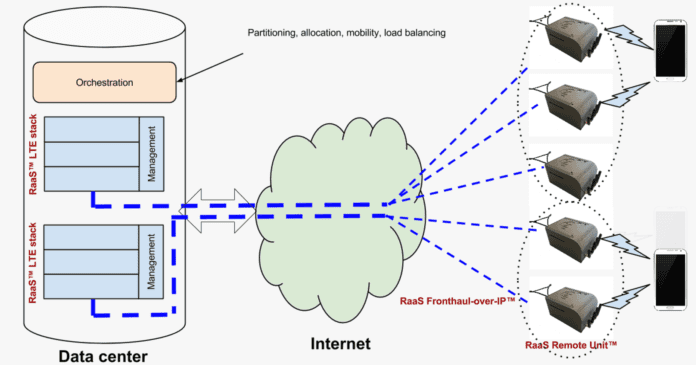

So, in the context of a small cell network in an urban area, for instance, instead of putting an expensive box at each of the radio sites, that equipment would be centralized in a data center or colocation facility. Centralizing control functions allows for more efficient use of spectrum resources, which improves network performance. As to fronthaul, this is often CPRI or, the much more expensive option, fiber. Phluido has a patented protocol for fronthaul over IP.

According to the company, radio-as-a-service (RaaS) model “makes it possible to deploy, upgrade and maintain cellular networks with dramatically lower capex and opex…enabling profitable densification…There is no need for traditional cellular base stations, equipped with expensive, power-hungry, and difficult-to-upgrade hardware. Any place where IP network access is available can host a simpler client RaaS base station, as RaaS makes it possible to perform all complex operations remotely, with virtual base stations running in the cloud.”