Who is winning and starting the year off right?

It is a busy time of year and we are still playing catch up, so we apologize for the delay in getting this update out. Compass Intelligence just completed the final assessment of Q1 2017 and the evaluation and comparisons to previous quarters in 2016 in terms of improvements and declines. We do this each quarter to understand the subscriber and share changes, as well as evaluate the key trends taking place in the wireless industry for both consumer and B2B. We have been tracking the quarterly metrics since 2007. Some metrics are our own internal modeling and estimates, as the market does not report in all categories. A few highlights from Q1 include:

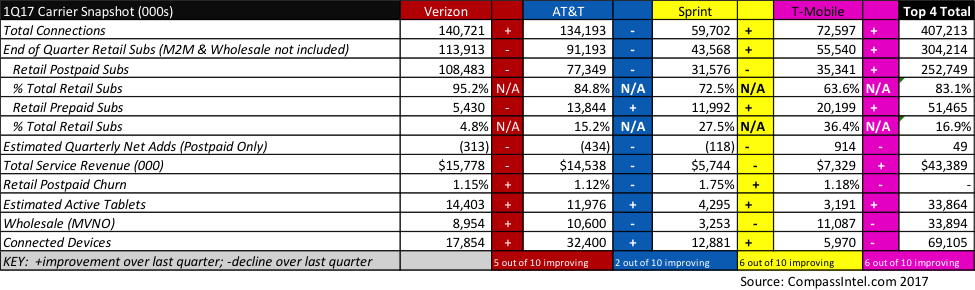

- Both Sprint and T-Mobile scored a 6 out of 10 improvement in key metrics, with both seeing positive net adds in both total connections and retail subscribers from Q4 2016 to Q1 2017

- T-Mobile again dominated with total subscriber additions of 1.3M

- Verizon had a net positive of 117,000 connections in Q1, while AT&T lost 666,000 in total connections overall

- AT&T continues to lead in total connected devices (IoT and M2M) in the U.S. with 32.4M

A snapshot of Q1 2017 is below. Compass Intelligence compared last quarter’s results to this quarter to show which metrics showed improvement over others (denoted by + or -).

Below are additional thoughts and insights based on the quarter and annual performance:

- Summary:

- The industry added 777,000 total connections (includes IoT and mobile subscribers), in Q1, with an addition of 906,000 retail subscriber additions (half of what was added in Q4)

- Compared to Q1 2016, Q1 2017 only added about 10% and 33% of total connections and subscribers, representing a huge drop off to what was happening a year ago

- Total Connections reached 407.2M by the big 4

- Retail Subscribers for the Top 4 carriers reached 304.2M

- A total of 1.3M tablets were activated in Q1), with Verizon adding an overall 507K just in Q4 2016 alone.

- Based on total connections alone, AT&T and Sprint lost total market share while Verizon maintained and T-Mobile gained.

- AT&T added 809K connected devices in Q1, reaching 32.4M total connections in Q1

- REVENUE: Similar to last quarter, All carriers reported lower service revenue QoQ except for T-Mobile. (this has been a continuing theme)

- T-Mobile increased revenue in Q1 2017 by $84M compared to Q4 2017.

- Combined the industry experienced a loss of $862M in service revenue compared to Q4 2016

- POSTPAID ADDS:

- All carriers ended the quarter with negative QoQ postpaid adds, except for T-Mobile

- T-Mobile dominated with postpaid adds, adding 914K postpaid net adds in Q1

- CONNECTIONS:

- Total industry connections reached 407.2M at the end of Q1 2017 for the top 4 carriers

- Total industry subscriber base: 419.0M (Includes ALL MNOs and MVNOs)

- Total smartphone subscribers=323.9M

- Total Connected Devices reached 69.1M for the industry.

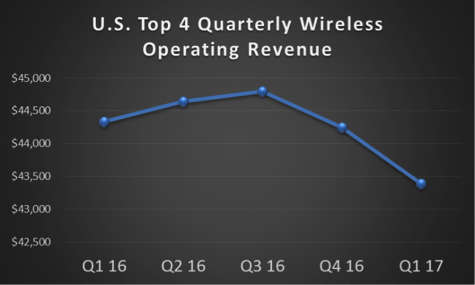

As a summary, this has been a fairly poor performing quarter with the exception of T-Mobile. Now the B2B market looks completely different (contact CompassIntel.com to see what is happening in U.S. B2B). The biggest indicator is the overall drop in operating sales revenue, and watching this continue. The top 4 carriers as a whole continue to see a decline in overall quarterly sales revenue, with this quarter totaling a combined $43.4B. Verizon launched “unlimited” in February, so in Q2 it might be interesting to see how the market responds.