For the past two years, we have been studying the internet of things market, waiting forIoT good NB-IoT products to emerge so that we can make hard-nosed comparisons. It’s time.

China Telecom is moving very quickly with NB-IoT, and they are tracking millions of bicycles on their network today. The chipsets are still warm from the fab, but China Telecom is pushing very aggressively with partners like Ofo, Mobike, and others. Similar ventures are tackling the smart meter, elevator, and building automation markets in China.

At a technical level, NB-IoT has a clear advantage over all of the unlicensed LPWA formats. The “white paper wars” have made this comparison very confusing for people, because U-LPWA proponents often assume no interference in the unlicensed bands, and clearly this is not the case in reality. In a thorough technical comparison completed recently, NB-IoT has between 10 dB and 30 dB link budget advantage over U-LPWA, depending on interference levels.

This link budget advantage often does not translate into miles of coverage, because in an NB-IoT network, the antennas are tilted toward the ground to limit coverage on purpose. There are plenty of cell sites, so range is not an issue for NB-IoT. The mobile operators are trying to maximize reliability and in-building penetration. The U-LPWA vendors are tilting their antennas to the horizon for maximum range, but they achieve poor in-building performance in most of the “coverage area”. Be careful as you compare coverage area between different wireless standards.

On the other hand, business model factors can outweigh the technical side. Some LPWA formats can be deployed as ad hoc networks, without any operator. LoRa, in particular, has the potential to become the “Wi-Fi of the IoT market”, as enterprises can choose to deploy an access point and some cheap devices to create a mini-network anywhere, anytime. Imagine an auto dealership keeping track of its inventory without paying anybody a monthly fee.

Of course, there is no single answer for the IoT, but we’re tracking 65 different connectivity formats … and we believe that this list will drop to about 25 formats. NB-IoT and LoRa will be on the short list. A few of the other U-LPWA formats will also survive, as they have an early lead in key niche market areas. Companies like Ingenu, Silver Spring, and Telensa have the ability to develop easy-to-use products for specific vertical markets … so technical drawbacks or even cost issues will become less important.

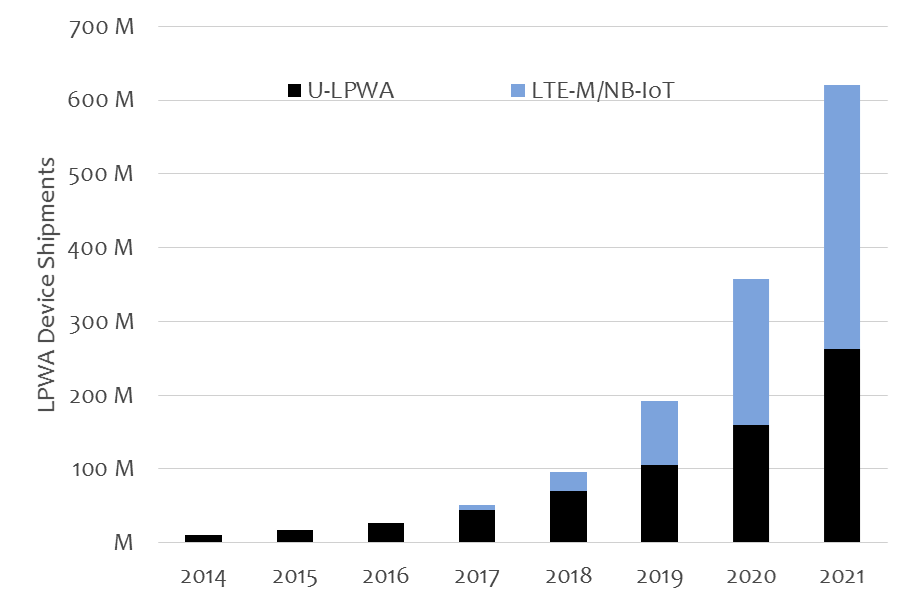

After five years of industry hype– silly guesses of “50 billion devices by 2020”–the rubber is now firmly on the road. Our forecast predicts an installed base of more than 1 billion LPWA-connected devices by 2020, based on firm intelligence and direct input from end users.