The internet of things is the next frontier for mobile network operators, as smartphone growth slows down and new mobile chips enable low-cost connections for all manner of assets and equipment. Companies in almost every industry are investigating the IoT, and carriers want them to choose cellular instead of an unlicensed spectrum alternative. All four nationwide carriers are in the process of rolling out dedicated IoT networks, and all of them have millions of connections already on their existing networks.

AT&T is the leader among U.S. carriers when it comes to IoT connections. The carrier ended the second quarter with 33.7 million IoT/machine-to-machine connections, according to Compass Intelligence. That’s a 4% increase from the first quarter, and more than twice the number of connections reported by Verizon and Sprint combined. Compass Intelligence reports that Verizon ended the second quarter with 18.2 million connections and Sprint has 13.2 million. T-Mobile US had an estimated 4.6 million IoT connections, down 22% from the first quarter, according to the analyst firm. Compass Intelligence estimates IoT connections at 65% of wholesale connections, which were down in Q2 at T-Mobile US due to the company’s decision to remove Lifeline subscriptions from its wholesale connections.

The nationwide operators are relying heavily on their existing business relationships to build their IoT businesses. Verizon Wireless is actively training its Verizon Enterprise Solutions sales force to market IoT products and services, and all the carriers are looking at enterprise wireless customers as potential IoT customers. AT&T’s high number of existing connections is closely related to its success with enterprise customers. During the first half of 2015, the carrier signed IoT-related deals with 136 companies in a range of industries, including agriculture, automotive, aviation, energy, healthcare, transportation, security and supply chain logistics.

As a group, the four nationwide U.S. operators have added an estimated 7.5 million IoT connections within the last year, an increase of almost 11%. AT&T’s number of connections is up 16%, Verizon’s is up 8% and Sprint’s is up 20%. T-Mobile’s number of IoT connections appears to be down 11% over the last year, based on the Compass Intelligence estimates.

Wireless carriers hope to see their numbers of IoT connections skyrocket with the roll out of new network technologies that enable low-cost connections over LTE networks. Both AT&T and Verizon have activated LTE Category M1, which keeps costs low by transmitting and receiving very low amounts of data. Verizon and AT&T have IoT data plans in place already, and these prices could come down even further as technologies evolve.

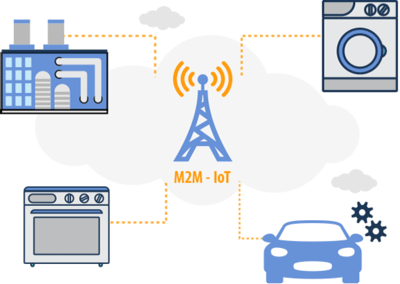

Image source: IVR Technologies