This is a critical time to ensure state public safety needs are met by FirstNet’s plans for the nationwide public safety broadband Network (NPSBN). Wireless 20/20 has published a new white paper designed to help state officials and governors evaluate the available information, and understand the benefits of issuing a Request for Proposals (RFP) to ensure that states get the best FirstNet deal meeting their public safety needs.

By issuing an RFP, states are able to define their needs, make their demands known and review competitive bids. Basic common business sense dictates that any state that does not explore its options regarding FirstNet is doing a great disservice to its constituents and First Responders. Only by issuing an RFP, can states ‘take control of their own destiny’ in getting the coverage, capacity, service quality, low cost and revenue sharing potential made possible by FirstNet. States should not be rushed to accept the initial proposals made by FirstNet to serve their public safety needs for the next 25 years.

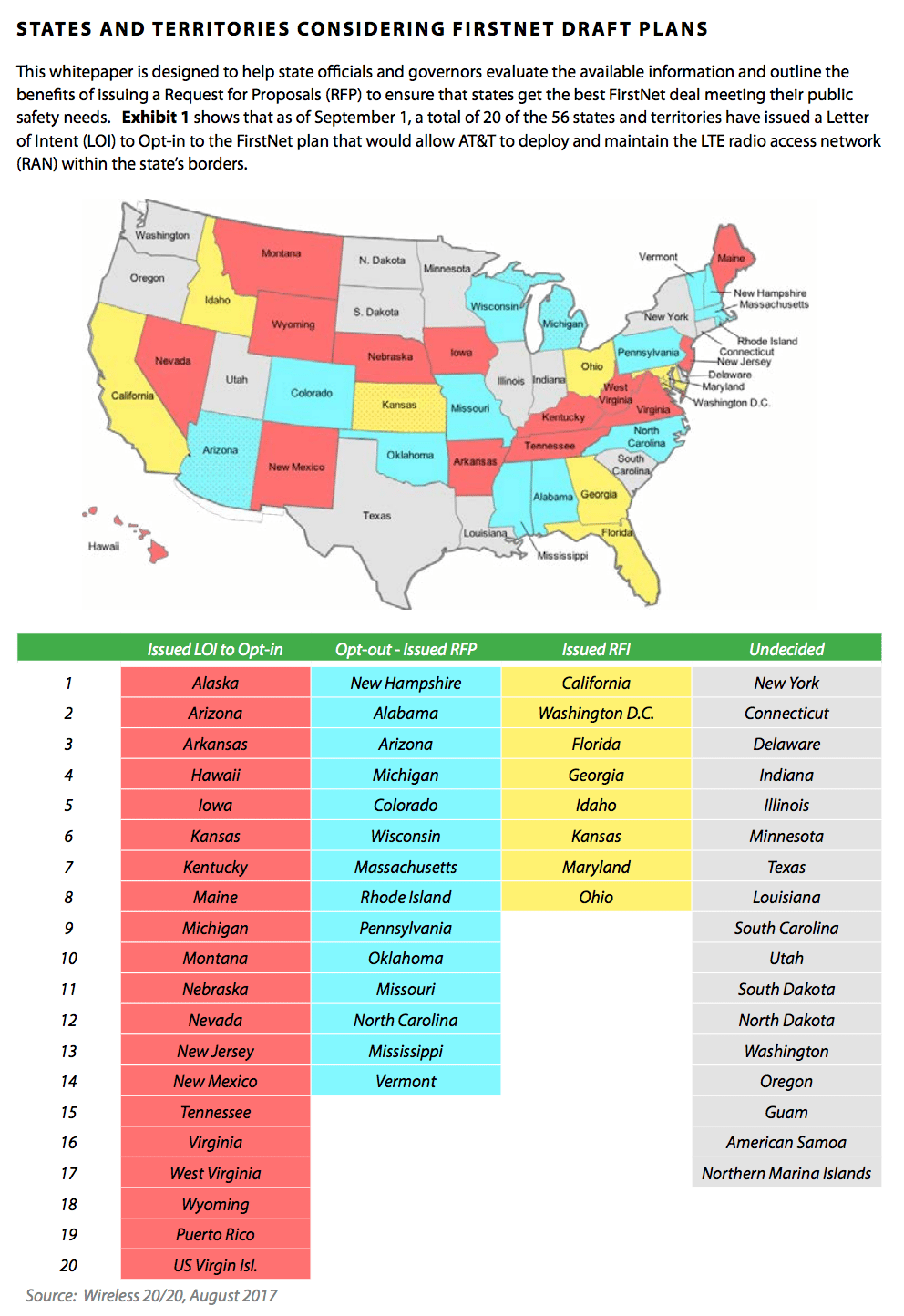

States and Territories Considering FirstNet Draft Plans

As of September 1, 2017, a total of 20 states and territories have issued a Letter of Intent (LOI) to Opt-in to FirstNet plans, however these LOIs are not binding. Major questions remain for the 30+ still mulling the decision, particularly regarding coverage and pricing. States should not and cannot make final opt-in decisions until the final state plans are made available on state portals and the critical information is provided on the grants and payments for the use of Band 14 spectrum and the FirstNet core.

Another 12 states are pursuing the “opt-out” alternative, which would enable the state to issue an RFP and select an alternate provider to deploy its FirstNet RAN and maintain it for the next 25 years. In addition, 8 states have issued “requests for information” (RFIs) which may lead to a more detailed RFP. We estimate that 53% of Americans live in states that have issued RFPs or RFIs and 22% live in states with non-binding LOIs to accept AT&T’s final plan when it is delivered in September. Meanwhile 17 states and territories are still undecided about whether to issue RFPs.

Few concrete details on FirstNet’s pricing, network design and geographic coverage have been released by FirstNet and AT&T in draft state plans available only to state officials via a secure portal. The detailed information on network design, technology and pricing is considered confidential and only accessible to state single points of contact (SPOC) and their designees. This information is designed to allow governors to review and make ‘opt-in/opt-out’ decisions by mid-December 2017. States were given an additional 180 days following this 90-day window to select a vendor for their state alternative plan, and retain the option to “opt-in” to the final state if they are not satisfied with the outcome of their RFP process.

Since June several states have complained that the AT&T draft plans do not provide:

- complete state-wide public safety network coverage in both urban and rural areas

- dedicated purpose-built “public safety-grade” network using Band 14 spectrum

- local control by the states and their designated public safety officials

- any specific pricing for public safety users reflecting their unique requirements

- any payment or revenue share back to the states

States that opt-in to FirstNet without investing the time to issue an RFP and understand their alternatives inevitably fail to serve the interests of their constituents

States that have Issued FirstNet RFPs Have A Clear Advantage

The intent of issuing an RFP is to explore the options available that will be most responsive to the needs of the state and its public-safety entities before choosing to opt-out or opt-in the FirstNet offer. This approach allows state officials to conduct a comprehensive analysis of the available options so that the pros and cons of each option can be clearly understood, and then make an informed decision which has such important implications on its public safety entities.

The Wireless 20/20 white paper summarizes the current status of the RFPs issued by the states. Wireless 20/20 has reviewed 12 of the RFPs issued by states over the past month, and has identified several as good role models for State’s planning to issue FirstNet RFPs. The purpose of these RFPs is to develop a state plan that is an alternative to the one that will eventually be provided by FirstNet. States issuing an RFP will have all the information they need to make an informed final opt-in or opt-out decision on FirstNet implementation. States should also request the opportunity to share in the recurring revenues generated from the use of this valuable Band 14 spectrum. First responders will likely use only a small portion of the available bandwidth most of the time. The rest could be monetized and the resulting revenue should be shared with the states. AT&T has not offered any revenue sharing opportunities to date, and by issuing an RFP states can negotiate revenue sharing opportunities with alternate providers.

Several of these RFPs have attracted multiple bids and offer states the best opportunity to compare offers. Rivada Networks, Verizon and the Macquarie Group are competing in response to RFPs from states like Pennsylvania, Colorado and Rhode Island. Alabama and Arizona both received three bids in response to their RFPs, while Colorado officials have announced that two bidders responded to the state’s public-safety LTE procurement. Regional wireless carriers such as C-Spire, Southern Linc, Shentel and US Cellular have also demonstrated interest in participating in state FirstNet RFP responses. These states have stated that their governors have not yet decided whether to pursue the “opt-out” alternative. Unfortunately, AT&T has not responded to any of these RFP, and relies instead on the draft state plans submitted to the states on June 29. 2017. However, AT&T has been negotiating with some states issuing RFPs to convince them to opt-in.

Nationwide “Purpose-Built” Public Safety Network

States bring control of an extremely valuable spectrum resource to the negotiating table. Based on recent auctions for low-band spectrum, the value of the FirstNet spectrum is between $8.3 billion and $17.6 billion and its value will continue to improve during the next 25-years. States should not give away control of this valuable and vital public safety spectrum or forgo access to federal grant monies to subsidize the initial network build without securing the best deal.

At a minimum, states should have an opportunity to dictate a mandatory build-out plan for the Band 14 spectrum that has been allocated for a nationwide “purpose-built” public safety network. Although AT&T is obligated to build out the Band 14 spectrum on a “significant portion” of its FirstNet nationwide LTE network, state specific build-out plans and coverage timelines are not clearly defined. During a recent Senate subcommittee hearing, AT&T testified that it will deploy infrastructure on the 20MHz of 700 MHz Band 14 spectrum that is licensed to FirstNet only in geographic locations where it needs additional bandwidth capacity.

According to the AT&T FirstNet Wireless Network Coverage Map, there are large gaps in LTE connectivity in several Rocky Mountain and northern New England states. Detailed coverage and build-out information for Band Class 14 by year is in the draft plans on each state portal. AT&T has declined to provide any greater specifics, citing the proprietary nature of the information. AT&T’s first responder network will provide coverage for only 76.2 percent of the continental US, with several tiers of coverage availability, ranging from LTE “with priority”, down to 2G coverage.

AT&T has stated that deployment of LTE on FirstNet’s 700 MHz Band 14 spectrum could begin as early as late 2017 in

certain parts of the country. A careful examination of AT&T maps reveals that FirstNet has essentially made the AT&T commercial wireless network the primary NPSBN, with the Band 14 spectrum playing, at best, a supporting role in parts of the country. This was not the intent of the FirstNet legislation to allow AT&T to hold the valuable Band 14 spectrum in reserve while failing to deploy a true nationwide public-safety grade network.