So finally after months of dating, Arris and Ruckus are finally getting married, generating a great deal of enthusiasm among analysts and reporters.

The deal is said to enable both entities to leverage each other position in the market. Arris gets a strong portfolio of wireless solutions to offset its declining pay TV set-top business while Ruckus gets access to a wealthy partner and strong relationships among MSOs. Arris’s hopes to further expand into areas like education, public venues, enterprise and MDUs, and greatly enhance its wireless portfolio. As Greg Beach, Vice President of Wireless Products at Ruckus Networks reminded me “the main reason arris acquired Ruckus was to diversify its business and enter the enterprise business.”

Arris can now add WiFi and Lan switching, and some cellular elements, to its cable offerings. It is creating a new enterprise networks business unit to house Ruckus, under the leadership of the latter’s former COO, Dan Rabinovitsj. But it will be more important for Arris to use its new subsidiary to bolster its position in the cable market before it starts eyeing new pastures.

For Arris, being able to incorporate a capable WiFi service into its CPE and set-top devices would appeal to the cable companies and telcos looking to leverage their broadband lines to add quad-play offerings to their line-up. The broadband line can provide backhaul for a distributed WiFi network that would form part of a mobile offering, which would give customers access to WiFi hotspots wherever there was a TV or broadband customer, and wider access to national cellular networks via an MVNO agreement {Wireless Watch}

“This combination underscores our shared vision of achieving market leadership across wireless and wired networks in close partnership with our valued customers and channel partners,” said Dan Rabinovitsj, President of ARRIS Enterprise Networks.

“The vision is to become one of the largest technology companies providing technology and both carrier and enterprise,” said Arris CEO Bruce McClelland.

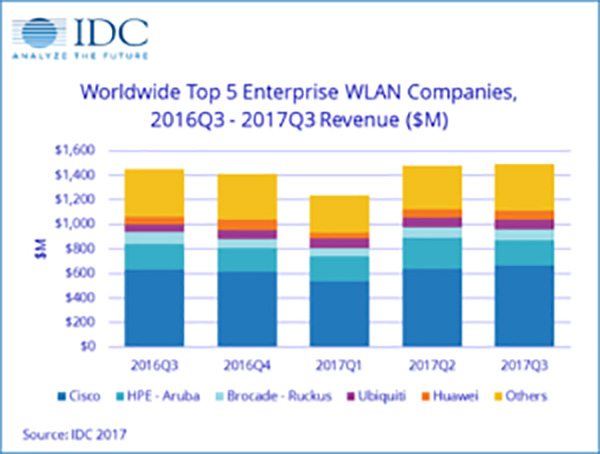

Although it is said that Arris acquires a market position in the enterprise market, it is a small one. Indeed, Brocade-Ruckus accounted for 5.9% of the overall market in 3Q17, up from 5.8% in 2Q17 and down from 6.7% in 3Q16 according to IDC. Ruckus’ legacy enterprise WiFi business seems to have stabilized after the weakness created by the disruption from Brocade but as the figure indicates Ruckus does not have a strong position in the enterprise WLAN market except in the hospitality sector where it is believed Ruckus is the dominant vendor. Ruckus is rather known as the leader in the carrier Wi-Fi market, but this market only represents so far about 10% of the total WLAN market. It is unclear how much leverage will Arris be able to make among current Ruckus carrier clients and vice versa.

It is worth noting that consumer WLAN market revenues continue to struggle and decreased another 5.2% year over year in 3Q17. This was the fifth consecutive decline on a year-over-year basis for the consumer class WLAN market. So the opportunity seems to lie heavily on the enterprise WLAN for Arris.

The CBRS opportunity

Perhaps the combination Arris-Ruckus will take its full potential in leveraging the CBRS opportunity. Some use cases are emerging for MSOs to leverage CBRS. The CBRS band could, for example, help MSOs get access to spectrum that augments the spectrum they are using in their MVNO deals. Comcast is using that model for Xfinity Mobile (with Verizon as the partner), and Charter has similar plans underway. It’s possible that cable operators will build CBRS-based small cells and supply the backhaul, effectively accessing capacity and spectrum that is less expensive than what comes the way of their MVNO agreements.

An MSO could build out CBRS infrastructure in areas with high concentrations of subscribers. When customers aren’t in reach of that network, they roam to the MVNO network.

Cable operators might also use CBRS as a fixed wireless technology that helps them reach areas that are not covered by their wired networks, or as a solution for business service customers that want to beef up wireless coverage in their buildings.

As well as carrier and enterprise WiFi, Ruckus had started moving into cellular technologies, particularly for private networks, with an indoor LTE system called OpenG. Among other bands, this can run in the US 3.5 GHz CBRS shared spectrum. Given that cablecos are interested in using shared bands to support their own subnets of cellular small cells — to support residential or business customers while minimizing their reliance on MVNO deals with mobile operators — this could be a very strategic product for Arris.

Arris is one of the investors in Federated Wireless which is building spectrum controller systems for CBRS. The rules around CBRS don’t speak to specific types of radios, but it’s viewed as a major opportunity for LTE-based technology.

Finally, the deal also includes the ICX switching product line from Brocade.

Now the teams need to get together and combine their resources and avoid duplicating their efforts to generate the value they are hoping for.