First-generation chips deployed, first full-duplex chips on the way

When Vijay Doradla first introduced Kumu Networks to his partners at Verizon Ventures, the reception was lukewarm at best.

“It’s a science project, a bunch of Stanford guys,” Doradla remembers his colleagues telling him, and he understood their skepticism. “What Kumu had ventured out to do was something that people said could not be done,” Doradla said.

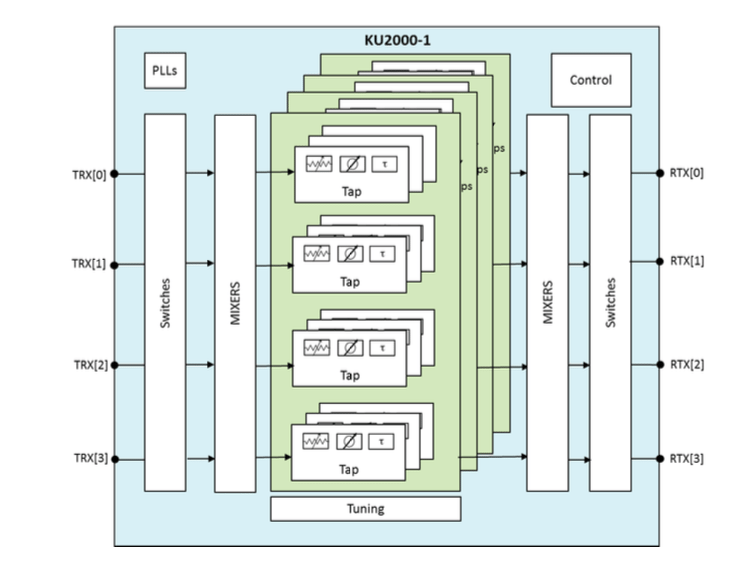

What Kumu had set out to do was to redefine wireless communication by enabling radios to send and receive at the same time on the same channel. Full-duplex self-interference cancellation is indeed a science project, but as of this year it is also part of the specification for a programmable analog chip called the KU2000-1. Kumu says its chip will enable full-duplex or adjacent channel cancellation across a wide range of frequency bands, bandwidths, transmit powers and MIMO modes.

Doradla did convince his colleagues to invest in Kumu in 2015, and Verizon may already be benefitting. Kumu says its first-generation chips are live in commercial deployments with two of the top four U.S. carriers in the form of LTE relay nodes. Up next will be true full-duplex technology.

By the end of this year, Doradla says Kumu will have a chip scale product that can be “fully integrated into something that can be plugged and played.” The hardware is likely to show up in Wi-Fi and cable networks before it makes its way to cellular. Kumu sees Wi-Fi as its first target market.

“There are many aspects of our technology that can assist Wi-Fi,” said Kumu’s Joel Brand, VP of product management. “Tri-band Wi-Fi could take advantage of our technology as soon as we have an analog chip to make sure the cost and power consumption fits into the kind of prices consumers are willing to pay for Wi-Fi devices.”

“Wi-Fi is a low-hanging fruit for the company so there is no reason why we shouldn’t go after that,” said Doradla. But cellular is definitely part of Kumu’s long-term plan.

“It’s slowly creeping up into the standards,” said Doradla. “This is a technology that was relegated to a science project and now the 3GPP is talking about it.”

He says Kumu’s success is a testament to its executive team, led by entrepreneur David Cutrer. Cutrer was a co-founder of NextG Wireless, which Crown Castle bought for $1.2 billion, and of LGC Wireless, which was acquired by ADC Telecommunications for $169 million.

Kumu’s conviction that full-duplex can be commercialized has been seconded by another startup, Texas-based GenXComm. Doradla thinks Kumu is five to seven years ahead of GenXComm, and says that having more than one competitor is healthy.

“It’s always a good thing to have multiple players in the market,” he said. “Any large ecosystem has two or three competitors.”

Predicting that the market for full-duplex wireless will be a “large ecosystem” might have seemed overly optimistic two or three years ago, but now commercialization is on the horizon. If the technology finds its foothold in Wi-Fi networks, look for wide adoption in cable and cellular networks in the years ahead.