Qualcomm moves closer to NXP deal. Qualcomm tenders cash for all of NXP shares and does better than expected in Q2 results.

Qualcomm Incorporated has offered to buy all of NXP Semiconductors’ shares, as part of its bid to acquire NXP, tendering 12.7% of the outstanding NXP common shares.

The Qualcomm/NXP deal hit a regulatory speedbump when China’s regulatory body Ministry of Commerce in China (MOFCOM) rejected the merger but Qualcomm and NXP refiled to give China more time. U.S. and EU agencies have approved the deal. The Qualcomm/NXP deal has been in the works since October 2016.

Qualcomm’s tender offer expire at 5:00 p.m., New York City time, on May 11, 2018, unless extended or earlier terminated, in either case pursuant to the terms of the purchase agreement. Qualcomm has extended its offer a number of times as it tries to finalize the NXP deal.

“We are making good progress on executing our $1 billion cost plan, are focused on closing our pending acquisition of NXP and are well positioned to drive the global commercialization of 5G,” said Steve Mollenkopf, CEO of Qualcomm, in its quarterly earnings statement.

The estimated total cash consideration to be paid to NXP’s shareholders is $44 billion, according to Qualcomm’s Q2 results statement.

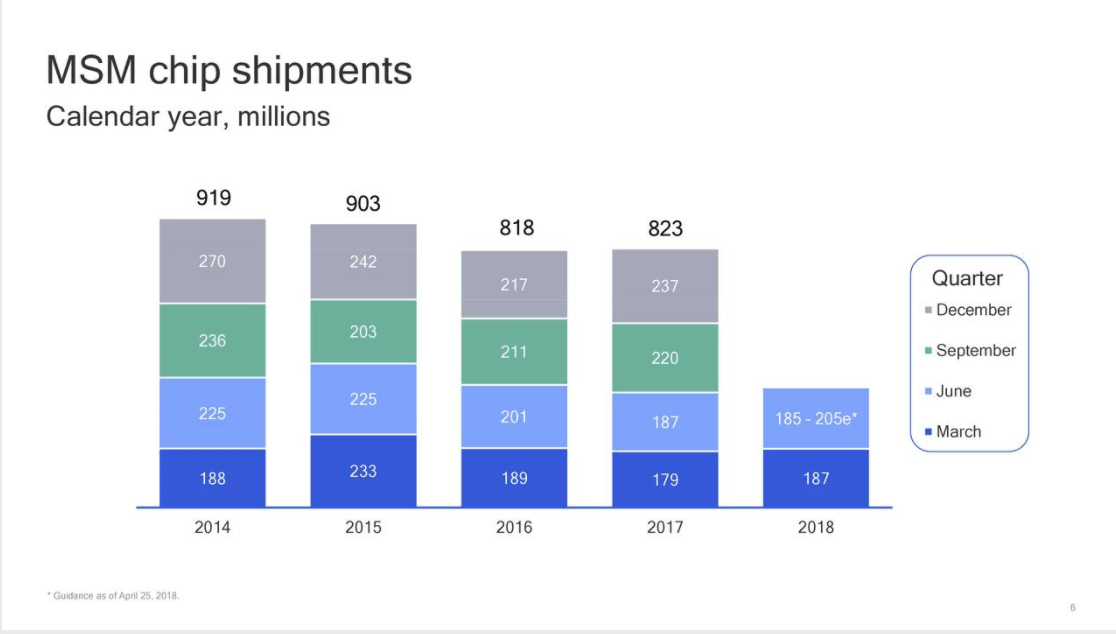

Qualcomm did better than expected in Q2 2018 overall, despite the ongoing dispute with Apple. QCT’s earnings before tax were up 28% year-over-year at $3.9 billion. MSM chipset sales were $187 million.

The Snapdragon 845 platform achieved over 100 design wins already, “including launched flagship devices by Samsung, Sony, ASUS and Xiaomi.” said Mollenkopf on the earnings call.

“We also recently announced the world’s first 5G module solutions, which include highly integrated turnkey 5G modules, including application processor, baseband, transceiver, memory, power management, RF front-end, antennas and other components that are designed to expand the ecosystem and accelerate 5G deployments,” Mollenkopf continued.

Qualcomm says its Qualcomm CDMA Technologies (QCT) semiconductor business makes up about 60 percent of its revenue, while the licensing business makes up about 40 percent of revenue.

NXP is not holding an earnings call for the second quarter of 2018 due to the pending acquisition of NXP by Qualcomm.