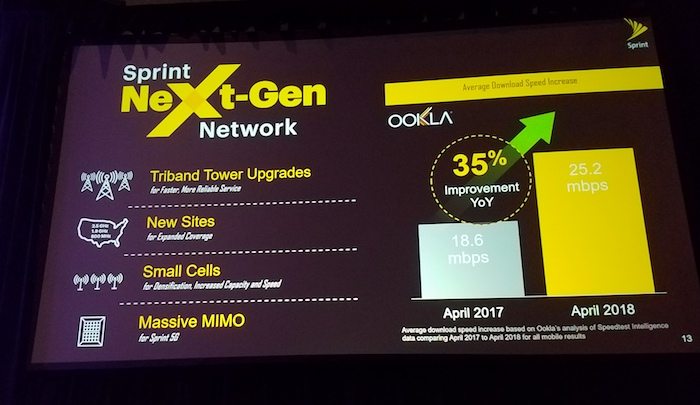

AUSTIN, Tx. — Sprint plans to leap over the competition by dropping 128-radio massive MIMO equipment on its tri-band towers for 2.5 GHz using a 4G/5G split in nine U.S. cities. This is how Sprint will get 5G up quickly and possibly beat other carriers to market, Kevin Crull, Sprint’s chief strategy officer, revealed in a keynote at 5G North Americas.

The company is also working on a 5G smartphone with a Tier 1 smartphone company. The design will be a plus size, Crull told RCR Wireless News.

Sprint also just announced that it will launch the massive MIMO 5G in three additional cities. The total now is nine markets: Chicago, Los Angeles, Dallas, Washington, DC., Houston, Atlanta, and the three new cities, Phoenix, Kansas City, Kansas, and New York City. “The teams picked those nine sites to begin with because of the comfort level in the approvals,” Crull told RCR Wireless News.

Sprint said the nine cities already have many 2.5 GHz sites set up, a lot of spectrum to use and high population centers to make it worthwhile to start in those cities first. “We are already well along in the rollout. That’s part of the reason we are comfortable with this,” Ron Marquardt, Sprint’s vice president of technology, Sprint Technology Innovation & Architecture, told RCR Wireless News.

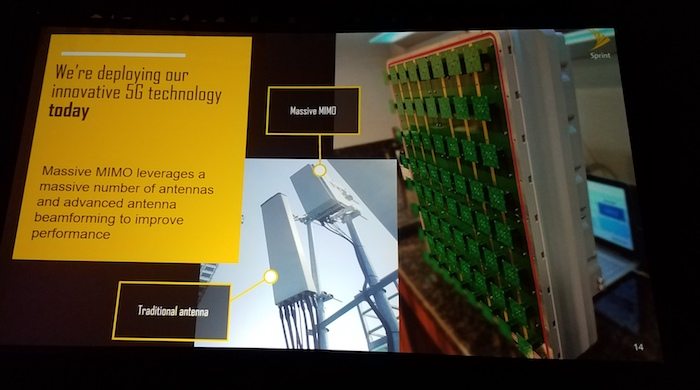

“Massive MIMO is very strategic for Sprint,” said Crull during his keynote. Half of the antennas in Sprint’s massive MIMO hardware will be dedicated to 4G and the other half to 5G.

“We’ve done these before,” Marquardt emphasized. Sprint used the same method for its 4G LTE rollout: splitting the antennas into two technologies (WiMax and LTE). “We are already well along with this [rollout].”

Sprint is using Ericsson, Samsung and Nokia hardware for the deployments, but “our advantage is the TDD spectrum,” said Marquardt.

Sprint is using TDD (time division duplex) spectrum in its massive MIMO, which Marquardt says makes it much easier to use massive MIMO than FDD. “That means every single Sprint phone that has Band 41 in it today can take advantage of it and have the beam forming immediately because it is using the same spectrum to send and receive and so it knows the channel and therefore can adapt the RF … on a very fine scale.” Marquardt explained. “In FDD, because you have two different channels, one sending and one receiving, they have to pass messages back and forth. So, if you are using FDD and massive MIMO, the phones won’t support beamforming until you get a software upgrade and that is not available yet. That protocol is not finalized.“

[What is massive MIMO? Read more here.]

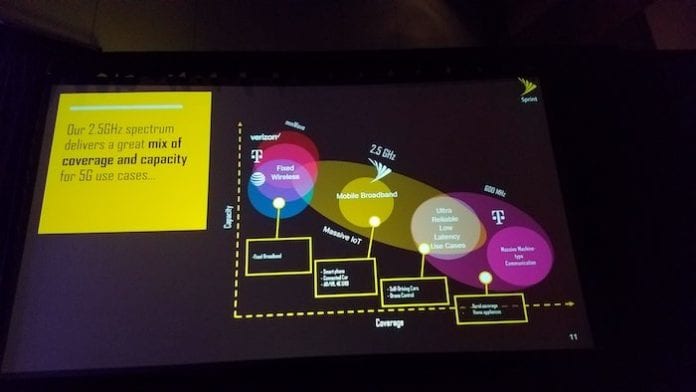

Sprint expects 5G to place more demands on what networks can support in their current states.

“What we see from 5G is consumer and business demands are outpacing what our networks can do exponentially,” said Crull in his presentation.

A number of speakers at 5G North Americas, including Crull, made the point that no one knows now what developers and business will create once they get 5G networks. Industry observers frequently cited companies like Uber that created a disruptive, on-demand economy in the 4G world.

When asked if certain cities would be harder or more technically challenging to deploy, the two Sprint executives shrugged it off. Phoenix is easier because of its dry desert air, but Washington, D.C. offers more deployment challenges from a security perspective: “You drive around with a van with radio gear on it and tall ladders, they tend to look funny at you,” said Marquardt.

Because Sprint is deploying on its current towers, the company needs to have some municipal approvals, said Crull, “but they are way lighter than a new tower.” All the backhaul will be on fiber-connected macro sites.

Vitualization

Sprint has already virtualized some of its LTE network, says Marquardt. As Sprint rolls out VoLTE, the entire VoLTE infrastructure will be virtual.

“Network slicing is a great tool for business people to approach enterprise with,“ said Marquardt. “It is not available yet. We have to wait for the 5G standalone core. It is still in development, but it is quite promising to be able to offer the right businesses essentially a virtual view into the network as if they owned that piece of it as an extended part of their infrastructure.” Network slicing relies on 3GPP standards and Sprint is working with vendors on it, as soon as the standards are finalized.

“It starts in [3GPP standard] 16 and then we have to get to a standalone core, which certainly won’t happen this year,” said Marquardt.

But the unavailability of network slicing doesn’t stop use cases from going forward. And, Crull says, the mix of customers on Sprint’s network won’t only be business and consumers. “There will absolutely be some smart city applications in the near term because you have a confined geography you are focusing on,” he said. “The consumer side is going to be about things that benefit from reliable speed and capacity. We’ll see a much improved video experience on mobile devices, such as high definition video. Gaming is an early good use case.”

“But I would say in mobile you can’t be too fast,” said Crull.

Corrections 5/17/18: The article incorrectly identified the fiber-connected macro sites as micro sites. They are macro sites.