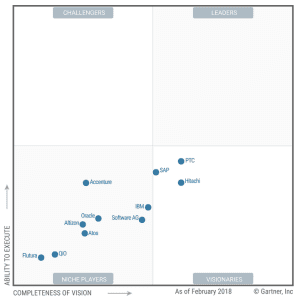

PTC, Hitachi and SAP have come top of Gartner’s inaugural ‘magic quadrant’ for IIoT platforms, ahead of IBM, Software AG and Accenture. But the analyst house warned also that major challenges remain for IoT providers in the industrial space, including with market fragmentation and inconsistency.

Gartner’s review considered industrial IIoT (IIoT) platforms in the manufacturing, transportation, and utilities sectors, ranking them for their service, execution, viability, pricing, vision, and various strategic aspects of their development, sales and marketing plans.

Among a mix of IT vendors, OT vendors, IoT platform specialists, and system integrators, PTC, Hitachi and SAP were rated as ‘visionaries’. IBM, Software AG and Accenture were rated as the best of a trailing group of ‘niche players’. None secured outright ‘leaders’ status in the quadrant, nor placed as ‘challengers’.

Oracle, Altizon, Atos and Qio rounded out a top 10; an eleventh, Texas-based Flutura, was also included and commended in the report.

Gartner, sensitive the ‘magic quadrant’ technique is not misconstrued, pointed to a blog post, which declared the ranking “reflects the overall position of a vendor within an entire market”.

It stated, in protest at over-simplification: “Just because a vendor isn’t listed as a ‘leader’ doesn’t mean that they suck. It doesn’t mean that they don’t have enterprise clients, that those clients don’t like them, that they don’t routinely beat out ‘leaders’ for business, or, most importantly, that we wouldn’t recommend them or that you shouldn’t use them.”

Either way, PTC, Hitachi and SAP ranked highest, with the industrial sector in general lifted by the combination of IoT technologies and edge computing. Gartner predicts on-premises IoT platforms, married with edge computing, will account for up to 60 per cent of IIoT analytics by 2020, up from less than 10 per cent today.

By 2022, more IIoT analytics will be performed at the edge than on “cold” data stores in the cloud, it said. At the same time, a lack of compelling platforms in the market will induce 15 per cent of manufacturers to take the technology in-house, by developing or acquiring IoT platforms, up from less than one per cent today.

Indeed, the new discipline of IIoT platform provision faces teething problems, including issues with priorities and perceptions. Device management, the “real net-new technology addition” in IoT platforms, as distinguished from familiar IT systems, is both the most critical and least regarded strategic challenge in new IoT deployments.

“Device management appears to be the technology element of the modern IIoT platform where vendors spend the least amount of effort and investment” said Gartner.

Many industrial systems operatives do not believe IoT solutions will “supplement, or obviate” traditional industrial control solutions. “Those users are correct today. Within the current generation of IIoT platforms, very few provide the functionality to directly monitor and manage OT assets and devices without significant integration challenges in terms of complexity and trade-offs relating to security.”

Gartner added: “Most address device management capabilities through a gateway proxy into OT assets and devices, protocol translation, and a set of open SDKs for integration and device management communications.”

The market in general is fragmented, with solutions from a variety of tech firms, including start-ups, large industrial players, system integrators and traditional IT companies. Telecoms providers and legacy industrial control and automation vendors will also enter the market in due course, it suggested.

There is a contradiction, it said. “Legacy technology and service companies are slow to invest in corporate-wide IIoT sales and marketing and delivery capabilities, but hundreds of companies are marketing and selling IIoT as mature catalogues with mature support organisations to create demand.”

Meanwhile, the sector is susceptible to tech follies; ‘digital twins’, used to test digital representations of physical assets in the design phase, are “big on promise, but short on value and impact”, it said.

“Many industrial assets require customisation. That means twins can naturally be generated as a function of design applications. However, vendor-specific twins will likely require vendor-specific applications for the twins to add value. Such an operating model further exacerbates OEM-driven walled gardens.”

Gartner explained: “IIoT must evolve to free owner-operators from OEM hegemony to pursue value-added applications that can generate digital twins independent of the OEM, as well as to allow digital twins to leverage third-party applications for enhanced capabilities.”

Despite showing “good [technological] vision”, Gartner said platform providers have also failed to show a “deep understanding” of sundry industrial standards.

“The list of standards for which manufacturers, utilities, and transportation and logistics sectors must consider in their engineering and operations is profound regarding numbers and importance. Users will require templates and design patterns that adhere to relevant industry standards for their IIoT use cases,” it reflected.

An understanding of industry standards is the minimum entry, or the “table stakes”, for IoT providers to even be considered for the leadership game; the competitive landscape could be transformed when new entrants grasp the challenge, it said.

“Many potential leaders in the IIoT platform market have yet to offer available products. Gartner believes that the potential leaders for IIoT will be legacy OT incumbents willing to disrupt their installed base as they adopt IoT through partnerships, acquisitions and organic development.”

Market pricing is also inconsistent, albeit evolving, it noted, tied variously to the number of assets, volume of data, and length of the contract. Adoption of managed IoT services will “bend the traditional pricing approach” towards value based and event based pricing, it said.

“When outcome-based services are predicated on service guarantees, there will likely be lower costs to implement a solution and a higher likelihood of pricing contingency fees based on shared risk-reward expressed as a percentage of saving/improved productivity or fee multipliers,” it said.

The process identified more than 40 vendors that were not included in the final analysis, because of non-conformance with the inclusion criteria. Gartner listed Bosch, Davra Networks, Eurotech, GE Digital, Microsoft, Schneider Electric, and Siemens notable exceptions, among these, and for further consideration.