Antennas: A critical element in your 5G network

The antenna has become a very complex and invaluable segment of the 5G network, and momentum is rapidly building up with 5G, particularly in light of recent announcements in the mobile service provider (MSP) world, on the standardization front, spectrum work and 3GPP, with Releases 15 and 16 making significant contributions. In September of this year, we’ll see Phase 1/Release 15, do standardization work up to 52 GHz. In December 2019, Phase 2/Release 16 will investigate bands up to potentially 100 GHz.

There are great expectations lined up in terms of these blocks of spectrum; for example, the GSA (GSM Suppliers Association) has made recommendations — that are reinforced by the GSMA (Global System for Mobile Communications Association) — that, ideally, the amount of contiguous spectrum allocated for 5G should be in the order of 100 MHz per spectrum license. There also needs to be accompanying versatility as well, in terms of the need for standardization support for segments from 20 MHz up to 100 MHz. Therefore, operators will need to rely upon Carrier Aggregation and Massive MIMO to utilize these spectrum assets most effectively. Many operators will take prudent steps toward 5G, using Non-Stand Alone (NSA) 5G NR, which allows 5G traffic to fall back on their LTE core network. LTE is used as a control plane anchor, and when 5G mobile broadband users move out of range, the devices can switch back to Gigabit LTE.

Ramping up traffic

Mobile data traffic continues to ramp up, which is being enabled by the upgrade in access technology, as we have evolved from 3G to 4G. When you open up a “data” highway, it starts to inevitably build up with traffic, enabling new applications. ABI Research has been tracking mobile data and traffic generated in different parts of the world, and we’ve seen that at the end of 2017, approximately 170 exabytes of traffic were generated (1 Exabyte = 1018).

When we see 5G launch around 2020 and gaining critical mass, we expect to see 5G traffic eclipse 4G by 2026. The net result will end up being approximately 1.7 zettabytes of traffic. To place into context, one zettabyte equals 1,000 exabytes. The reason for this stimulation is by no means a secret — by 2025, video traffic will represent nearly 80 percent of all traffic; within that domain, 4K will represent roughly 15 percent by 2020, and 40 percent of traffic in 2025, as more 4K devices, including smartphones, begin supporting 4K video resolution.

We are currently seeing a remarkable situation, in which the MSP will have at its disposal a range of radio assets that can complement each other and work in different dimensions. For example, at the very low frequencies, radio can penetrate buildings and provide wide area coverage — at higher frequencies, there’s greater capacity, but also can be limited to line-of-sight. Much of the existing spectrum currently sits at sub-3 GHz. Once you get up to 10 GHz mark is when you are increasingly into line-of-sight radio communications.

C-B and (3.5 GHz)

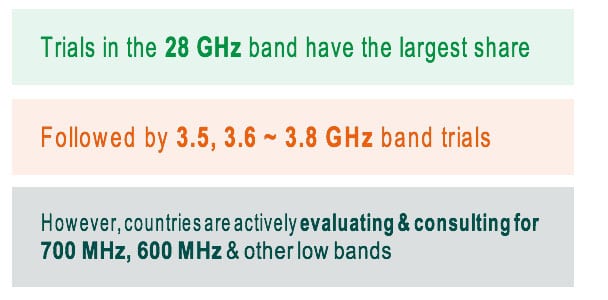

There has been a great deal of dialogue about the C Band, 3.5 +/- GHz bands, which will be an anchor “frequency” for MSPs. We expect Korean and Japanese operators to aggressively utilize the 3.5 GHz band to potentially provide national coverage. This could require up to 4x the number of existing cell sites currently being used, although solutions such as Huawei’s UL/DL decoupling could mitigate the limitations. There are plans in place, however, to use small cells in such a way to attain that goal. For millimeter-wave bands, we should see initial momentum in the North American market, particularly from AT&T and Verizon.  Particularly crucial will be fixed wireless access, and the ability to reach out to residential communities and small businesses in urban and rural communities, providing coverage that is effectively equivalent to fiber optic. We are also starting to realize the need for spectrum in the sub-1 GHz band, which can provide a very wide area coverage role for mobile operators with 5G. Over the next several years, we will also see potential interest in refarming the 3G and 4G spectrum. This will likely happen on a country-by-country basis, however, depending on the installed base of 3G and 4G users. Currently, the United States is focused primarily on the 24 GHz, 28 GHz, 37 GHz, 39 GHz and 48 GHz band. T-Mobile USA recently declared that they envision their 600 MHz spectrum as a complement to their 5G strategy, to provide increased mobility and IoT capabilities, although short-term barriers may arise with regard to the latter.

Particularly crucial will be fixed wireless access, and the ability to reach out to residential communities and small businesses in urban and rural communities, providing coverage that is effectively equivalent to fiber optic. We are also starting to realize the need for spectrum in the sub-1 GHz band, which can provide a very wide area coverage role for mobile operators with 5G. Over the next several years, we will also see potential interest in refarming the 3G and 4G spectrum. This will likely happen on a country-by-country basis, however, depending on the installed base of 3G and 4G users. Currently, the United States is focused primarily on the 24 GHz, 28 GHz, 37 GHz, 39 GHz and 48 GHz band. T-Mobile USA recently declared that they envision their 600 MHz spectrum as a complement to their 5G strategy, to provide increased mobility and IoT capabilities, although short-term barriers may arise with regard to the latter.

Innovative solutions

Regarding cell-site architecture and dynamics, OEM (original equipment manufacturer) vendors such as Ericsson, Huawei, Nokia, and ZTE have developed innovative solutions for upgrades in cooperation with antenna companies such as Kathrein. There are three complementary initiatives to keep an eye on: proactive cell shaping, where beamforming can be utilized to shape cell coverage; vector sectorization, which is the upgrade from a standard three-sector cell site to six-sector cell site. This provides more capacity to the MSP. A primary reason this has not been accomplished previously was the need to build traffic on an average basis in their cells to avoid interference at the cell edge, which would prevent deploying a six-sector strategy. The final initiative would be a move to MIMO antennas. Many existing LTE antennas are 2×2 MIMO, which has typically been the standard for many LTE networks, but there’s significant growing traction toward 4×4, and trials in place for 8×2 and 8×8 scenarios for MIMO. This can result in a variety of MIMO applications: Multi-User MIMO, where hotspots can track where users reside; Full-Dimension MIMO, in which the objective is to reach into buildings and skyscrapers more effectively; and Massive MIMO, which can provide substantial amounts of capacity using a range of spectrum bands, high and low.

Higher-order MIMO configurations

Fundamentally, we expect to see several different Massive MIMO configurations to enter the market. There won’t be a single Massive MIMO deployment scenario. For instance, we will see greater traction and need for 16×16, 32×32, and 64×64, and potentially higher combinations in the long-term. On the smartphone side, there are limitations by the form factor — many of the more cutting-edge smartphones in the marketplace (Samsung S8 and S9, as well as the iPhone X) can support the 4×4 configuration, which gives faster throughput.

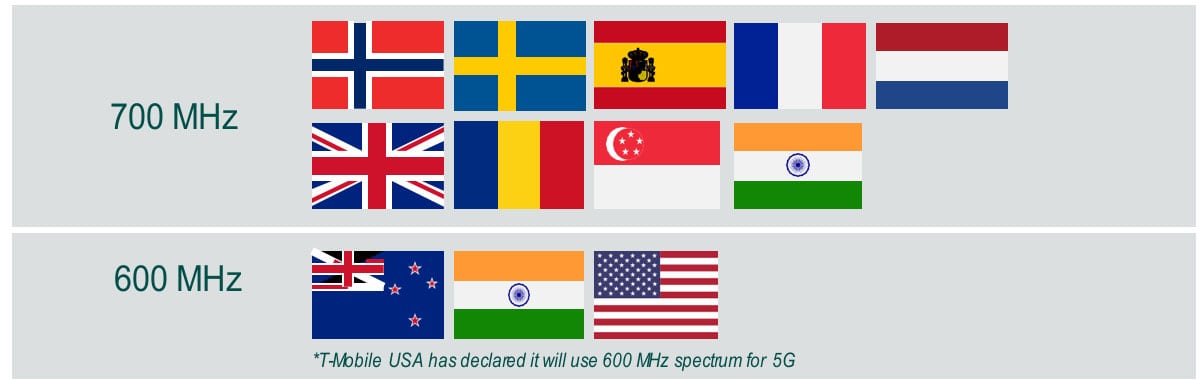

The outlook for antenna shipments yields a wide range of segmentations, from low port number antennas to 12-, 14-, 16-port, and even higher configurations being designed and developed by vendors like Kathrein.  At the end of 2017, the overall market was valued at around $3.6 billion and has grown just over 9 percent year-on-year. Macro base station new site deployments are tapering off, though there still is traction in emerging markets; we are seeing vendors centering their focus on African, Middle East, and South American markets to help compensate for these slowdowns, primarily happening in Europe and North America. Conversely, we see upgrade cycles in examining LTE Advanced and LTE Advanced Pro, as these spectrum combinations need to be deployed on the cell site. As we move into the 5G realm, there will be added opportunity for repeaters, which can complement the base station, also supporting 26~28 GHz and providing coverage in skyscrapers, residential homes, and urban canyons.

At the end of 2017, the overall market was valued at around $3.6 billion and has grown just over 9 percent year-on-year. Macro base station new site deployments are tapering off, though there still is traction in emerging markets; we are seeing vendors centering their focus on African, Middle East, and South American markets to help compensate for these slowdowns, primarily happening in Europe and North America. Conversely, we see upgrade cycles in examining LTE Advanced and LTE Advanced Pro, as these spectrum combinations need to be deployed on the cell site. As we move into the 5G realm, there will be added opportunity for repeaters, which can complement the base station, also supporting 26~28 GHz and providing coverage in skyscrapers, residential homes, and urban canyons.

Mobile antenna shipment outlook

2018 and 2019 could see a potential market slowdown in the lull of likely demand that will benefit 5G, which may end up in the range of three to four percent. Once 5G kicks in, however, we should see a stimulus, effectively reversing that trend. Also, while shipment volumes may be slowing, the mix of antennas does shift toward the more advanced multi-band antennas, as well as Massive MIMO antennas.

To further highlight the need to support a number of frequency bands and enduring a number of challenges in what frequency is available, we’ll see six-port, as well as eight and above combo port antennas, grow rapidly to potentially around 70 percent of the market by 2021. An interesting dynamic is the ratio between and TDD (Time Division Duplex) and FDD (Frequency Division Duplex) capable antennas; across the 2.5 GHz band, 5G and Massive MIMO, there is a significant increase in adoption of TDD.

MSPs will need to upgrade sites due to new form factors and new spectrum bands, but regular wear and tear is not to be overlooked. To use a specific example, global warming is expected to shape and shift weather patterns over time, creating a dramatic impact on the dynamics of the weather systems we experience. Due to the increase in global temperatures, the average intensity of tropical cyclones will increase by 2 percent to eleven percent by 2100, but the overall frequency of storms will decrease by 6 percent to 34 percent, therefore increasing the damage they inflict on equipment. With several tens of thousands of base stations to consider, minimizing the number of engineers repairing cell sites is crucial. As an added constraint, approximately 30 percent of MSPs have only one antenna mount per sector, and 40 percent report only having two available antenna mounts. With these challenges, these considerations should be addressed when looking at total cost of ownership.

Cannot ignore the tower management company

Tower management companies are an increasingly important part of the relationship for the MSP. Many MSPs have sold off their cell sites to tower management companies, allowing them to release large amounts of capital for future investment, but it has changed the operational expenditure (OPEX) dimension. Tower management companies are acknowledging the future impact that antennas — and what’s happening on top of cell sites — have on operators. Looking at total cost of ownership, a macrocell site over a five-year span can range from $100,000 to $200,000; examining further, OPEX comprises 67 percent of that total, which can be broken down into site lease (35 percent) and operation maintenance (25 percent), significant expenses when determining total cost of ownership.

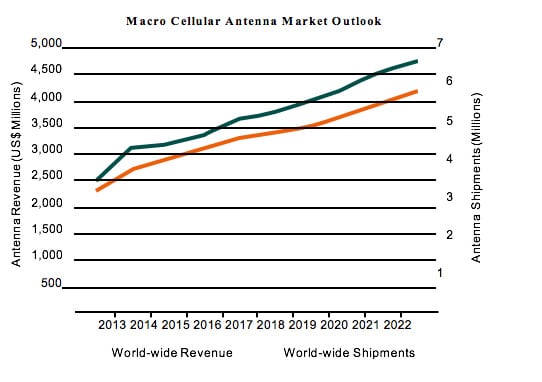

Evolution of the active antenna

One of the more exciting elements within the antenna environment is the evolution between passive and active antennas. To clearly define each, an active antenna is one that has active electronic components (i.e., transistors) and is not simply composed of passive parts such as metal rods, capacitors, and conductors. Included in this category are smart antennas, remote radio head antennas, and beamforming antennas. These will all play an increasingly important role in the network, and the ratio of active antennas is estimated to grow from nearly 6 percent in 2017 to over 10 percent by 2021. Much of this growth will be driven by MIMO and Massive MIMO configurations.

Massive MIMO enables 4.5G & 5G

The outlook for Massive MIMO reflects this growth. The install base of all MIMO installations in 2017 was 3.6 million. By 2021, we see that number growing to just under 9 million installations. A large portion of this increase will originate in Asia-Pac (nearly 5 million by 2021), followed by Europe (just over 2 million by 2021). As we drill down further to Massive MIMO, we expect to see an increase of nearly 380,000 installations.

In summary…

- The stage is certainly for 5G, so no concerns

- Network slicing will enable a range of novel 5G applications, but it needs to be enabled by the latest innovative antennas are a key component of that vision.

- There is continuing momentum on 5G, in the C-Band, 26~28 GHz Bands and in time sub-1 GHz bands (700 MHz, 600 MHz).

- Key considerations for operators will continue to be antenna height, weight, and install time, reinforcing the importance of implementing multi-band antennas; also, moving to multi-user MIMO, FD-MIMO and Massive MIMO configurations will be a significant strategy for