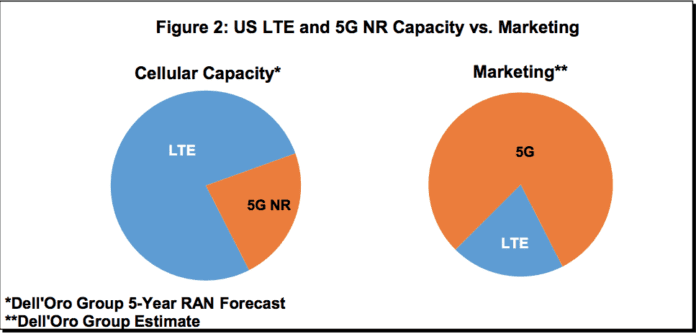

In addition to the typical location asymmetries between data consumption and mobile infrastructure investments that characterized the first part of the LTE cycle (Figure 1), differing spectrum assets among the US operators coupled with the resiliency of the LTE standard form the basis for the possibility of new asymmetries in the first phase of mobile 5G NR deployments in the US market – this time between marketing and capacity.

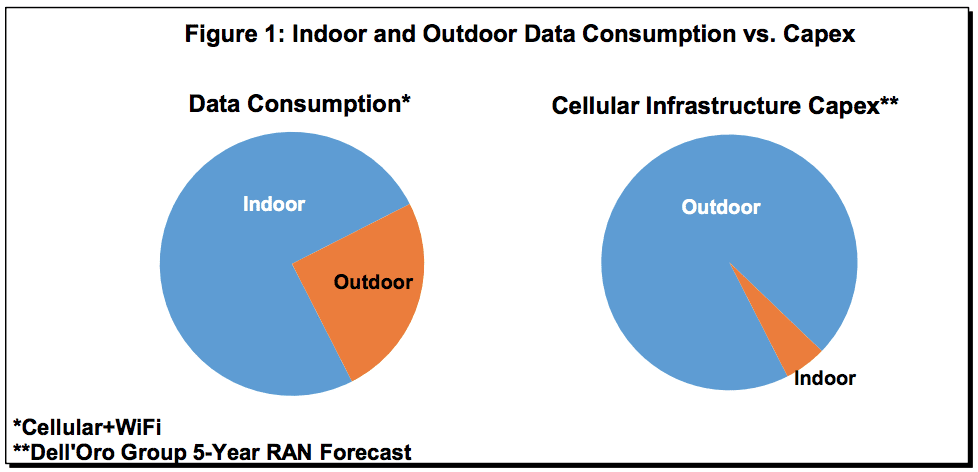

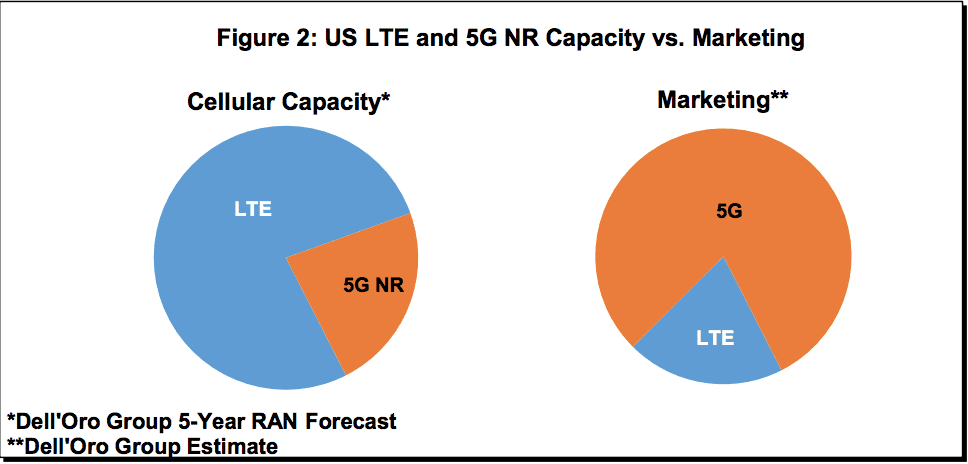

With the US carriers gearing up their marketing machines in preparation for the first phase of the mobile 5G launches, existing and projected spectrum positions imply the LTE macro and small cell networks will likely address the majority of the aggregate mobile speed and capacity requirements over the forecast period, even as 5G NR capex accelerate rapidly (Figure 2).

The analysis contained in these projections are predicated on the assumption that larger swaths of mid-band spectrum will provide the most ideal framework to accelerate the LTE to NR transition. While there is little doubt that preliminary results with the on-going millimeter wave (mmW) trials has surprised on the upside and the general industry sentiment around millimeter technologies for mobile applications is on the rise, our findings — primarily based on feedback from key players in the industry — suggest it still premature to conclude there will be any deviations between Qualcomm’s mmW coverage simulations and actual mmW deployments meaning ~50% to ~80% coverage in US cities using existing infrastructure could be slightly optimistic in some cases. Having said that, we have adjusted our mobile mmW projections upward to reflect greater than expected propagation characteristics with mmW technologies and significant progress on the device side while at the same time revising the mmW mobile 5G mobile traffic projections upward. But even with the upward adjustment it will naturally take some time before mmW technologies will address a substantial portion of the aggregate mobile LTE+NR traffic in the US market.

The other sub 6 GHz bands the US operators are looking into utilizing to realize nationwide coverage rapidly including band 5, 66, and 71 comprise less than a fifth of the aggregate sub 6 GHz spectrum assets for AT&T, Verizon, and T-Mobile.

In other words, all the US Tier 1 operators now have a path forward to ensure the 5G logo shows up on smartphones nearly nationwide by 2020/2021. From a marketing perspective, it might not be as important then that the incremental capacity and throughput upside will be limited with Band 5, 66, and 71, because operators can rely on their Gigabit LTE networks utilizing carrier aggregation with both the licensed and unlicensed spectrum, 4×4 MIMO, and 256 QAM to realize theoretical Gigabit cell capacities. The irony with this approach is of course is that consumers might believe it is always the 5G network that is delivering these impressive data speeds, when in reality the majority of the near-term capacity and speed investments will be addressed with the LTE toolkit until the 3.7 to 4.2 GHz spectrum becomes available.

Risks are broadly balanced. With NR yielding roughly 20% to 50% of spectral efficiency improvements over LTE, faster than expected availability of the recently announced dynamic spectrum sharing feature could simplify and accelerate the introduction of NR in multiple bands. One of the key takeaways from the MWC-LA and 5GAmericas events was that operators are excited about the dynamic spectrum sharing feature. Also, mmW has surprised on the upside and projections are being adjusted to reflect the increased likelihood that the technology can deliver better than expected performance in various mobility settings. The pace of the mobile mmW deployments will to some degree be dependent upon how much of the existing infrastructure can be utilized so clearly there is wiggle room in both directions.

In other words, the starting points in the first phase of the 5G era differ more among the US carriers than they did in the beginnings of the LTE buildouts. Consequently operators now have a wide range of options to differentiate their services as they seek to balance capex between capacity and speed to support the demands of the future while at the same time framing a marketing message that can leverage all these technologies and resonate with the end users. And even before the 3.7 to 4.2 GHz spectrum is available, US operators have the option to capitalize on the 5G marketing term, regardless of what is underneath the hood.