The second week of October was the annual 5G Americas annual Analyst Forum held in Dallas, Texas. The event was kicked off by the Chairman and CTO of T-Mobile US, Neville Ray (@NevilleRay). Just a few highlights to start off with regarding Neville’s keynote, which clearly showcased the global and nationwide competitive angle 5G is being championed for and towards (also heard at MWCA in LA).

- 5G revolves around 3 primary pillars: Enhanced Mobile Broadband (MBB or eMBB), Massive Internet of Things (IoT), and Low Latency Critical Communications (ultra-reliable) per Ray

- 5G Use Cases: High Def video, AR/VR, Fixed Wireless, Asset/Fleet Tracking and Monitoring, Alerting, Connected and Autonomous Vehicle, Factory/Remote Operations, eHealth and other automation applications

- 5G requires spectrum across all bands – low band (Massive IoT), mid-band, and mmWave (millimeter wave-spectrum between 30 gigahertz (Ghz) and 300 Ghz)

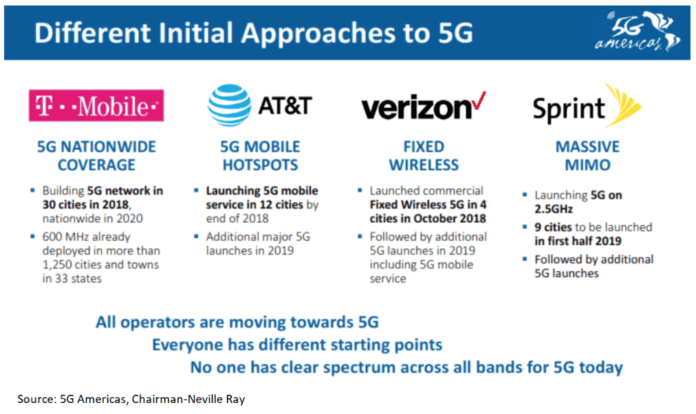

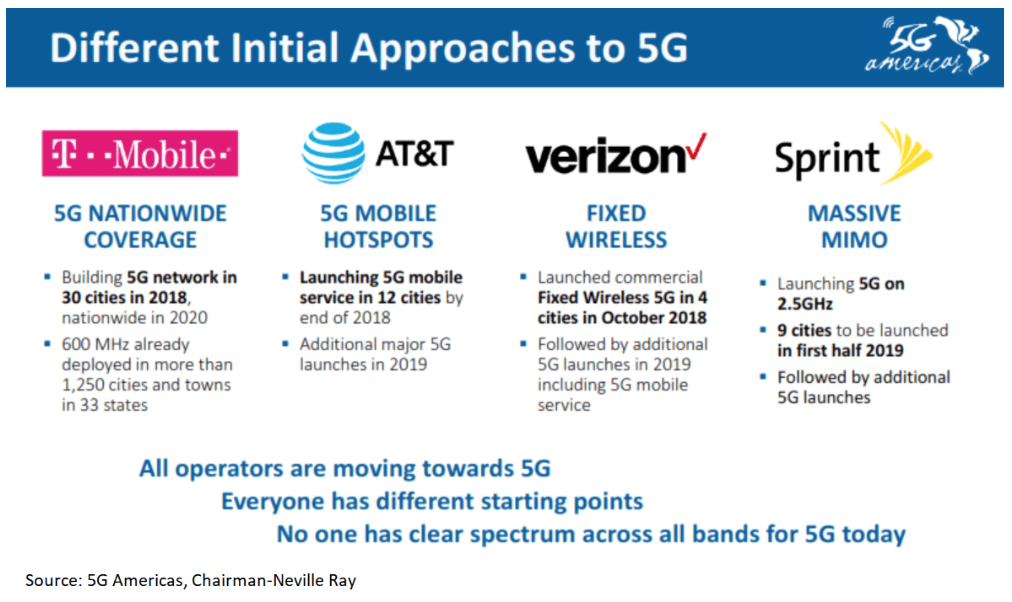

- 5G Carrier (T-Mobile, AT&T, Verizon, and Sprint) strategies and approaches vary (see depiction below)

Artificial intelligence and 5G

One of the first sessions I sat in on was focused around the impact of Artificial Intelligence (AI) to 5G and future growth in IoT. Ericsson is utilizing AI tools and software to improve their radio access network (RAN) specific to configuration and optimization, while Samsung mentioned heavily investing (see Softbank news on AI investments) in AI at the cloud level to support in new customer experiences (cX) and improve video content services (noted example of having video content follow users). Cisco’s perspective was a bit different as they are looking at AI to support in new learning algorithms (inference and information theory) around operations, as well as using AI tools and software for social impact initiatives. Lastly, Sprint mentioned leveraging AI to improve data quality, enhance machine learning tools, generating automatic code, and simplifying for categorization (think automated text categorization, read more here). Sprint also mentioned there may be a challenge with the human input and training is an issue.

5G and enterprise IoT

On the low band, 5G is expected to support in scaling massive IoT, specific to low latency connected and sensor solutions, specific to industrial, infrastructure, operations, and even smart cities. The use cases revolve around asset tracking and monitoring, fleet tracking and monitoring, some transportation and container tracking, and applications specific to agriculture, factory automation/manufacturing (mass production), and others.

Device ecosystem

Enhanced Mobile Broadband (eMBB) has been a focus for companies like AT&T, as they made announcements this year. As shown earlier, the carriers all have different approaches to device roll-out, yet 5G smartphones is not expected until mid-2019. On another note, there are some upcoming changes to 5G devices and antenna placement. Devices may have 3 to 4 mmWave antennas as part of 5G enhancements, and this will help to manage hand cover up issues from a user experience perspective. Qualcomm mentioned that some devices still have 2G, and that the OEMs they work with are choosing what bands to include in the devices. The 3G to 4G shift was more concentrated around power management, while that will not be as much of an issue for the shift from 4G to 5G. New RF modules will be an area of focus for 5G devices. This session had participants from Qualcomm, Samsung, and Sprint.

5G, more use cases

Focusing beyond MBB, the industry participants mentioned we need to look above and beyond broadband and smartphone devices. Sprint is focused around the mid-band, so 5G smartphones is key to their 5G strategy. Sprint is currently looking at the partnership model for 5G use cases. The foundational use cases are centered around mobility and fixed wireless. Many are in the exploratory stage from an ecosystem perspective and are seeking support from partners, research analysts, advisors, and customers. Carriers will be seeking use cases to better monetize traffic, as current smartphone revenues and the growth trajectory remains fairly stable or flat. Consumer is behind overall, and Enterprise is leading in 5G use cases at this time. Smart cities is an area to explore as well, and CityBrain (by Alibaba) was mentioned as a good use case to explore in terms of true ROI.

My two cents

- 5G being used as a case for the Sprint/T-Mobile merger approval

- 5G global competition is fierce, but China is expected to win…this does not mean we stop competing, but it may mean we stop thinking global competition and we focus on city/local competition

- 5G is being used by cities as a competitive and economic differentiator, so core use cases and applications may be an opportunity for cities/communities and civic applications

- 5G is coming fast, but let’s focus on LTE progress as customers are expecting good connectivity experiences today

- 5G Americas is succeeding in bringing the industry together to advance 5G and future revenue plans