In a tucked-away corner of a hangar-like exhibition space in Munich, US electronic design automation (EDA) company Mentor Graphics is reflecting on its recent status, as a small but notable function within German mega-corp Siemens.

“It probably sounds like a plug but I’ve got to say, personally, I am blown away with what Siemens is trying to do, and the investment it’s making,” comments Paul Musto, director of marketing for the company’s board systems division.

Mentor’s stand at Electronica 2018 is busy. It presence on the show floor is conspicuous by the absence of both its peers, and also its parent.

Cadence Design and Synopsis, like the rest of the EDA community, focus on the Design Automation Conference in Las Vegas; Siemens saves up for SPS IPC Drives 2018 in Nuremberg, where it takes a hall for itself.

Mentor’s appearance at the Munich event – Europe’s premier electronics showcase, in its leading industrial nation – makes sense in light its parentage, and also its expanded strategic priorities.

Its rivals in the EDA space should be afraid, reckons Musto. “It it’s not just a bunch of words on a piece of paper. In fact, I am nervous for the competition, because those companies will struggle to bridge that gap.”

Mentor announced its acquisition by Siemens two years ago; the deal closed in March 2017. At the time, the news was a surprise. But Siemens had always been its ‘white knight’, it turns out, in the background – contacted nine summers before, as Mentor faced a hostile takeover bid from rival firm Cadence Design.

In 2008, Mentor president and chief executive Walden Rhines called up Chuck Grindstaff, his counterpart at Siemens PLM Software, the German outfit’s software division in the US; Mentor’s chip design expertise could set Siemens apart, he reasoned, and save Mentor from the clutches of Cadence.

Siemens didn’t buy Mentor, then, but neither did Cadence. From late 2008, Mentor pursued its own growth agenda, picking up mechanical analysis business Flomerics Group, silicon testing outfit LogicVision, and printed circuit board (PCB) design firm Valor Computerized Systems in a three-year spending spree.

In Munich last month, Rhines appeared during a ‘meet-the-chiefs’ panel session, with top brass from Infineon Technology, NXP Semiconductors and STMicroelectronics alongside. In late 2018, the company is sitting pretty, he told a packed-out room, with its best-ever financial performance.

“Normally, you see companies go through a period of slowdown [after a merger]. We didn’t. We have broken records for all-time growth. And we can attribute that to the financial resources and credibility of Siemens,” he said.

Advantage has been gained the other way, too. Somewhere down on the show floor at the Munich Messe, which spreads across 17 cavernous halls for Electronica 2018 like an electro-mechanic’s Mecca, Musto says Siemens, of all the industrial giants, is streets ahead, and pulling away.

“There’s no question Siemens has taken the lead. It is going to be very, very difficult to assemble the pieces to be able to create the kinds of solutions Siemens is starting to offer. It has done very well,” he says.

At the end of September, sales at Siemens were about square for the year, finishing at €83 billion. Flat growth is hard to celebrate, except that Siemens was achieved in major part because of the stonking performance of its ‘digital factory’ division, among others, offsetting a spiralling decline at its ailing power and gas division.

Profit jumped 28 per cent in the fourth quarter for its digital factory business, which covers industrial internet-of-things (IoT) and automation solutions, finishing at €616 million in the quarter; its power and gas business saw a €139 million reverse, meanwhile, down from €292 million in the final quarter of 2017.

At the time of the purchase, early last year, Mentor was but a $1.4 billion revenue software design business, subsumed into a product lifecycle management (PLM) division of Siemens that contributed less than five per cent of its total revenues. But Mentor’s place in Siemens’ expanding Industrie 4.0 jigsaw is important, says Musto.

“Siemens wants to digitalise the entire design platform – from ideation to utilisation. The thing it was missing was the electronics element,” he says.

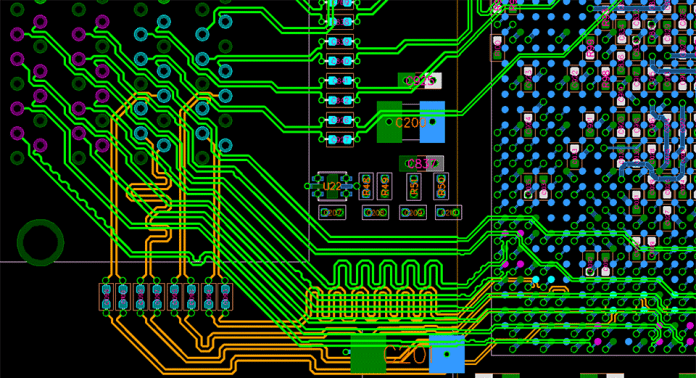

As brief context, Mentor’s main business is split between software for design automation and electronic systems. The first grouping covers simulation and testing for integrated chip (ICs) designs; the second covers integration of electrical systems, networks, and wiring harnesses onto printed circuit board (PCBs).

Its Calibre business is the market-share leader for IC verification and sign-off. “Calibre is the golden standard,” says Musto. In parallel, in the EDA market, Synopsis is considered the gold standard for logic synthesis, and Cadence is the gold standard for layout design.

Continued… see link to part two, below.