Service providers are sitting on more marketable data than even Google — but they’ve been slow to harness it for profit. Here are some ways they can turn things around

Not even Google can rival the wealth of consumer data that communication service providers (CSPs) have at their fingertips. A study conducted by Ovum Researcb last year, for example, found that 67 percent of brands consider telecom operators a better original source of data insights than Google, Apple, and Samsung.

However, most CSPs have yet to turn that data into profit. If telecom providers are to enrich their customer engagement and value in ways that increase their profit margins, they need to capitalize on the privileged position they enjoy in the digital food chain.

Over-the-top (OTT) digital titans, such as Amazon, Facebook, Google, and Netflix, have visibility into their own subscriber data, which they are already successfully exploiting for providing a personalized customer experience and ultimately a bigger monetary gain. However, they have no visibility into CSP or other OTTs’ subscriber data. The CSPs who deliver these and other OTTs’ content, on the other hand, have access to their own customer data and that of all the OTTs that use their networks. CSPs are sitting on a veritable data goldmine that places them firmly in the catbird seat of digital marketing and delivering a better customer experience.

How to capture and capitalize on new network and subscriber data insights

Most CSPs know they need to harness their valuable data, but struggle with how to do it. Putting AI and analytics tools to work alongside their deep-packet inspection (DPI) classification engines, providers can learn a lot more about their customers, then categorize them in understandable ways that allow the provider’s marketing department to approach them with targeted, personalized and meaningful service offers. Let’s examine a few ways CSPs can succeed.

- Recapture video dominance and avoid churn by measuring each subscriber’s QoE.

CSPs can capture new subscriber data insights and put them to work to recapture share in the booming video services market. U.S. OTT streaming video services generated an estimated $20.1 billion in revenue last year on 15.2% growth, according to the PricewaterhouseCoopers Entertainment & Media Outlook for 2018, which forecasts those revenues to continue to grow by nearly 9% annually through 2020.

By some estimates, 40% of TV viewing has already migrated to streaming video delivered by OTT companies, according to Advanced Television, Ltd. in London. CSPs should be using their customer data and analytics to win some of this business back. Here’s how:

- Set a business goal. Let’s say “CSP X” offers on-demand and streaming video as one of its services. Its customers might be consuming some of those services, but they might also be consuming OTT video from content companies like Hulu, Netflix, and Acorn. CSP X might set a goal to at least be the majority provider of the video content that each subscriber consumes.

Having the visibility to know how much of the subscriber’s video usage is their own vs. the OTT competition empowers the CSP’s marketing department to create compelling and customized offerings to sway consumers towards their own offerings. Analytics software can provide this exact information and help identify the best types of promotions, the best candidates to receive those promotions, and customers’ preferred methods of delivery.

- Measure subscriber QoE. By integrating Layer 7 (application-layer) network data deep packet inspection (DPI) signatures that CSPs already run in their networks today with analytics tools that standardize the type of usage and content classification to the CSP’s business decision makers, CSPs are able to see, in plain English, what applications subscribers are running and their usage levels. That empowers CSPs to apply additional QoS metrics to a given user’s stream to understand latency, jitter, and throughput to gain some QoE perspective on each user.

CSPs should measure QoE against usage and vice-versa. Looking at the QoE variation is equally important, because unstable experiences are a big driver for service churn, particularly for real-time services such as VoIP and video streaming. If video is the main reason a customer is a network subscriber and those video experiences are erratic, then video service churn will lead to CSP churn and customer loss.

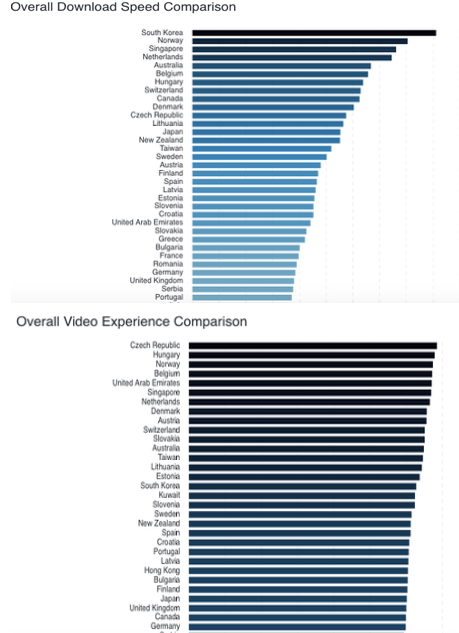

It’s important to note that user experience isn’t determined only by network download speed and bandwidth, though CSPs commonly equate the two. For instance, South Korea shows the best network download speed among 69 countries evaluated by Open Signals for its State of Mobile Video Study, 2018. Yet the country ranked number 16 in terms of its video experience score. On the other hand, the Czech Republic video experience score ranked number 1 but the country ranked only number 11 in terms of network speed. The QoE scoring is calculated from the Layer 7 QoS metrics and per data service analytics information in order to establish a reliable QoE measurement instrumentation.

- Create custom offers based on subscriber’s current video experience. Determining what video experience users are already having on their network is very helpful in guiding the CSP to know what to promote and to whom. Those users with high-volume usage and highly stable QoE levels, for example, are targets that can be qualified with a high propensity for additional video service adoption. By the same token, it would probably be a mistake to heavily promote additional video offerings to subscribers already frustrated by poor or unstable experiences with the CSP’s video services, despite that they may still be showing high video usage. Instead, those showing an unstable or poor video QoE could be considered for network improvement or alternative solutions to fix their problems.]

- Find new ways to classify subscribers and additional opportunities for custom campaigns.

Once you have your hands on this data, there are many useful ways to classify users. Are there subscribers who consume large volumes of video and also consume large volumes of music, for example? Do they have different personas? And is there significant overlap of these subscribers in one or more specific geographic markets? If so, a campaign could be created to target big streaming video and music consumers, say, in the San Francisco market with a combined video and music package.

It’s also possible for telecom providers to understand other behaviors that occur on their networks, such as on-line shopping interest, and use that information to determine new markets to enter, such as retail or banking. The provider’s marketing department can begin formulating offers that are based on actual customer interests—movies, music, sporting events, shopping—rather than offering traditional, generic sales packages that are all about network speeds, feeds, and minutes which aren’t fully appreciated by customers in terms of how these will translate into an improved experience for them.

- Take a tip from the OTT playbook and meet customers on their terms, but with better data.

The OTT companies have succeeded largely by creating a level of intimacy with customers, which has involved getting to know and understand their interests, speaking the customer’s language, and meeting them on their own terms. When CSPs do this, they too will empower themselves to target a particular subscriber with a customized offering of interest to that subscriber and to do so in a way that matches how that customer interacts with the world.

For example, would more customers respond to the proposition of watching a movie starring Dwayne “The Rock” Johnson or to an offer to buy a 50GB streaming http/s service? While millennials and Gen Zers might understand the second option, most consumers prefer offers in direct language that they can classify quickly as “want” or “don’t want.”

Similarly, a WhatsApp user and old movie buff might appreciate being contacted about a special classic movie package using the WhatsApp messaging service. After all, today, OTT companies like WhatsApp account for more than 80 percent of all messaging traffic—not the carriers’ SMS services, according to former GSMA chairman and Telenor CEO Jon Fredrik Baksaas, in a Q&A published in February 2018 by McKinsey & Company.

So pitching a service to a WhatsApp user using WhatsApp as the delivery medium puts the telco in the running by meeting that user on his turf.

- Create consistent, omnichannel experiences using better data insights.

In today’s crowded digital market, it’s all too easy for a customer to click-to-close an offer or capability they don’t readily identify as being from a company they do business with or one they simply don’t understand. It’s important that CSPs adopt an integrated, multi-channel approach to marketing, selling, and serving customers.

Customers should experience consistent interactions with the CSP regardless of the channel they’re using. Being consistent allows customers to recognize the CSP brand and to readily know how to interact with the company, so they don’t give up out of confusion or frustration.

Look deeper into the network and subscriber data for the answers on subscriber characteristics

Providers can glean a wealth of insights by looking deeper into the vast volumes of customer and operational data moving onto their networks. They can use these insights to solve imminent challenges such as personalizing customer experiences, growing revenues, and creating more efficient operations.

The analytics market has advanced to the point where CSPs no longer have to be frustrated by trying to translate data expressed in Internet jargon into meaningful information; the tools now exist to give them the foothold they need to become primary providers of all kinds of services in all kinds of markets.

CPSs own the largest and most effective service delivery platforms—the world’s communications networks. They just need to integrate their own packet signature solutions with today’s AI and analytics tools to put the valuable customer data stored in those networks to use. Once they can determine what types of compelling, personalized content and services to offer their subscribers, they’ll successfully compete with the many OTT companies endangering their turf and overhaul the economics of their businesses.