Nokia’s biggest opportunity, it explains, is to go beyond its traditional customer base to serve industrial markets directly, with private networking solutions. The total market for private LTE, and later private 5G, masts is potentially twice as large in straight volume terms as the existing carrier market for macro base stations, it calculates.

“Our traditional customers serve the enterprise segment, of course. But we have felt for long time we could make a much bigger difference if we could bring business and mission critical connectivity inside those spaces,” explains Stephan Litjens, general manager of the digital automation at Nokia.

Litjens is talking at the opening of HPE’s new innovation lab in Geneva. The pair have worked together for ages, he says, but creeping digital change among the industrial set – billed as a fourth industrial revolution, and a new machine-animated Industry 4.0 era – has made them closer than ever.

“We are increasingly partners, and the reason is IoT is an opportunity for us both to grow. We connect people and things, which means we collect data – which you need to compute. You can see how that match-up works.”

But the most interesting aspect of Litjens’ presentation in Geneva is his frank discussion of Nokia’s own transformation, in service of the industry’s wider one. “We think there is a business for us. We have invested a huge amount, billions, R&D wise; we set up a new business group,” he says.

The Finnish vendor has grouped its industrial IoT solutions into a new architectural framework and enterprise division, called ‘Future X for industries’. It wants to unlock “trillions of dollars” of economic value in the next decade, by working directly with the manufacturing, logistics, transportation, and energy markets, among others.

Litjens explains: “We are a €26 billion business, but we want to grow, like every company.” Litjens quotes US economist Paul Krugman. “Productivity isn’t everything,” he repeats. “But in the long run it’s almost everything.”

Big data analytics in the cloud and fast data analytics at the edge have helped bring higher intelligence to industrial operations, leading to greater efficiency and productivity.

Nokia figures it can play between the lines, by re-routing industrial traffic via private wireless networks. “We felt we could make a difference, and that, if we could, there was money in it, which made it worth investing.”

He puts the opportunity from private networking and direct selling into perspective. “Look at number of base stations out there, the radios our clients have installed – the Vodafones and Deutsche Telekoms, and so on.”

There are seven million of them, among every operator, globally, he says – not a patch on the number of sites Nokia has earmarked for private deployments, via a mapping exercise with Harvard University. “We analysed all the locations where it makes sense,” he explains.

He makes reference to Cern, down the road from the HPE lab in Geneva, as just an extreme example of the kind of industrial-scale private commission it is interested in. “You want to wrap these places in a special connectivity bubble,” he says.

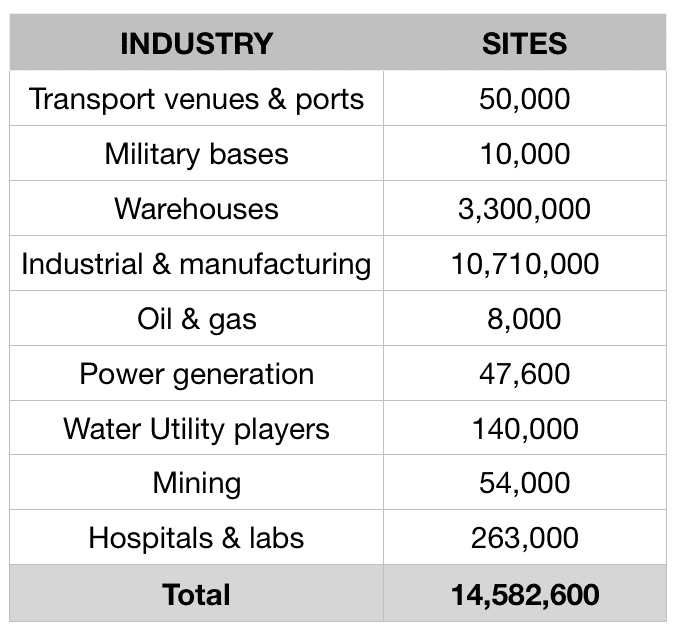

In total, Nokia has calculated no fewer than 14.58 million potential venues for private LTE, and later private 5G – “where it could have an impact on the automation level, and hence an economic impact,” says Litjens.

In total, Nokia has calculated no fewer than 14.58 million potential venues for private LTE, and later private 5G – “where it could have an impact on the automation level, and hence an economic impact,” says Litjens.

Among this number, Nokia has identified 50,000 transport hubs, including air ports, sea ports, and train ‘ports’. It goes on. “Warehouses? Millions,” he says. Nokia has counted them all: 10,000 military bases, 8,000 oil and gas plants, 47,600 power stations, 140,000 water utilities, 54,000 mines, 263,000 hospitals and labs.

The biggest market for private networking is the industrial and manufacturing space, home to 10.7 million candidate sites, reckons Nokia.

“So it’s seven million macro base stations versus 15 million locations,” says Litjens. “It’s an area we feel, as a company, will move the needle, revenue-wise. And if it moves the needle, then we have an ability to invest.”

The point with specialist private networking is it achieves for industrial companies what general-purpose networks, as built and managed by public operators, have failed to deliver.

This article continues here – From 50ms to 1ms and 5x9s to 6x9s – Nokia makes case for private industrial networks