American enterprises rule for IoT, and the transport industry leaves the automotive sector for dust when it comes to connecting ‘things’. These are the conclusions of a new study by Vodafone, which nevertheless finds higher adoption, higher confidence, and higher urgency among global enterprises.

One in four businesses (25 per cent) in the Americas claims to be well-embedded with IoT, already, compared to 17 per cent in Asia Pacific (APAC) and just 11 per cent, less than half the US average, in Europe, the Middle East and Africa (EMEA).

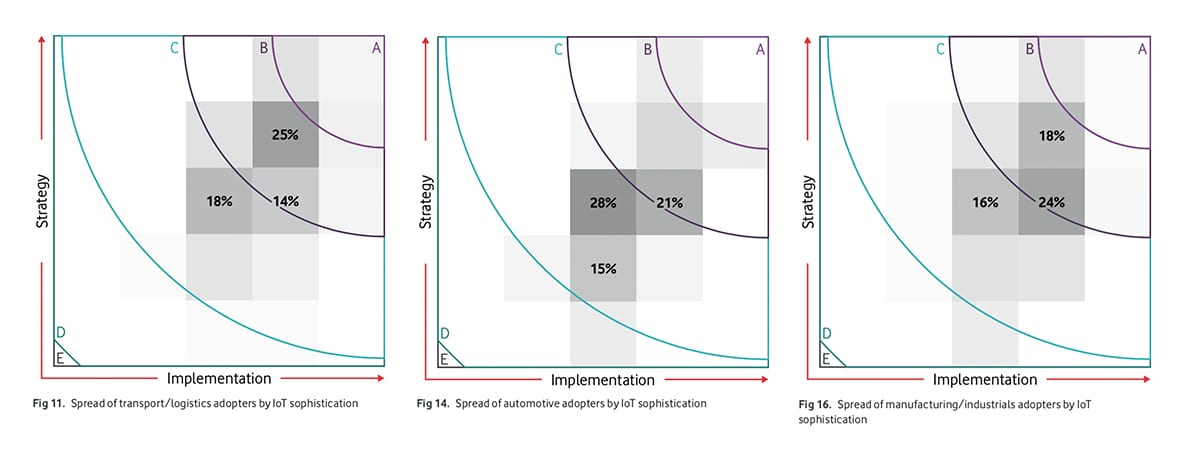

Meanwhile, the transport and logistics sector is most sophisticated among vertical markets when it comes to IoT deployments and applications – and not the automotive or manufacturing sectors, often held up as industrial elites for digital transformation.

In total, Vodafone quizzed 1,758 businesses worldwide, as part of its latest ‘IoT Barometer’ study. Almost half of respondents (49 per cent) to the survey were from the EMEA region; 22 per cent were from the Americas and 29 per cent were from APAC. Overall, the trend was up, unsurprisingly. More than a third (34 per cent) of businesses now use IoT; 70 per cent of these have moved beyond pilot stage and 95 per cent are seeing the benefits of their investments in IoT technology as it moves into the mainstream.

Sixty percent of businesses that use IoT agree that it has either completely disrupted their industry or will do so in the next five years, the report said. Eighty-four percent of adopters report growing confidence in IoT, with 83% enlarging the scale of their deployments.

Globally the report found that 53 per cent of adopters fall into the top two levels of sophistication, as either ‘most sophisticated’ or ‘very sophisticated’ – out of five grades in total.

Regionally, the Americas is the most advanced. Two thirds of adopters (67 per cent) fall into the top two levels, compared to 51 per cent in APAC and 46 per cent in Europe. The numbers are lower when both adopters and non-adopters are included, as at the top of the page: 25 per cent for the Americas, versus 17 and 11 per cent – and 15 per cent as an average across all respondents.

More EMEA enterprises, as many as two in five (42 per cent) are trapped in pre-launch mode,‘still considering’, as well; the numbers are a little less and a little more than one in three in the Americas (28 per cent) and APAC (37 per cent). Vodafone commented: “This suggests that businesses in the Americas are progressing faster than those in other markets, moving from individual projects to coordinated, strategic programs.”

Meanwhile, among verticals, Vodafone found transport and logistics the best, with the highest adoption rate (42 per cent), biggest year-on-year increase (15 percentage points), and highest average sophistication score (not revealed). Over half of adopters (65%) are in one of the top two bands. The numbers are higher among transport firms than logistics firms within the bracket.

The section in the Vodafone report on the different verticals is somewhat confusing (see graphics below), withholding comparable break-out scores, to reveal snapshots of each sector only. Vodafone said over half of financial services companies, participating in the survey, rank as ‘very sophisticated’. This sophistication is driven by the emergence of fintechs, it said.

Otherwise, Vodafone noted that the band-A count (‘most sophisticated) of adopters was highest in the healthcare and wellness sector, although, again, the precise figure was not clear. The automotive sector, which tends to be recognised among the elites for industrial IoT, suffered in the Vodafone sophistication index because of the inclusion of various business types — “from manufacturers to independent dealers”.

The energy and utilities suffers in the sophistication stakes because of the critical nature of the projects under consideration, and because legacy infrastructure is “making integration more difficult”. Meanwhile, in manufacturing and industrials, adoption of IoT rose from 30 per cent to 39 per cent in 12 months. Just under half (49 per cent) of IoT adopters in these industries rank as very sophisticated.

The report also consider 5G, of course, and found over half (52 per cent) of IoT adopters plan to use 5G for higher data volumes, increased reliability, and lower latency. “Combined with mobile edge computing, which will process application traffic closer to the network edge, users can expect better performance, less risk and faster data speeds,” said Vodafone.

Stefano Gastaut, chief executive of IoT at Vodafone Business, commented: “The good news is that IoT platforms make the technology easier to deploy for businesses of all sizes and NB-IoT and 5G will improve services and potential. In this climate, companies need to be considering not if but how they will implement IoT, and they must also be fully committed to the technology to realise the strongest benefit.”