On April 10, 2019, Canada’s ISED announced the 600 MHz provisional auction results. This was two years after the FCC announced the results for the US broadcast incentive auction which yielded $19.8 billion in gross revenue for 70 megahertz of valuable “low-band” spectrum to lay the groundwork for 5G networks and services.

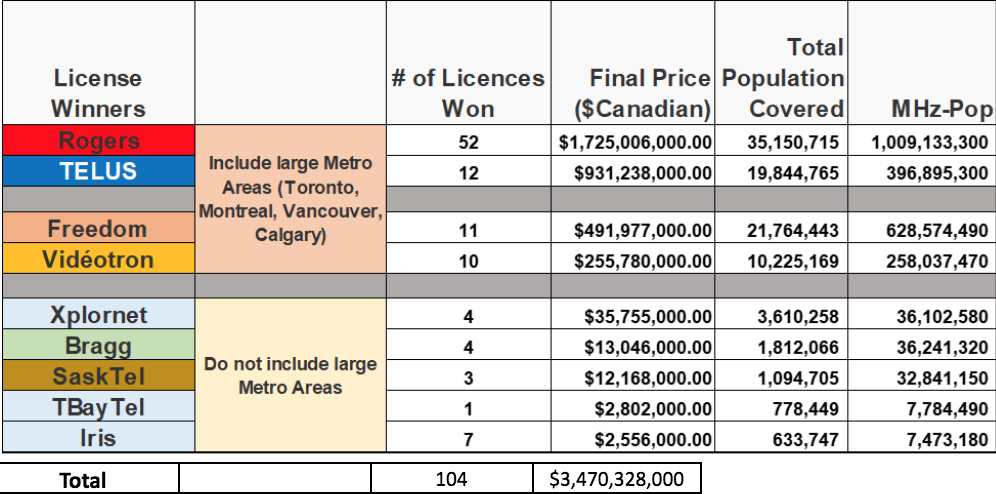

Nine Canadian wireless operators spent Can $3.47 billion for 104 licenses in the 600 MHz auction. Below we present the results by the numbers and provide an analysis of the value of the Canadian based on the planned use of the spectrum for 5G.

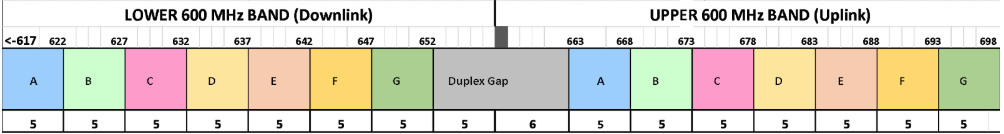

There was a total of seven blocks in 13 markets or Service Areas. Each block consisting of 5+5MHz FDD paired spectrum as follows:

To encourage competition, ISED had reserved three blocks in each market for non-tier-1 players (Bell, Rogers, Telus), who could only bid on 4 open blocks.

Some of the blocks included large metro markets, such as Toronto, Montreal, Vancouver, Calgary, and Edmonton. Bidders who won licenses in these markets paid higher prices in absolute dollars as shown in the Final Price Paid column in the table above. Analysts often use a normalized matrix such as $ paid per MHz-Pop to compare the value of spectrum. To calculate the $/MHz-Pop figure for each of the licenses, it is important to know the number of blocks each licensee won in each of the service areas.

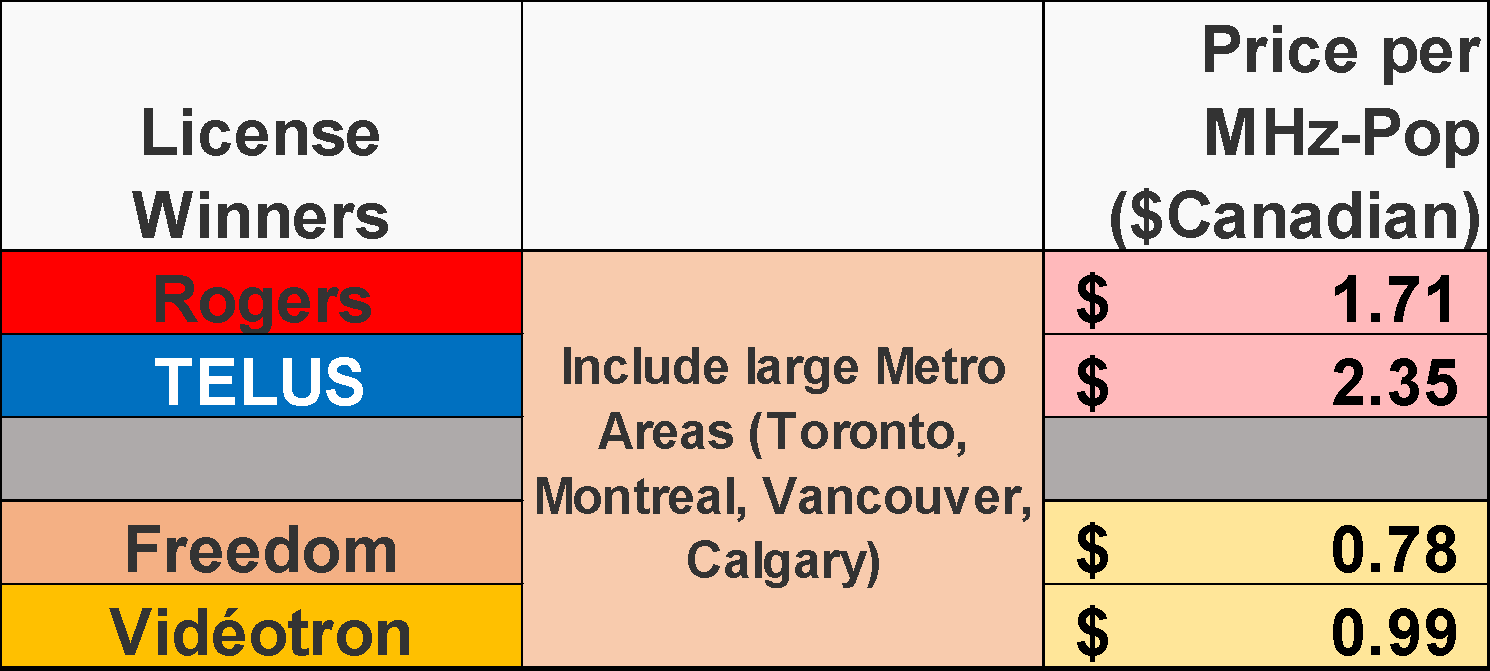

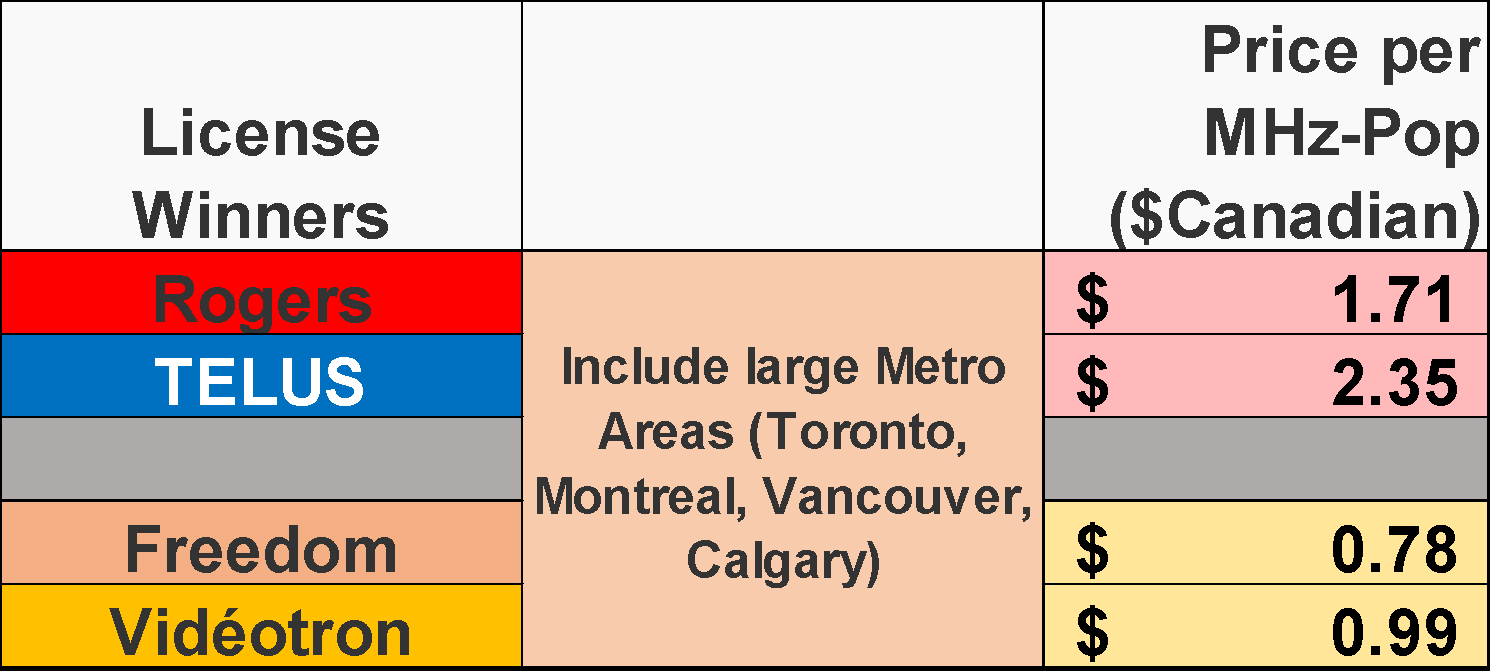

On its website, ISED made available the number of licenses won by each of the bidders and the population covered by each licensee as an aggregate of all the licenses won, therefore it is easy to calculate the MHz-Pop won by each of the licensees. The following table shows the MHz-Pop for each license. Using this information, we calculate the $/MHz-pop paid by each licensee for the package of licenses they won. ISED does not make the price per license information available since the nature of the auction is a combinatorial auction where bidders bid for specific combinations or packages of licenses. The following table summaries the normalized prices paid by each of the top four licensees who won spectrum in the larger metropolitan service areas.

Nearly half of the total was spent by Rogers Communications which paid Can$1.72 billion for 52 licenses, followed by TELUS which paid Can$931 million for 12 licenses. Shaw’s wireless subsidiary, Freedom Mobile invested Can$492 million for 11 licenses and Vidéotron, owned by Québecor, won 10 licenses at a cost of Can$256 million. Absent from the list of winners was Bell, who ended up empty-handed. Although Bell was a registered bidder, it wasn’t awarded any of the 600 MHz licenses later saying it has sufficient low band spectrum in both urban and rural locations.

The average price paid by the tier-one bidders was Can$1.89 (US$1.42).

In the US, the average price paid at the US 600 MHz auction in April 2017 for the top 40 PEAs was US$1.31. But that was two years ago when the TV channels were still not cleared, there was no infrastructure ecosystem for 600MHz and the device ecosystem was non-existent. Fast forward to 2019, thanks to T-Mobile, who spend US$8.0 Billion during that auction, and has invested heavily in developing the ecosystem for 600MHz both for LTE advanced and 5G, the spectrum is surely worth significantly more. Most smartphones now support B71 for LTE and will soon support band n71 for 5G. With 600MHz being excellent spectrum to support 5G and IoT networks, Wireless 20/20 anticipates an acceleration in the deployment of this band.

In Canada, most of these channels are now clear or will be clear very shortly, and Canadian operators who won this spectrum have an opportunity to anchor their 5G deployments on the unencumbered 600MHz spectrum which has superior propagation characteristics. This is not only significant in metro areas where 600MHz can penetrate through walls, and provide excellent indoor coverage, it is also critical in rural markets where it’s uplink and downlink propagation characteristics can be leveraged to adequately cover the vast geography of Canada.

Wireless 20/20 provides spectrum valuation services for leading operators around the world and keeps a database of spectrum transactions which estimates the value of the 600 MHz spectrum in 2019 to be in the US$2.03 range (Can$2.71) per MHz-Pop. Wireless 20/20 believes ISED has just provided “oxygen” to the 5G fire in Canada and has done so at a deep discount. The discount was significantly deeper for the set-aside licensees.