That math looks wrong, so perhaps we should explain? To shamelessly co-opt a quip from my Corning colleague Bill Cune, “Small cells and DAS go together like chocolate and peanut butter.” In this article, we’ll discuss the compelling math that really makes the headline true.

Terminology baseline

In order to make sure that the use of terms is correct, let’s define a few things:

- Distributed Antenna System (DAS) – A system that takes the Radio Frequency (RF) signal source from one or more mobile operators and distributes it throughout a structure or venue so that mobile devices have great service. Capacity is delivered on a DAS system by dividing it into sectors (usually equating into 100,000- to 250,000-square-feet areas) and connecting an RF source to each sector. There are several major types of DAS infrastructures, ranging from analog coax fed to digital fiber fed.

- Headend – A physical location where the heart of the DAS is housed. All remote elements are fed from the headend, and the RF signal sources and network terminations to the mobile core are collocated in it.

- RF Signal Source – Otherwise known as a base station (BTS) or eNodeB that connects to a single mobile operator’s core network and actively radiates cellular RF signal. In typical structure or venue applications, the eNodeB RF ports connect to the headend of a DAS. A typical eNodeB will have the required sectors of capacity and operating frequencies as specified by the mobile operator who provides it.

- Small Cells Enterprise RAN (E-RAN) – A system that connects to a single mobile operator’s core network and actively radiates cellular RF signal from numerous small cells with built-in antenna installed throughout a building. The small cell system and its collection of radios look like an eNodeB to the mobile operator network. A small cell can typically cover about 10,000 square feet, depending on RF propagation characteristics of the building, where open floor plans have larger coverage and concrete internal wall construction (like in hospitals) have much less coverage per small cell. Additionally, most small cells use 802.11at Power-over-Ethernet plus (PoE+) for the in-building network so they are very economical to deploy by leveraging Cat5e cabling and the Enterprise’s existing Ethernet transport.

The state of affairs today

Up until recently when enterprise mobility went from nice to have to mission critical, the DAS investment was fairly straightforward and the potential issues were around acquisition of the necessary eNodeB from each mobile operator.

The changes in the landscape over the last few years have disrupted the model and have left some enterprise IT decision makers with stranded DAS investments. We’ll touch upon a few of the changes below and, after that, discuss a holistic approach to addressing these critical enterprise issues in a long-term manner.

- Mobile operator investment – As operators have refocused their capital on building out 5G, the investment pool to provide enterprises with eNodeB has dried up. It appears that only the largest and most important enterprises and venues will be in the investment pool in the future. This means the enterprises who need cellular services will need to participate, to a large degree, in funding the projects beyond just the DAS infrastructure.

- Exponential consumption growth exhausting capacity – Enterprises have been dealt a double hit with unlimited data plans (subscribers don’t manage usage anymore) and an eNodeB + DAS environment that is not sized to handle it. For older DASs that are sectorized in hardware/cabling, it is a very expensive proposition to go into the ceilings to break a sector into multiple sectors. Additionally, for every eNodeB in the headend, a new sector of capacity for every operating frequency will need to be procured.

- Tech changes – 5G, mmWave, CBRS, LTE-LAA, re-farming, and new LTE bands are arriving and causing uncertainty in determining the right solution for each enterprise. Enterprise IT decision makers are being asked to own decisions that may or may not support future implementations by their mobile operator partners. It can be career damaging to make the wrong eNodeB + DAS decision and then have to shovel a lot of annual operations money into continual evolution.

- Small Cells – When they came on the scene in 2012, they provided a cost-effective solution for buildings from 25,000 to 400,000 square feet in size. In spite of the single operator nature of the small cells, they occupied a valuable niche in providing cellular service where there was no viable business case for eNodeB + DAS

A flexible approach to tomorrow

In recognizing the impact of changes facing enterprises, many IT decision makers who value mobility will be looking at the bigger picture for system acquisition. Depending on many factors in play, they may converge their enterprise onto their contracted mobile operator. Most enterprises have at least one contracted mobile operator because corporate monthly rates are about half of consumer rates. This convergence enables the use of an E-RAN type small cell system throughout their campuses and buildings. But for many enterprises, convergence onto a single mobile operator may not be feasible and they will want to invest in an eNodeB + DAS to support the operators required by their enterprise.

DAS/Transport

The future needs to be considered in both physical transport and DAS. Because of the anticipated infrastructure shift being driven by both capacity growth and 5G, DAS architectures that are fiber optic driven are the natural choice. Further, the more that the environments are software driven, the less changes will be required to the physical infrastructure. For example, re-sectorizing a DAS from a keyboard is far less costly than physically re-constructing it. When enterprises today look into DAS systems, the so-called premium price for fiber-fed software- driven DAS architecture is quickly paid back by replacing physical reconstruction projects with simple keyboard-driven configuration changes. Finally, from what we have experienced at Corning, 5G is going to consume lots of fiber all the way to the edge, especially as mmWave comes indoors. Not only should there be plenty of ready fiber capacity in the risers, forward-looking enterprises will define wiring zones from every IDF closet. Each zone should be supplied with plenty of optical capacity so when 5G arrives, the enterprise will just install the radios and add a composite optical jumper cable from the wiring zone hub to the radio.

Cellular RF Signal Source

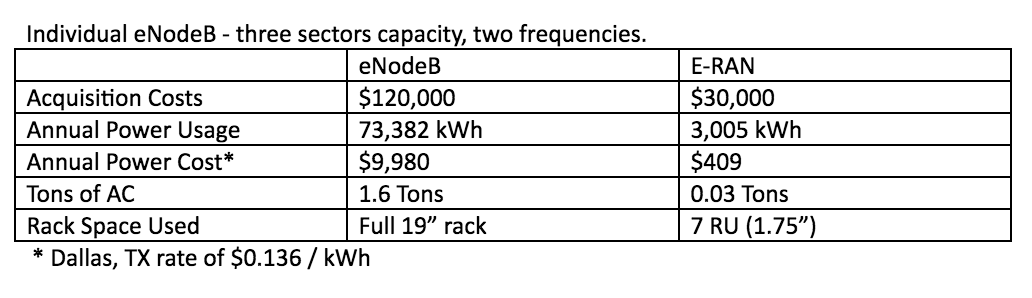

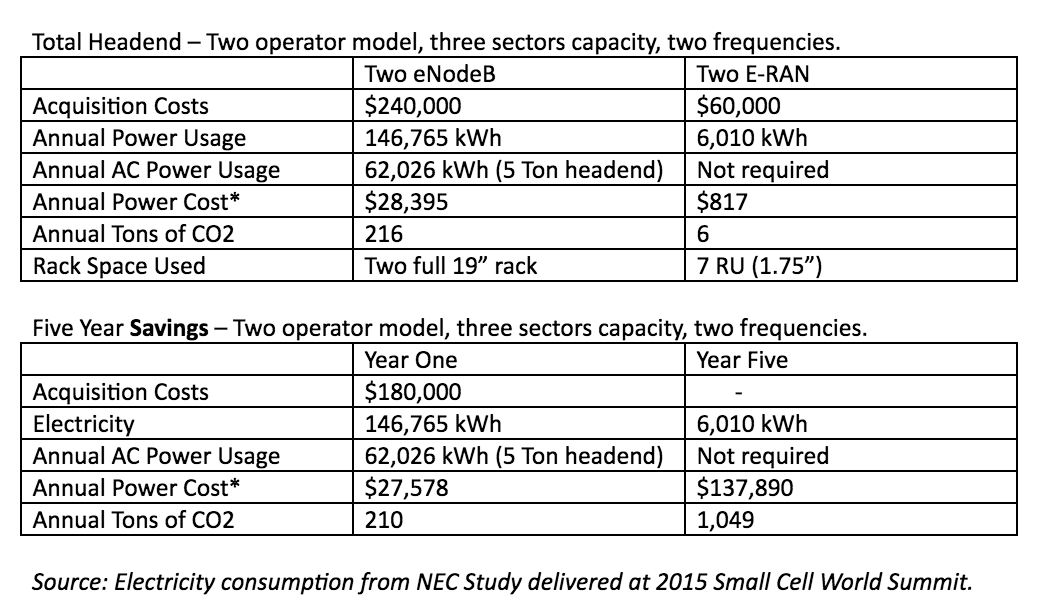

The eNodeB acquisition difficulty has been significantly transformed in the last year by the approval to replace the traditional eNodeB with a small cell E-RAN by three of the four major US mobile operators. Note that in some high-density urban areas, mobile operators may extend a C-RAN radio head from a telecom hotel to provide RF signal source. However, in most areas of the US, a full eNodeB must be provisioned to a headend. Corning has many small cell E-RAN fed DAS sites up and running across the US, and it is a proven solution. For enterprises who must fund the eNodeB installations, the list below identifies the factors that we think fulfill the 1+1=3 equation with which we opened. As a matter of fact, after enterprises consider the utility costs of running a traditional eNodeB, they may want to use a small cell E-RAN headend even when they are not providing the capital funding.

Traditional eNodeB vs. small cell E-RAN in the headend

Summary

As mobile operators change their business funding models, enterprise buyers will be seeking a total solution to their indoor cellular service gaps that is affordable and adaptable to the future. The combined architecture of small cell E-RAN and a software-driven optical DAS deliver a fresh alternative to them that has a better TCO, space utilization, and is greener.