Big opportunity for 5G home broadband services

According to a new report from Ericsson Consumer & IndustryLab, 5G, despite some industry skepticism, will provide numerous benefits to consumer users. That’s not to say the next-generation of cellular won’t be hugely important to enterprises and industries, but this analysis focuses in on the opportunities for delivering new experiences and services to consumers.

The report outlines four myths commonly associated with 5G:

- 5G won’t bring any short-term consumer benefits

- The use cases won’t command a rate increase

- Smartphones are the only device-type for 5G

- It’s difficult to predict future demand

In response to the short-term benefits, Ericsson cites data that shows consumers are unhappy with LTE speeds, network congestion has significant impacts in urban areas and 5G as a home broadband alternative represents a big growth opportunity.

To that last point, Verizon went to market with 5G in the U.S. using a fixed wireless access deployment model in four cities; this paradigm also speaks to the third myth around smartphones–clearly home broadband potential speaks to 5G opportunities for consumer premise equipment.

According to Ericsson, one-third of fixed home broadband users are looking to switch providers in the next six months and, similarly, 25% of households have more than 10 connected devices. Thus, 5G-based home broadband is a clear market opportunity.

CEO of Austria’s Three Jan Trionow said, “The market is established and home 4G broadband connections are under pressure. Capacity is needed to continue the business, improve connectivity and to do this on a nationwide scale.”

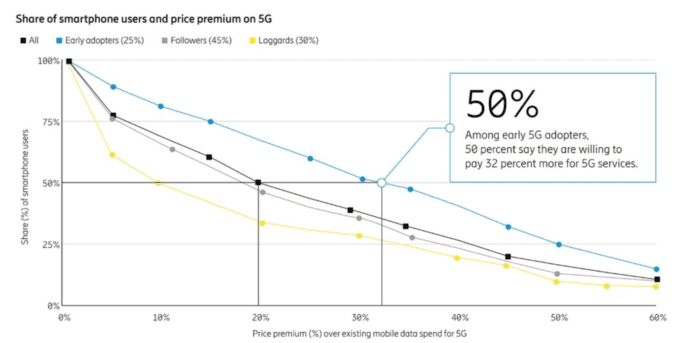

To the 5G for a premium point, according to Ericsson’s research, subscribers are willing to pay more but that may take time as network coverage is scaled and new apps and services come online. The report suggests 67% of survey-takers would pay more for 5G; specifically, smartphone users would pay 20% more and early-adopted would pay 32% more.

Ericsson pegs current smartphone use at 5.6 GB per month in 2018 with an expected increase to 21 GB per month in 2024 with major growth in video consumption.