Three quarters of the IoT market will be given over to low-power wide-area (LPWA) network solutions, compared with just one quarter for high-bandwidth low-latency 5G applications.

So says the LoRa Alliance, which continues to push its line about being the key technology in low-power ‘fix-and-forget’ machine applications, as well as in the IoT space at large – as both “de facto standard for LPWA networks” and the “de facto LPWAN standard for IoT”.

Donna Moore, chief executive and chairwoman of the LoRa Alliance, said: “Seventy-five per cent of the mass IoT market is in the low power, long life battery, small data messages, deep penetration in building, and easy ramp up, as well as connections in rural areas and over water.

“Twenty-five per cent of the mass IoT market will be 5G with low latency, high bandwidth for applications like emergency services, connected car, videos and entertainment, which isn’t LoRaWAN’s niche.”

She added: “LoRaWAN hits the sweet spot of applications that are never-ending.”

The LoRa Alliance, emerging from its annual summit, in Berlin last week, has published a sponsored wite paper with ABI Research, which compares LoRaWAN and NB-IoT, the twin non-cellular and cellular LPWA variants.

“LoRaWAN has a clear advantage over NB-IoT, with a mature ecosystem of vendors, certified IoT devices and end-to-end solutions that are ready for implementation today,” says ABI in the white paper.

ABI Research said earlier this month LoRa and Sigfox have extended their market-share lead over LTE-M and NB-IoT, as the latter technologies have been “plagued by network hardware and connectivity module issues. LoRa has been boosted by the rollout of private networks, and Sigfox remains a popular choice for public network operations.

Most LPWA network connections will be on LoRa and Sigfox through 2024, at least, said ABI Research. By 2026, LTE-M and NB-IoT will combine to capture a greater share of more than 60 per cent of total LPWA connections.

Meanwhile, IHS Markit calculates worldwide LoRa connections are double that of NB-IoT and 10 times more than Sigfox, based on data from its fourth annual LPWAN report.

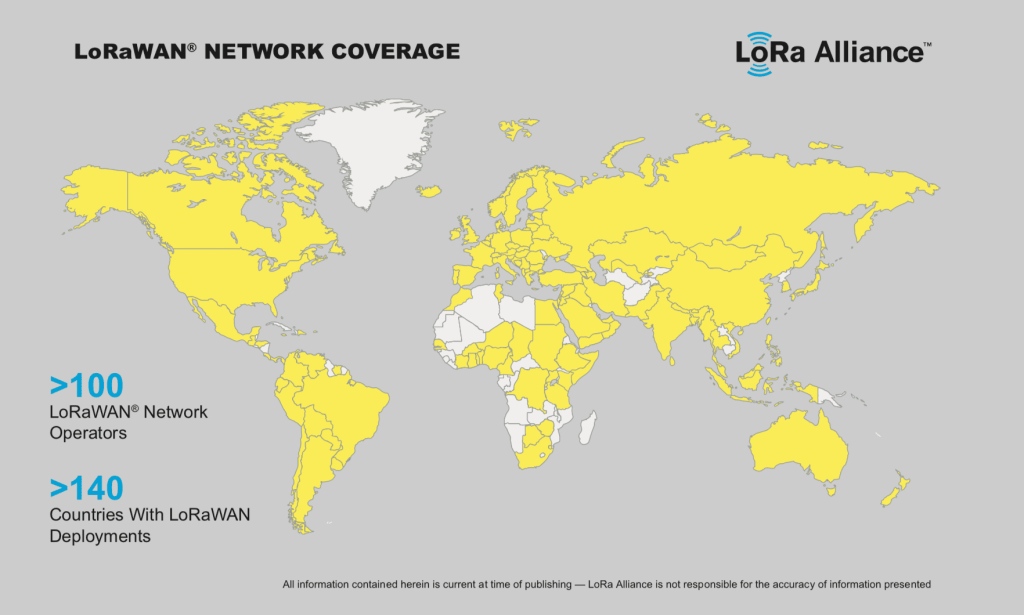

The LoRa Alliance claims 60 per cent growth in LoRaWAN network operators in 2018; its total networks stand at 117, in 140 countries, it said in Berlin. These figures do not take into account private LoRaWAN networks, which the LoRa Alliance believes makes up 50 per cent of LoRaWAN networks.

It also claims the largest developer ecosystem. “The market is limitless in terms of applications – server room, labs, theme parks, hotels, convenience stores, grocery stores, pharmacies, casinos, hotels, restaurants… For this reason, we believe current analyst predictions are not even close to the real potential, which is impossible to predict because there is no end to the market expansion in sight,” said Moore.

The LoRa community’s tails are up – its objective is global coverage, and it is aiming for the stars, literally. Semtech, author and owner of the LoRa technology, has said the first phase of testing of satellite-connected LoRa communications has finished. Semtech has collaborated with UK and Netherlands satellite IoT company Lacuna Space for two years to extend LoRa connectivity to the whole planet.

The pair have been working to evolve LoRa to enable direct communication from LoRa devices to satellite gateways utilising the LoRaWAN protocol, they said.

Lacuna launched a satellite on April 1 2019 from the Satish Dhawan Space Centre in India, where it shared a ride to Low Earth Orbit with EMISAT and 27 other satellites. Lacuna’s LoRa-based “space gateway” was hosted on a 6U cubesat satellite provided by Nano Avionics. The satellite and the gateway out-performed expectations during the initial commissioning phase, said Lacuna.

Thomas Telkam, chief technology officer at Lacuna, said: “We have test systems deployed around the world in countries as diverse as South Africa, Netherlands, UK, USA, India, Japan, Slovenia and the Reunion Island, and we have shown that we are able to communicate effectively from anywhere in the world, no matter how remote, to our LoRa-based Space Gateway.“

Nicolas Sornin, chief technology officer, Semtech said, “Lacuna expanding the LoRaWAN-based network coverage to the most remote regions is an incredible technical achievement. More users will develop LoRa-based applications that need long range, low power and flexible capabilities.”

A further three satellites are set for launch in the second half of the year. Lacunawants “more extensive demonstrations” with a select group of users at the end of 2019, with funding and support from the European Space Agency and UK Space Agency.

Rob Spurrett, chief executive at Lacuna, said: “We are eager to get these next satellites launched so we can increase the performance of the whole system, including the fine tuning of our novel adaptive radio approach that enables us to detect tiny signals directly from battery powered sensors in remote locations.”

The LoRa Alliance said its members are focused on smart cities, building automation, industrial IoT, utilities, agriculture and asset tracking. “We are deploying in many, many more as market needs are application driven,” said Moore.

Moore commented in Berlin: “Over the past year, the industry has moved from an environment where LoRaWAN was in trials and proof of concept, to the current market where LoRaWAN deployments are massive and scaling.”

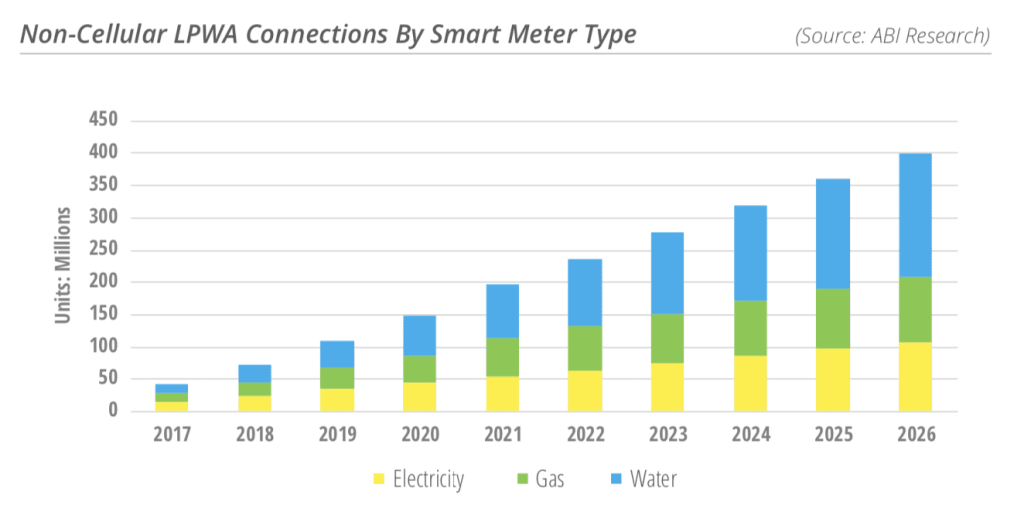

In particular, it is putting focus on smart metering. ABI Research reckons there will be an installed base of 1.34 billion meters by 2023, giving way to new use cases. Nearly half of smart meters will be used for the water utilities market, it noted.

The North America water metering market represents one of the first markets deploying LoRaWAN devices at scale, with hundreds of thousands of connected meters already in use in 2019, said The LoRa Alliance.

LoRaWAN provides certain advantages to the water market, according to its cheer-leaders, including enhanced Advanced Metering Infrastructure (AMI) capabilities, improved infrastructure reliability and security, and the ability to support additional water and wastewater automation initiatives.

Meanwhile, the LoRa Alliance has refreshed its board of directors for 2019. It includes executives from leading alliance members Actility, Cisco, Kerlink, MachineQ, Objenious, Orange, Sagemcom, Semtech, STMicroelectronics, and Tencent.

Moore said: “A critical aspect of our success is our member ecosystem, which spans from silicon to solutions. The open, collaborative ecosystem means that customers aren’t reliant on a single vendor and, in fact, have options available across every part of the ecosystem, giving end customers huge flexibility in their solution design and deployment.

The LoRa Alliance has recently expanded its LoRaWAN certification programme to simplify and reduce testing for device makers and network operators.

A single certification process will cover conformance, interoperability, and radio-frequency testing, reducing time and expense for device manufacturers. Network operators will not be required to run additional network testing on certified devices.

The number of devices connected to the internet is expected to reach 50 billion worldwide at the end of 2030, according to a study by Strategy Analytics. The study also reported that global IoT connections will reach 38.6 billion by 2025. Last year, there were 22 billion IoT connections globally.