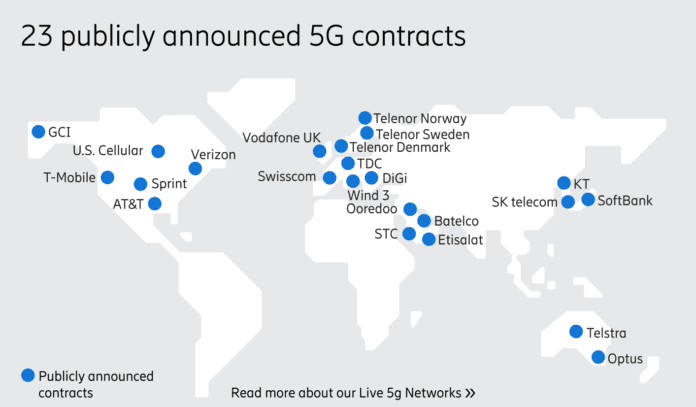

Ericsson has 23 publicly announced 5G contracts

With its gear supporting 23 publicly announced 5G contracts, including with the four Tier 1 U.S. carriers and all three Korean mobile network operators, Ericsson reported this week a 10% second quarter year-over-year increase in sales driven by uptake in North America and Northeast Asia.

CEO Börje Ekholm said Ericsson’s equipment is presents in “almost two-thirds of all commercially launched 5G networks…Initially, 5G will be a capacity enhancer in metropolitan areas. However, over time, new exciting innovations for 5G will come with IoT use cases, leveraging the speed, latency and security 5G can provide. This provides opportunities for our customers to capture new revenues as they provide additional benefits to consumers and businesses.”

Net sales in the second quarter totaled about $5.9 billion, up from about $5.3 billion in the same quarter last year. Here’s a detailed look at the vendor’s Q2 financials.

Ekholm continued: “5G is now launched on four continents and we actually see good pick up on the consumers. Today we have a competitive portfolio across RAN as well as core. What we see today is that in most customer engagements there is a 5G component. That’s very different compared to just a few quarters ago.”

He also noted that Ericsson is working with operators on 5G at millimeter wave frequencies and in mid-band spectrum.

Particularly among government officials, the global conversation around 5G has been characterized as a race with the winner reaping long-term economic benefits. While all four major U.S. operators have some type of service available and their Chinese counterparts do not, China is still viewed as a leader largely based on its top-down, strategic approach to managing telecoms.

Ekholm briefly mentioned discrepancies between the approach to 5G in Europe and China. “China is significantly more clever than Europe in issuing frequencies. Instead of using an auction to maximize price for frequencies, they actually award them free of charge. This will lead to much faster build out than in Europe.”

The company reported a decline in sales and gross margin for its Managed Services business unit following increased R&D costs and contract exits.

Ekholm expects this to turnaround as investments in automation, artificial intelligence and machine learning come to fruition. He said this will lead to “longer-term change and improve the margin profile of the business.”