Industrial giant Siemens, reticent on the subject until now, has been gushing in its support of 5G for industry, as a means to automate and animate digital factories, and bring total flexibility to production facilities.

“Once we start to realise these possibilities, we will not be far from reaching the vision of the self-organising factory”. This is a line from Herbert Wegmann, head of Industrial communication and identification at Siemens, quoted in a company blog post on the topic of industrial 5G.

Meanwhile, telecoms vendor Ericsson, with an interest in selling 5G to industrial companies, and anyone, has written separately, to say 5G will cut factories loose from fixed wires, tying them to fixed horizons, and make real the promise of industrial IoT.

“Fixed wires are holding IoT prisoner in homes, offices, factories, warehouses and industrial spaces around the globe. It’s time to cut loose,” says Kiva Allgood, head of IoT at Ericsson. “5G provides the foundation to realise the full potential of IoT. It provides higher reliability, lower latency and tougher built in security.”

The twin commentaries, published together, separate of each other, make clear momentum is building for industrial 5G, as 3GPP, the mobile radio standards organisation, prepares to standardise the requirements of industrial companies in Release 16 and Release 17 of the 5G NR specification, expected in mid 2020 and late 2020, respectively. “It’s only a question of time,” says Wegmann at Siemens.

Crucially, spectrum liberalisation in major industrial markets has also focused minds — notably with the release of a 150 MHz wide chunk of the 3.5 GHz CBRS band (3550 MHz to 3700 MHz) in the US, the issue of 100MHz between the 3.7 GHz and 3.8 GHz bands for localised industrial usage in Germany, and, most recently, with the UK offering the 3.8-4.2 GHz band for localised private and share networking deployments.

Wegmann comments: “It’s clear in Germany we can use [dedicated] frequency for industrial applications with a high quality of service. We’re happy about that, not only because we have advocated this policy but also because Industrial 5G will enable us to completely connect industry for the first time.”

Sander Rotmensen, head of product management for wireless industrial communication at Siemens, also quoted in the blog post, says: “It makes sense to give industrial companies direct access to these frequencies. After all, we are the ones who know the requirements of our plants best of all – and we can therefore optimise the network in line with our specific applications.”

Siemens notes eye-popping benchmarks for 5G in terms of performance metrics: one million connected units per square kilometre, a transmission rate of up to 20 gigabits per second, and a reaction time of only a few milliseconds, it says. “These numbers speak for themselves,” remarks Wegmann.

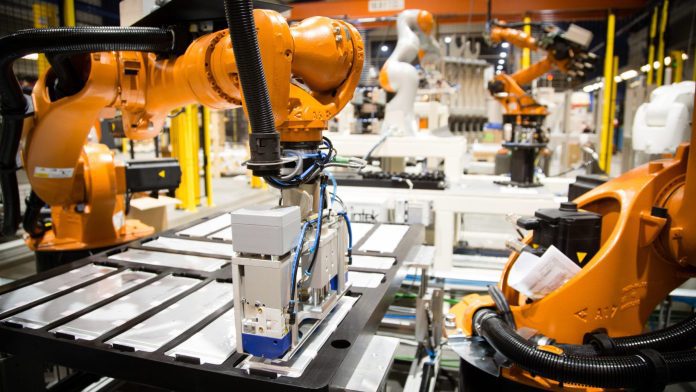

They translate into practical functionality: 5G means robot arms will stop instantly if cameras identify a foreign object on a conveyor; the potential of augmented reality will be brought to bear in factory environments, marking a “new stage of interaction between human beings and machines”.

Wegmann says: “Not until now, with the advent of industrial 5G, has it been possible for us to completely connect industrial companies…. What impresses me most is the things industrial 5G will make possible. It can be used to develop completely new and flexible factory concepts. Companies will be able to dynamically adapt their production areas to current circumstances at any time, without having to make major changes to infrastructure.”

At Ericsson, Allgood says momentum is building for industrial 5G and cellular IoT, at large, but will spiral upwards in the next years. “IoT is here now. With mobile data traffic up 82 per cent year-on-year and 5G uptake going even faster than anticipated, we can expect cellular IoT connections to follow suit. Today there are one billion cellular IoT connections in play. Five years from now, that number will triple to more than four billion.”

She adds: “But questions remain. How do we move from wired to wireless networks to capture the promise of trillions of dollars in value that industrial IoT will bring? We need history to repeat itself — from connecting people on the move with mobile phones to connecting mobile industrial devices and machines with wireless networks.

Ericsson calls for collaboration between technologists and industrialists, and shared focus on the functional aspects of use cases, rather than the technical prowess of the solutions.

She cites a public safety project, from “years ago”, where the various stakeholders “weren’t speaking the same language” — and definitions of ‘the edge’ variously included the analytics at the network operations centre, the compute functionality on the drone, and the transport and compression capabilities in the networking gear.

“Speak a common language focused on results, not technology. Avoid technobabble, 3GPP jargon or exabyte-speak. Understand what people, typically IT and OT professionals, need. Then it’s easy to advance IoT,” she concludes.

Siemens, which has been faltering on the subject before, mindful of the political aspect of Germany’s approach to releasing spectrum for industry, is more focused on the dream of industrial 5G.

“5G is designed to be a wireless network that can unify everything, from automated shelving systems to production robots, air-conditioning systems, and control consoles. It will be a comprehensive network that will make it possible to control an industrial plant without any cables. It will be robust and either ultra-fast or equipped with a comfortable bandwidth,” it writes.

Rotmensen says: “The opportunities are immense. Imagine a plant complex in which an autonomous vehicle fleet transports goods, spare parts or finished products between delivery ramps, factory halls and warehouses back and forth with timing that is precisely adapted to the production schedule. All of this will be made possible by Industrial 5G.”