Note this is a serialised version of an editorial report, called LPWA connectivity in IoT – who is winning what?’. It is continued from a previous instalment, which can be found here. The full report, including additional content, is available for download here.

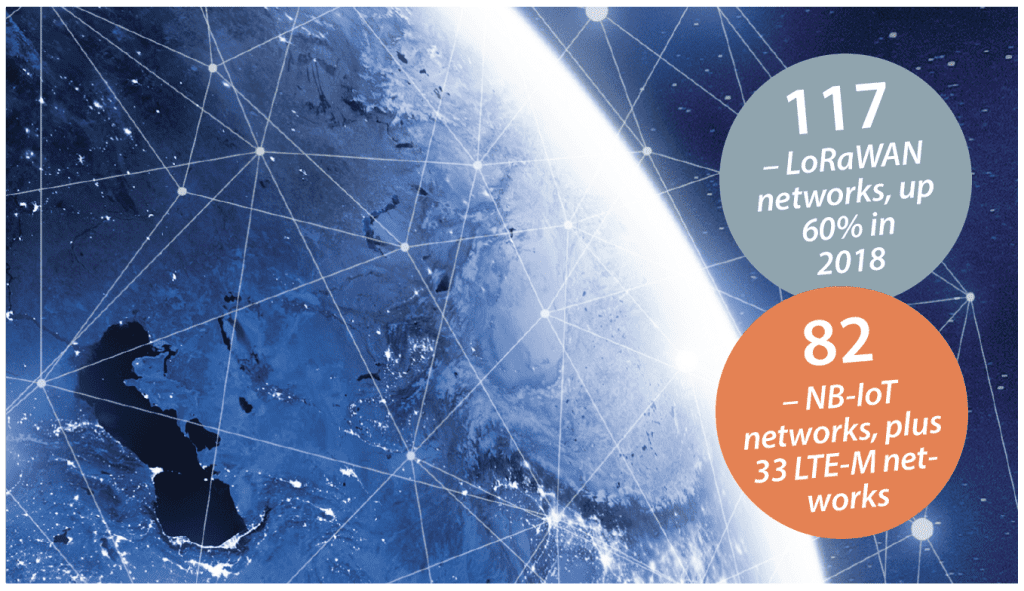

Let’s take another look at the numbers, as a way further into this question of coverage. The LoRa Alliance, which pedals a line about LoRaWAN as the “de facto standard for LPWA networks”, claims the number of LoRaWAN networks jumped 60 per cent in 2018 to 117 in 56 countries. It claims the figure excludes private deployments.

As reference, the GSMA counted 82 NB-IoT networks and 33 LTE-M launches as of May 2019, with 22 operators running both technologies in tandem. (Huawei, it may be noted, has its own count – see pages 14-15.) More will be switched on, matching existing cellular coverage in each territory in an instant.

But LoRaWAN is extending at pace, too. Semtech – which licenses LoRa chips for LoRaWAN networks – claims LoRa countries climbed by 40 per cent, from 50 to 70, in the first quarter, alone. The LoRa contingent in the blue corner has its tail up, clearly.

Cumulative shipments of LoRa end-nodes reached 87 million at the end of the 2018/19, says Semtech, from 50 million a year ago, a jump of 37 million in the period – and a 54 per cent advance on ABI’s late-2018 count (24 million), and a 63 per cent reverse on IHS’s 2019 forecast (98.16 million). Semtech predicts it will ship another 53 million LoRa-connected units in 2019/20.

Sigfox comes out punching, at last. “The LoRa community is fantastic. But it’s disparate and disjointed – it’s more of a hobbyist thing,” says Harris. Ouch. He goes on: “It makes it hard to deliver national coverage. Operators can open their networks, but there are differences between them. Yes, it encourages a larger ecosystem. But Sigfox offers simplicity – the connectivity is just there.”

Moore, with the LoRa Alliance, counters. “We are successful precisely because of our ecosystem. I mean, IoT is complicated – it takes a global network of partners to come together, from the chip to the solution,” she says. It’s not just for bedsit developers; major industrial and internet players are involved, including ABB, Alibaba, Comcast, Cisco, Schneider Electric, and Tencent.

A number of cellular operators are involved, too. Orange, KPN, Proximus, and Softbank are offering LoRaWAN. Water company Veolia is connecting no fewer than three million water meters to Orange’s public LoRaWAN network in France – Sigfox’s home country. “It’s hard to be a global de facto standard just with start-ups,” says Moore. “You need the big companies as well to knock open the doors.”

It may be a global standard, but roaming is a challenge on LoRaWAN, as Harris suggests, except where operators have deployed common hardware, as between Orange, KPN, and Proximus, which use the same radio gear from Actility. “It is a challenge, otherwisedevices moving from one place to another might go out of coverage. We’re seeing more campus deployments,” says Krishnan.

Hebbelynck at Proximus says roaming will be enabled through the LoRa Alliance quickly enough, but that most applications do not seek to go abroad. “We’re talking about setting up with neighbouring countries. That will happen quickly, but most use cases today are national. There is not much demand for trans-border roaming.”

BORDER CROSSINGS

For its part, Sigfox rates itself as a “borderless technology” (and a way to solve the Irish border question in the Brexit crisis, perhaps?) with downloadable radio software and a centralised billing system, which does not require roaming agreements like between cellular operators or infrastructure alignment like between LoRaWAN networks.

But even with availability in 63 countries on five continents, it is missing certain territories completely, in the shape of China, India, and Russia. “The objective is to be in those markets by the middle of next year (2020). Today, we are on track against plan,” responds Laetitia Jay, chief marketing officer at Sigfox.

The French firm will likely go with a country operator in these markets, as it has done everywhere so far except France, Germany, Spain, and the US. It is looking for better balance in its makeup, which is still inclined towards Europe. It has struggled in the US, notably, where “states are like countries”, and it has been forced to take a more tactical approach to securing cell sites and coverage.

WND, the biggest Sigfox operator, will not appear for it in China, India, and Russia, it says. “They’re too big, too remote for us.” But it might lend advice on how to rollout an LPWA network. Its UK network has achieved about 90 per cent population coverage, with 2,000-odd base stations, in two years. “We have in place the only credible nationwide LPWA network in the UK,” says Harris.

“The first priority is to build the network – you can’t sell coverage without it. You need a credible network – and 50 per cent coverage does not make a credible network. But if you’ve got over 90 per cent – well, let’s be honest, the mobile boys haven’t got that. They’re launching 5G, they say they’ve got 4G, they haven’t even got 3G in lots of places.”

A guerilla-style approach to network building is required, he says. “LPWA is not like telecoms. You can’t have the same mentality; otherwise you’re dead in the water. We haven’t got expensive licenses, we can’t afford expensive towers. The back-end costs are minimal – and have to be. We’re only offering 12 bytes per message, so the front-end charges are peanuts.”

The only way to build is with huge volumes of connections, and Sigfox has set its stall out. It claims 6.7 million active devices in the field (“not counting proofs of concept, just commercial rollouts in diverse industries”), and has an ambitious (bonkers, surely?) target of one billion connections by 2023, under the strategy-moniker ‘1B23’.

A billion, by 2023? Really?

This article is continued here. A full version of the editorial report, including additional content, is available for download here.