Qualcomm President Cristiano Amon gave a keynote presentation at the IFA consumer electronics show in Berlin today, laying out the company’s ongoing 5G strategy, which is focused on driving access to 5G devices and opening up potentially lucrative new use cases like 5G fixed wireless as an alternative to wired home broadband.

Right now 5G, for the most part, is limited to parts of major metropolitan areas; this is especially true for operators like AT&T and Verizon taking a millimeter wave-first approach. But 2020 will be a big year for scaling out those networks with the aforementioned operators both working toward nationwide coverage sometime next year. To make that work, operators will tap dynamic spectrum sharing to essentially operate 5G and LTE in the same band at the same time without re-farming spectrum.

On the device side, Qualcomm’s Snapdragon 855 mobile platform, which supports dynamic spectrum sharing, powers most all in-market 5G devices, including the Samsung Galaxy Note 10+ 5G, OnePlus 7 Pro 5G and OPPO Reno 5G–all premium tier devices.

How to scale 5G?

The first wave of 5G devices actually beat the availability of networks, Amon pointed out in his presentation. As service providers look to scale out, “We need to enable the operators to have that ecosystem ready so you can start providing new devices with dynamic spectrum sharing… We want all the users to have the benefit of this technology.”

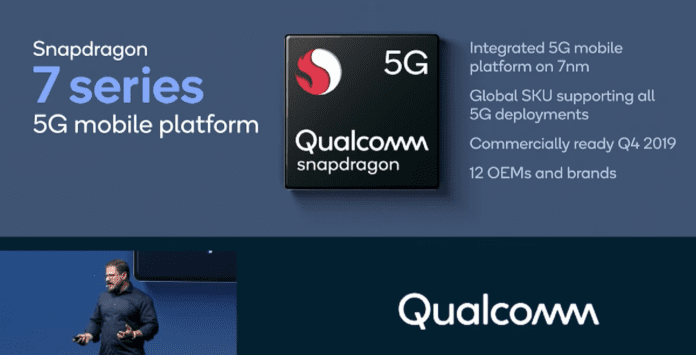

To make that possible, Amon announced Qualcomm would bring its portfolio of 5G mobile platforms out of just the 8-series and into the 7- and 6-series in 2020. Amon said a dozen OEMs were already onboard. with the 5G-enabled 7-series. “We are going to bring 5G to scale with our many partners.”

Anshel Sag, an analyst with Moor Insights, explained in a tweet why this is important: “This is a big deal because it means smartphones of all price points will get 5G next year, not just premium phones. This will also help to accelerate 5G device sales significantly because the 600 and 700 series are very popular in devices that ship to India and China.”

Qualcomm’s Dean Brenner, vice president of spectrum strategy and technology policy, in an August interview with RCR Wireless News, said dynamic spectrum sharing “accelerates and expands the 5G roll out instantly because we don’t have to do re-farming. We can immediately get 5G deployed into the legacy 4G bands.”

He said the non-standalone mode of 5G is the consensus route to initial launch but that maximum efficiency and performance comes with standalone. “DSS is a very important bridge to get there. DSS is pushing 5G coverage out as expansively as possible. So that means when the 5G core is launched, you’re already going to have this very, very broad 5G coverage. If you didn’t have DSS you have kind of two problems–you have to get to the 5G standalone core but you also have to get 5G built out.”

5G for fixed wireless access

Executives with Verizon and AT&T have both discussed 5G fixed wireless access as a way to expand their reaches into the home broadband market while realizing a capex efficiency by reusing mobile sites for fixed services and vice versa. In fact, Verizon went to market with a fixed 5G service in October last year, although that was based on an internally-developed specification. Verizon’s 5G Home is available in four markets.

CEO Hans Vestberg has said 5G Home was initially limited due to the lack of availability of 3GPP-based consumer premise equipment. Once the device-side catches up, he has said Verizon would re-launch 5G Home. Per Amon’s IFA keynote, the device side has not only caught up but taken things to the next level.

During his presentation, Amon announced a new millimeter wave antenna module, the QTM527, for the Snapdragon X55 Modem-RF System and optimized to support fixed wireless access. The company touted the “extended-range” capabilities.

Ahead of the IFA announcement in a pre-brief with media, Qualcomm’s Mohammed Al Khairy, a senior product marketing manager, said the company ran trials to study millimeter wave propagation in three distinct deployment scenarios:

- In a rural/suburban environment, the company connected over 1.7 kilometers from the radio to the CPE;

- In a dense urban environment, Qualcomm saw a range of 1.1 kilometers;

- And when using fixed 5G to provide backhaul to a high-rise, Al Khairy said CPEs can be mounted in windows to deliver “a very feasible use case.”

Amon identified the questions and the answer: “How can we bring 5G to more places?” Amon asked. “How can we use wireless to connect the unconnected? Can 5G help us you know deliver that? We’re now solving the problem of millimeter wave for fixed wireless. It’s going to enable…an alternative to fiber in suburban, rural and dense urban areas.”