Greetings from the Queen City, where the IT scene is red hot even though cooler fall temperatures have finally arrived. I was pleased to be the guest of San Mateo-based Aryaka Networks at the 2019 Orbie (CIO of the Year) awards on Friday. It was great to catch up with many folks in attendance including Karen Freitag (pictured), a Sprint Wholesale alum and the Chief Revenue Officer at Aryaka.

Greetings from the Queen City, where the IT scene is red hot even though cooler fall temperatures have finally arrived. I was pleased to be the guest of San Mateo-based Aryaka Networks at the 2019 Orbie (CIO of the Year) awards on Friday. It was great to catch up with many folks in attendance including Karen Freitag (pictured), a Sprint Wholesale alum and the Chief Revenue Officer at Aryaka.

This week, we will dive into drivers of wireline earnings. At the end of this week’s TSB, we will comment on several previous briefs (including the AT&T Elliott Memo fallout) in a new standing section called “TSB Follow Ups.” We close this week’s TSB with a special opportunity for reader participation.

Wireline earnings: Enterprise, expense management and extinction

One of my favorite things to write about in the TSB is wireline – that forgotten side of telecom and infrastructure that serves as the foundation for nearly all wireless services. Wireline is a case study in competition, regulation, cannibalization, innovation, and a few other “-tions” that you can fill in as we explore the following dynamics:

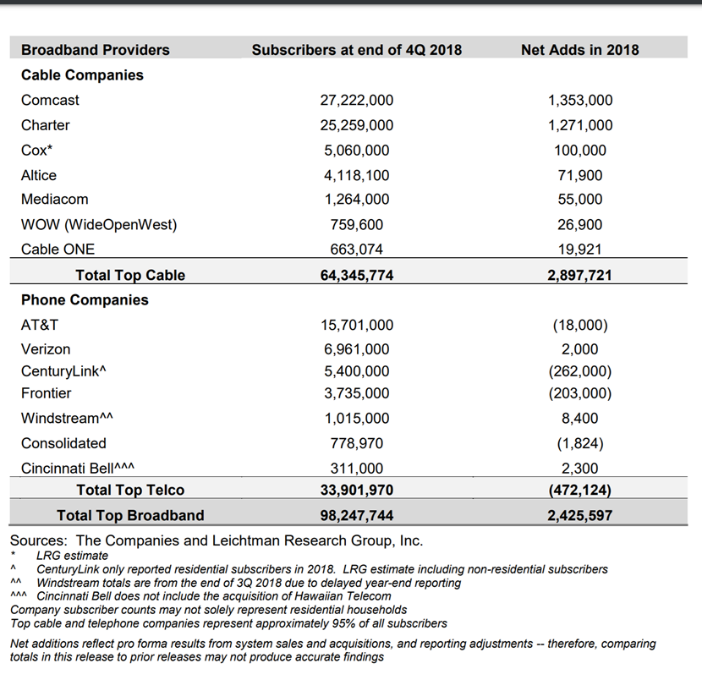

- Residential broadband market share (measured by net additions). Before the Sunday Brief went off the air in June 2016, cable was taking more than 100% share of net additions. This means that customers were leaving incumbent telco DSL (and possibly FiOS) faster than new customers were signing up. At the end of 2018, cable continued its dominance with 2.9 million net adds compared to 400 thousand net losses for telcos (see nearby chart. Source is Leichtman Research – their news release is here). If this trend holds through the end of the month, it will mark 18 straight quarters where cable has accounted for more than 95% of net additions (Source: MoffettNathanson research).

To be fair to the telcos, all of 2018’s losses can be attributed to two carriers: CenturyLink and Frontier. We have been through the Frontier debacle twice in the last three months and will not retrace our steps in this week’s TSB (read up on it here).

But CenturyLink is a different story, with losses coming in areas like Phoenix (where Cox is lower priced), Las Vegas (Cox lower priced except for 1Gbps tier), and legacy US West areas like Denver/ Minneapolis/ Seattle/ Portland (Comcast has lower promotional pricing). Even as new movers are considering traditional SVOD alternatives like Roku and AppleTV in droves, there’s a perception that the new CenturyLink fiber product is not worth the extra cost.

A good example of the perception vs reality dichotomy comes from the latest J.D. Power rankings for the South Region:

While these ratings reflect overall satisfaction with the Internet service, it’s very hard for new products to overcome old product overhang (and DSL experiences can create long memories).

But superior customer satisfaction (749 is a decent score for telecom or wireless providers regardless of product) does not guarantee market share gains. AT&T (Bell South) has continued to improve its fiber footprint, invested heavily in retail presence, and improved the (self-install) service delivery experience. Even with that, it’s highly likely that AT&T’s South region lost market share to Comcast (2nd place) and Spectrum (4th place). Why is a three-circle product outperforming a five-circle product?

The answer lies in several factors: Value (see comments above about promotional pricing and go to www.broadband.now for additional information), Bundled products (which links back to value – bundle cost may be significantly cheaper), and Legacy perceptions (DSL overhang mentioned above, tech support overhang, install overhang).

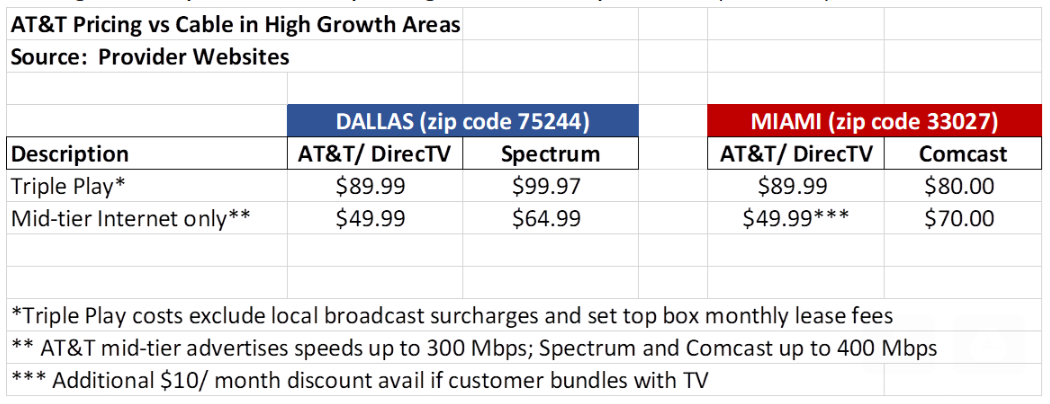

For more details, let’s look at two very fast-growing areas: Dallas, TX and Hollywood (Miami), FL. Nearby is a chart showing online promotional pricing for AT&T, Spectrum (Charter) and omcast. There are some differences on contract term (AT&T has contracts in Dallas; Spectrum does not. Comcast has a 2-yr term with early termination fees to get the $80/ mo. rate for their triple play in Miami). Both zip codes selected above have over 50% served by AT&T fiber. AT&T is more competitively priced than Spectrum in Dallas, and extremely competitive with Comcast especially at the mid-tier Internet only level (promotional rate gigabit speeds are $70/ month with no data caps).

With superior overall customer satisfaction and competitive pricing, why does AT&T continue to tread water on broadband and lose TV customers? Are cable companies out-marketing Ma Bell? Is there a previous AT&T experience overhang? Are AT&T retail stores creating differentiation for AT&T Fiber (compared to minimal showcase store presence for Spectrum or Comcast)?

Bottom line: Cable will still win a majority of net adds despite lower customer satisfaction and higher prices. Why AT&T cannot beat cable especially in new home (AT&T fiber) construction areas is a function of marketing, operations and brand mismanagement.

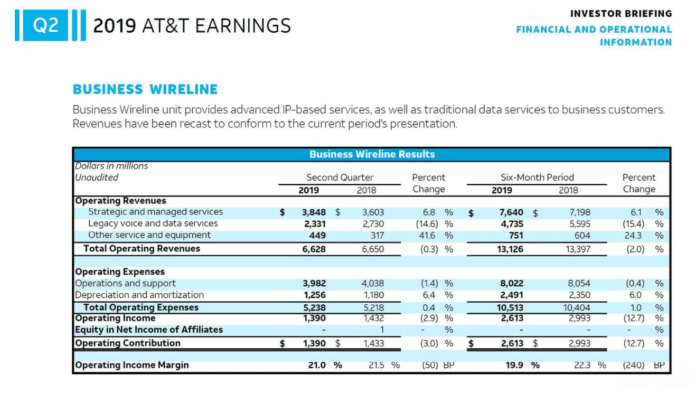

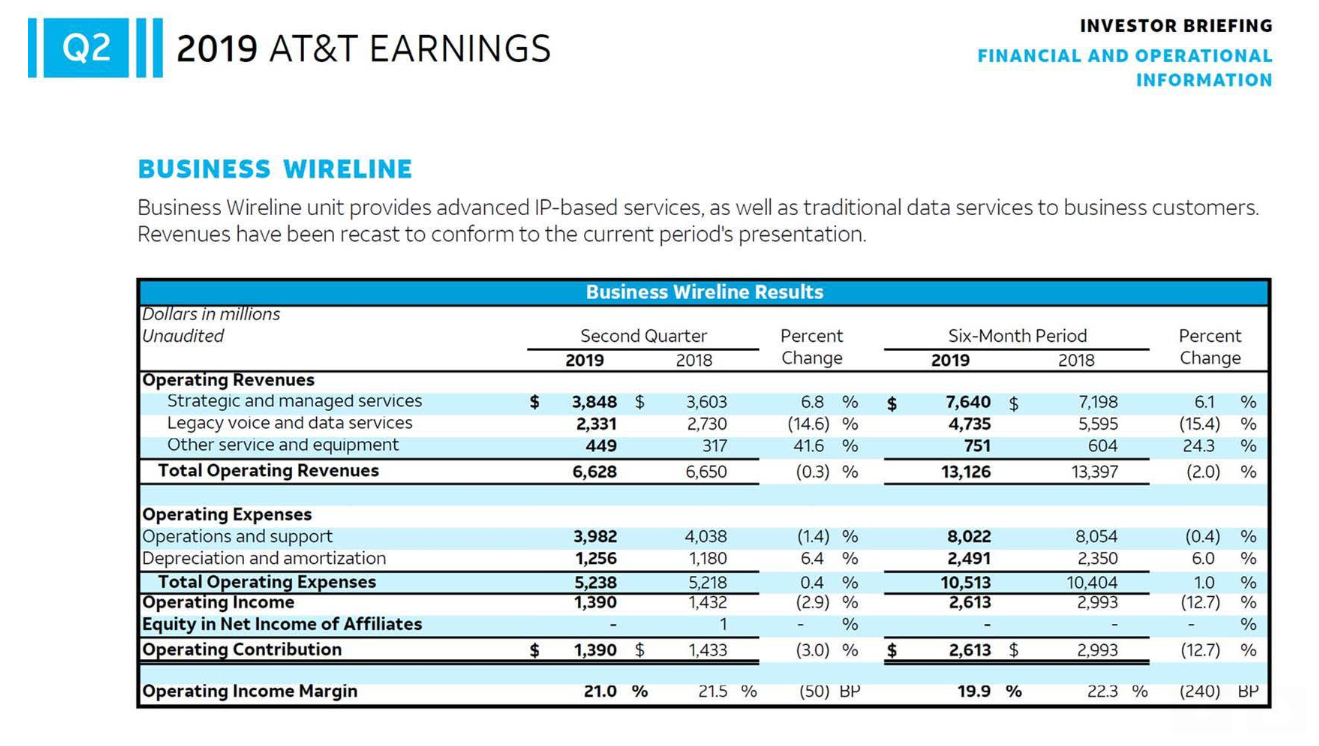

2.Enterprise spending – Did it return to cable instead of AT&T/ Verizon/CenturyLink? We commented last week on AT&T’s expected gains in wireless enterprise spending thanks to the FirstNet deal. How that translates into wireline gains is an entirely different story. Here’s the AT&T Business Wireline picture through 2Q 2019:

While these trends are not as robust as wireless and operating income includes a $150 million intellectual property settlement, AT&T management described Business Wireline operating metrics as “the best they have seen in years.” What this likely indicates is that AT&T’s legacy voice and data service revenue losses (high margin) are beginning to decelerate (at 14.6% annual decline, that’s saying a lot – Q1 2019 decline was 19.2% and the 2Q 2017 to 2Q 2018 decline was 22.0%!).

Meanwhile, Comcast Business grew 2Q 2019 revenues by 9.8% year over year and is now running an $8 billion run rate (still a fraction of AT&T Business Wireline’s $26.5 billion run rate but a significant change from Comcast’s run rate in 2Q 2016 of $5.4 billion). Spectrum Business is also seeing good annualized growth of 4.7% and achieved a $6.5 billion annualized revenue run rate. Altice Business grew 6.5% and is now over a $1.4 billion annualized revenue run rate. Including Cox, Mediacom, CableOne and others, it’s safe to say that cable’s small and medium business run rate is close to $13 billion (assuming 33% of total business revenues come from enterprise or wholesale). That leaves a consolidated enterprise and wholesale revenue stream of ~ $5.5 billion which is more than twice Zayo’s current ARR.

The business services divisions of cable companies are repeating the success of their residential brethren. They are aggressively pricing business services, using their programming scale to grab triple play products in selected segments such as food and beverage establishments and retail/ professional offices. And, as Tom Rutledge indicated in last week’s Bank of America Communacopia conference, they are starting to sign up small business customers for wireless as well. I would not want to be selling for Frontier, CenturyLink or Windstream in an environment where cable had favorable wireless pricing and the ability to use growing cash flows to build a competitive overlay network.

Enterprise and wholesale gains are important for several reasons. In major metropolitan areas, segment expansion gets cable out of the first floor (think in-building deli or coffee shop) and on to the 21st floor. To be able to get there, cable needed to have a more robust offering. Comcast bought Cincinnati-based Contingent services in 2015, and Spectrum also improved its large business offerings. They are not fully ready to go toe-to-toe with Verizon and AT&T yet, but with some help from the new T-Mobile (all kidding and previous John Legere lambasting aside, a new T-Mobile + cable business JV would make perfect sense), things could get very difficult for the incumbents.

Moving up in the building is important, but there’s another reason to expand from the coffee shop: CBRS (if you are new to TSB, the link to the “Share and Share Alike” column is here). Given that 2-3 Gigabytes/ subscriber of licensed spectrum (non-Wi-Fi) capacity are consumed within commercial offices per month, there’s a ready case for MVNO cost savings as Comcast, Altice, and Spectrum Mobile continue to grow their wireless subscriber bases.

Further, since many enterprises are going to be introduced to LTE Private Networks soon, there’s a threat that Verizon and AT&T (and Sprint if the T-Mobile merger closes) stop provisioning cable last mile access out of their regions and only provision wireless access. As we have discussed in this column previously, the single greatest benefit of 5G LTE networks is the ability to control the service equation on an end-to-end basis for branch/franchise locations. It represents a compelling reason to move to SD-WAN, and allows cable to deepen its fiber reach and build more CBRS (and future spectrum) coverage.

Bottom line: Cable continues to grab share in small, medium, and enterprise business segments as they move from connecting to the building to wirelessly enabling each building. CBRS presents a very good opportunity to do that. Even with cable’s entre into the enterprise segment, it will still be dominated by AT&T (with Microsoft and IBM as partners) and Verizon for years to come.

- Expense Management and Productivity Improvement. Flat to slowly declining operating costs in an environment where revenues are declining more precipitously is a recipe for increased losses. Even with some of the capital and operating expense being shared with 5G/ One Fiber initiatives, the reality is that lower market share is leading to diseconomies of scale and both are going up a cost curve right now.

That’s why reducing operating expenses is not a spreadsheet exercise – operating in a territory originally engineered for 80-90% market share that is now at 30-40% share requires increased efficiency. Connecting to neighborhoods is hard and connecting through neighborhoods to individual homes is even harder. Combine this with a change in technology (fiber vs twisted copper) ratchets the degree of difficulty ever higher.

One of the great opportunities for all communications providers is using increased computing (big data) capabilities to quickly troubleshoot issues and recommend remedies. For example, customers who go online or contact care and are “day of install” should have a different customer service page than someone who has been a 4-month regular paying customer or a 2+ year customer who is shopping around.

There’s no doubt that the online environment has been improved for every telco, and also no doubt that many more issues in the local service environment require physical inspection and troubleshooting. But when telcos move to correctly predicting customer needs through online help 95+% of the time, the call center agent will go the way of the bank teller and the gas pumper: Convenience and correct diagnosis will trump in-person service.

For those of you who are regular followers of TSB and read last week’s column, there’s also the issue of territory dispersion. Without retreading the information discussed last week, one has to ask if there are trades to be made in the telco world (or spinoffs) that make sense to do immediately (Wilmington, North Carolina, a legacy Bell South and current AT&T property would be a good example using last week’s map).

Bottom line: There won’t be any dramatic changes to the wireline trends – yet. But, as 5G connectivity replaces cable modems and legacy DSL (particularly to branch locations) and as cable expands its fiber footprint to include in-building and near-building wireless solutions (starting with CBRS), the landscape will change. And there will be a lot of stranded line extensions if wireless efforts are successful.

TSB Follow-Ups

- Randall Stephenson met with Elliott Management this week, according to the Wall Street Journal. At an analyst conference prior to the meeting, Stephenson offered somewhat of a hat tip to Elliott Management, saying “These are smart guys.” The AT&T CEO also stuck by his decision to move John Stankey into the COO role, noting “if you’re going to go find somebody who can do both, right, take a media company that has transitioned to a digital distribution company and pairing it with the distribution of a major communication company, and you want to try to bring these two closer and closer together and monetize the advertising revenues, all of a sudden, that list gets really, really short.” If Elliott’s decision to go public with its criticism is based on the Stankey announcement, I wonder how that logic was received in New York last Tuesday.

- Apple iOS 13 fails again, this time failing to display the “Verified Caller” STIR/SHAKEN (robocall identifier standards) on Apple devices until after the called party has answered. Kind of defeats the point, right? More in this short but sweet article from Chaim Gartenberg at The Verge – we agree with the T-Mobile quote in the article “I sure hope they get this fixed soon.” Don’t hold your breath, as Apple is running on its 12th year of not allowing developers to access the incoming phone number.

- The Light Reading folks have a very good chronicle of what’s going on with CBRS trials here.

Sharing can work, but it takes a lot to do it. The value has to be clearly present to increase carrier attention and participation.

- Eutelsat can’t seem to make up its mind. On September 3, they dropped out of the C-Band Consortium (Bloomberg article here) and last week they seemed to backpedal based on this FCC memo. Time for Commissioner Pai to save the day!

Next week, we will cover some additional earnings drivers. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list.

One last request – we are currently on the hunt for some of your favorite titles that chronicle telecom/ tech history. No title is off limits. Currently, we have three that have made the cut:

- The Deal of the Century: The Breakup of AT&T by Steve Coll (1986)

- The Master Switch: The Rise and Fall of Information Empires by Tim Wu (2010)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World’s Most Important Company by Michael S. Malone (2014)

Have a terrific week… and GO CHIEFS!