Greetings from our nation’s capital (now home to the World Series champion Washington Nationals) and Lake Norman, NC. This was a very busy week for earnings with Apple, AT&T and T-Mobile all announcing earnings. We are going to start with AT&T given their 3-year guidance but will also devote time to both Apple and T-Mobile earnings.

Given the level of earnings-related news, we will not have a TSB Follow-Ups section this week but will resume this section in an upcoming Brief. First up – AT&T.

AT&T’s multiple headlines: Legacy bottom within sight, new wireless pricing plans, fiber penetration coming, and renewed reseller focus

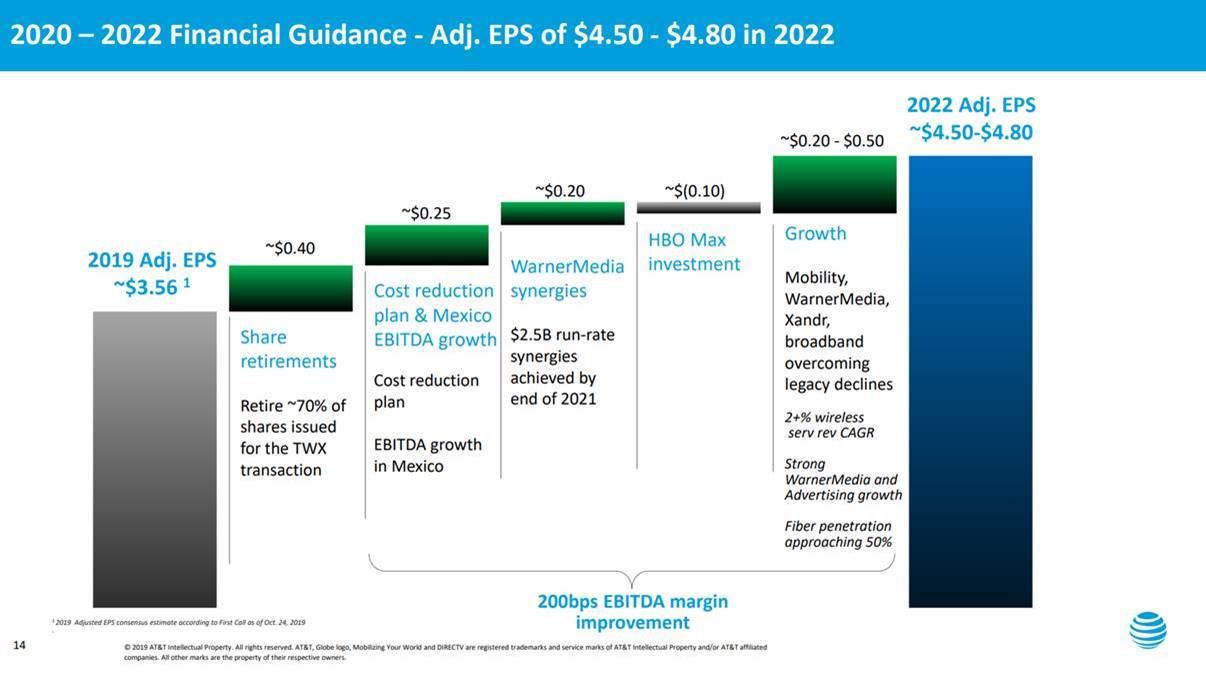

AT&T led this week’s earnings with a detailed assessment and lengthy earnings call hosted by CEO Randall Stephenson and CFO John Stevens. At the end of the earnings presentation, they showed the following waterfall chart outlining how they would improve earnings per share:

There are many important things to note in this slide. First, the 2.0% (200 basis point) improvement in overall margins. AT&T’s reported 3Q EBITDA was ~ $15.4 billion when you exclude Puerto Rico operations (entire PR and US Virgin Islands P&L is held in Corporate & Other) on a base of $44.6 billion in 3Q operating revenues (34.5% EBITDA margin).

To improve 200 basis points, AT&T will need to remove ~$890 million in quarterly costs or about 5.5-6.0% of their total expense base across the corporation AND replace each lost dollar of EBITDA (e.g., from premium video or DSL or legacy business voice) with a dollar of EBITDA from new sources (higher value-added fiber subscribers, mobility ARPU increases from service upgrades, higher revenues from smartphone insurance).

On top of this, AT&T will need to cut an additional $350 million in quarterly costs ($1.4 billion annually) to cover the HBO Max investment (which will not significantly impact revenues and EBITDA until early 2Q 2020). Roughly speaking, the operating expense net improvement will need to be ~$1.24 billion per quarter or about $5 billion per year (again, some of this improvement may come from the differential between higher new product and lower legacy product margin differentials, as we will explain below with fiber).

Highlighted throughout the earnings call was the need to penetrate more households with fiber. On the residential side (small business and enterprise were not reported), AT&T ended 3Q with 3.7 million fiber customers on a total base of 20 million fiber homes and businesses passed. This equates to a 19% penetration. Assuming 10% of the 20 million represent business locations passed, the residential penetration rate comes out at 21%, within the 20-25% range mentioned by Randall Stephenson on the earnings call.

Assuming the fiber penetration in the chart above is achievable, AT&T is targeting growing the 3.7 million base to ~ 9 million (on an 18 million homes passed with fiber base) over the 2020-2022 period. An incremental 5.3 million broadband customers (at a $55 ARPU – 10% higher than current) represents 440,000 net additions every quarter for the next 12 quarters and would generate $3.5 billion in incremental annual revenues and $1.8-2.0 billion in annual incremental EBITDA by the end of 2022. Bottom line: Increased fiber penetration to homes is a big part of AT&T’s profitability improvement plan.

To put this in context, Comcast’s rolling four quarter High Speed Internet additions quarterly average is 304,000 and Charter’s metric is around 350,000. Assuming that Comcast and Charter are ~100% share of decisions (including DSL migrations), the 440,000 net additions figure assumes that AT&T reverses that trend nearly overnight AND take some legacy share from cable (!). All this in light of the DOCSIS 4.0 rollout of cable to multi-Gigabit speeds at very low incremental capex costs.

To reemphasize, AT&T’s average growth in the fiber base (much of it from fiber-fed DSL, also called IP broadband) over the last several quarters has been between 300,000-320,000. Assuming growth comes from net new growth (not DSL conversions), the operation will need to grow 30-40% overnight.

More to come here, as we have assumed a 10% premium and cable is either matching or 10% lower than AT&T pricing, and we have not begun to talk about T-Mobile’s plan to acquire wireless high speed data customers using their combined spectrum holdings. Bottom line: There’s little reason to believe that AT&T will be able to materially move the share of decisions needle and grow 20-30% market share points in Los Angeles (Charter), Dallas (Charter), Chicago (Comcast), Atlanta (Comcast), or Miami (Comcast) at a market premium in light of T-Mobile’s (and others) market entry. As a duopoly, it’s a stretch – with three or four players, it’s a pipe dream.

Another source of growth mentioned on the call was Reseller. As we noted in other blog posts, Reseller losses were almost perfectly offset by Cricket (Prepaid) gains. As AT&T explained on the call, this was largely by design due to spectrum capacity constraints. Asked in the earnings call Q&A whether AT&T would consider an MVNO relationship with cable, Randall Stephenson replied:

Yes. We would actually be open to that. So you should assume that, that’s something we’d be open to. And not just cable guys, but there are a number of people in the reseller space that are reaching out. And it’s just as John said, we got a lot of capacity now in this network, and we’re at the point of evolution in this industry where we ask, how do you monetize most efficiently, capacity? And so we’re going to look at all those channels.

As we discussed in last week’s TSB, the cable operators want more call control. Would AT&T really offer that? At what cost? At what margin? Could Altice convert their new T-Mobile core + AT&T roaming relationship into a true wireless least cost route mechanism which would only use AT&T in areas where their own (CBRS, C-Band, other) network and new T-Mobile could not reach?

This was a surprising comment to say the least. AT&T has not courted large wholesale customers since Tracfone in 2009. A simple glance of the Wikipedia AT&T MVNO list includes a number of smaller players as well as AT&T-primary providers such as Consumer Cellular, PureTalk USA, and h2o. It’s very hard to imagine a major MVNO play that would not harm Cricket (which grew 700,000 net additions over the last four quarters) or the core business.

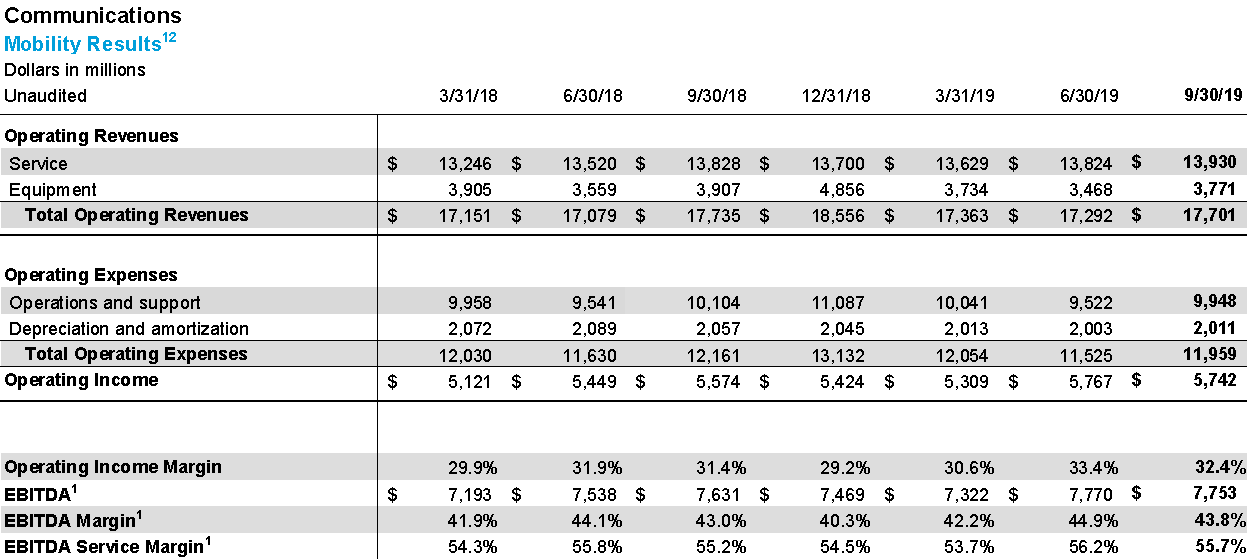

Lastly, the mobility business, even in the “golden era” of relative price stability, video compression, and low device upgrades, did not improve adjusted earnings much in Q3. Here’s their income statement:

Unlike Verizon, who still has a large base of traditional subsidy-oriented plans (for every dollar of equipment revenue, Verizon has $1.06 in equipment costs) AT&T has minor if any equipment subsidies. The implication is that for every dollar in reduced equipment revenues, operations and support costs should decrease a dollar. This did not happen on a sequential basis (equipment costs +$303 million, operations costs +$426 million) and the 3Q to 3Q reduction is negligible (equipment revenues down $136 million, costs down $156 million). If incremental scale is driving incremental profitability, it’s being offset by other spending.

Embedded in these numbers is FirstNet, now with close to 900,000 connections across 9,800 agencies per the most recent Investor Handbook. In the second quarter, the same figures were “over 700,000” connections. Given our understanding of the public space, let’s assume this translates into 175,000 net additions from FirstNet in 3Q with 125,000 (70%) of these coming from phones. Bottom Line: AT&T reported 101,000 postpaid phone net adds in the quarter, and without FirstNet, it’s very likely they would have been negative.

Bottom line: AT&T continues to integrate into an end-to-end premium content and network communications provider. They made a big three-year earnings promise that depends on new and different execution (particularly broadband growth and reseller market penetration) that has not been seen from AT&T in decades. We are confident that AT&T can cut costs but equally skeptical that they can grow share.

Apple Card launches, and 0% a.p.r financing is announced. The first impact is device financing.

On Wednesday, the Cupertino hardware (and now services) giant announced strong, broad, and expectations-beating earnings. iPhone sales, while down 9% from last year’s quarter, were still strong and Apple CEO Tim Cook gave very bullish guidance on this quarter’s device sales. In this light, Apple announced that trade-in volumes were more than 5x greater than they were a year ago (recall that Apple highlighted lower monthly payments and device values with trade-in starting with last September’s announcement. The 5x figure is therefore based on a few weeks – this figure could be much higher after a full quarter is measured).

The big announcement came through Tim Cook’s discussion of Apple Card performance:

… I am very pleased to announce today that later this year, we are adding another great feature to Apple Card. Customers will be able to purchase their new iPhone and pay for it over it over 24 months with zero interest. And they will continue to enjoy all the benefits of Apple Card, including 3% cash back on the total cost of their iPhone with absolutely no fees and the ability to simply manage their payments right in the Apple Wallet app on iPhone. We think these features appeal broadly to all iPhone customers, and we believe this has been the most successful launch of a credit card in United States ever.

A customer purchasing an iPhone 11 (64 GB) with their Apple Card would pay $21 less using this plan than purchasing through Verizon or AT&T (T-Mobile offers the 3% cash back Apple Card feature) or $28.25 per month prior to trade-in. This represents a $71 reduction ($2.96/ month) from what a customer would have paid for the iPhone XR (64 GB) in 2018 and produces an optically significant sub-$30/ month price point.

On top of this, Apple is offering slightly better than average trade-ins per our comments with analysts who follow store activity (hence the 5x increase described earlier). If customers believe that using Apple directly delivers a better financial outcome, they will go direct.

The 0% a.p.r, 24-month term mirrors the offer Best Buy currently gives to their My Best Buy Visa Credit Card customers (more on that offer here). While unlocked Android devices are currently covered (including the Samsung Galaxy S10 and Note 10), it remains to be seen if/ how the interest-free offer might be extended to Best Buy.

As we have discussed in previous Sunday Briefs, Best Buy and Apple recently extended their service relationship (more on that here), and Apple announced that their Authorized Service Provider locations had grown to over 5,000 globally. Extending this relationship into financing is not a slam dunk, especially given the current success Apple experienced last quarter without Best Buy, but the option exists to tie Apple Card promotions to Best Buy distribution. If this were to happen, the wireless carriers would need to demonstrate more value (financial, bundling, services) than both Apple and Best Buy.

As Apple disclosed on the call, this was the best quarter for Apple Care revenues on record. As was also disclosed on the AT&T and Verizon calls, device protection was a driver for their wireless service ARPUs in the quarter. This business is profitable to the carriers ($5-7/ mo. in incremental EBITDA for every device protection plan is material to customer lifetime values), and the consequence of the loss of this profit stream should not be ignored. There’s more to this than the loss of revenues – service margins will be impacted by any move to Apple Card.

In the August 25 Sunday Brief, we suggested an enhancement that would significantly accelerate Apple Card usage and iPhone upgrades: Multiply the Daily Cash savings (we suggest 2x) when it’s applied to your iPhone 0% a.p.r plan. This would shift marginal purchases (especially for multi-line accounts) to the Apple Card (driving up transaction fees and potentially interest charges) while providing the benefit of potentially paying off the device faster. Fully paid devices could encourage additional upgrades and improve customer satisfaction. This would also be more difficult for the wireless carriers (or Samsung) to duplicate.

Five-fold increases in trade-ins with only a partial quarter of measurement… best-ever Apple Care revenues… now Apple Card 0% a.p.r financing and 3% daily cash for 24-months. That would be a lot to digest even if iPhone sales were missing expectations. But, as we will show in a TSB online post in a few days, the iPhone 11/ Pro/ Pro Max inventory levels are still tight heading into the Holiday season. This may not be the time to push the idea of Daily Cash sweeteners. The opportunity, however, is almost too good to pass up.

T-Mobile’s stellar quarter – Only treats from bellevue

Caught between AT&T’s earnings, the HBO Max announcement, and Apple’s surprise financing offer was the continued strong performance of T-Mobile. They reported the following:

- 754,000 branded postpaid phone net additions (versus 101,000 for AT&T – see above – and 239,000 for Verizon). Most importantly, T-Mobile’s net additions beat Comcast + Charter’s combined figure of 453,000.

- Branded postpaid monthly phone churn of 0.89% (versus 0.95% at AT&T and 0.79% at Verizon)

- Service revenue growth of 6% (versus 0.7% total mobility services growth at AT&T and 1.83% at Verizon)

We were very close to our early September estimates of 205 million POPs covered by 600 MHz (200 million actual) and 235 million POPs cleared (231 million actual). T-Mobile also updated their estimate of POPs cleared by the end of 2019 to 275 million, slightly down from previous guidance of 280 million.

We think that the addition of 100-110 million new POPs in the second half of 2019 provides plenty of room to grow even without Sprint. Also, T-Mobile’s total debt (including debt to Deutsche Telekom) is down to $25.5 billion from $27.5 billion at the end of 2019, and the resulting debt to EBITDA ratio stands at 2.0x, down from 2.3x in 3Q 2019.

We will have a full readout of T-Mobile’s earnings in next week’s TSB (which should be viewed against Sprint’s earnings due Monday and T-Mobile’s special Uncarrier announcement this Thursday).

Bottom line: T-Mobile had a spectacular quarter, outpacing AT&T and Verizon in nearly all consumer metrics and is well prepared to thrive in a post-merger environment. We still anticipate a settlement of the AG lawsuit in the next month or so, but believe that a trial outcome is likely to be found in T-Mobile’s favor for reasons stated in previous TSBs.

That’s it for this week. As mentioned earlier, we will be posting the latest Apple inventory charts to www.sundaybrief.com in the next day or so. Next week, we have Sprint and CenturyLink earnings as well as the T-Mobile Uncarrier announcement to cover. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list.

Have a terrific week… and GO CHIEFS!