Satellite connectivity, spurred by new projects from the likes of Amazon and SpaceX, will support 24 million IoT connections by 2024, bringing new competition to established IoT technologies like LoRaWAN, Sigfox and NB-IoT.

While the burgeoning IoT market scratches it head at the array of ground-based low-power wide-area (LPWA) connectivity options, new space-based satellites will start to take rapid share in the next years.

ABI Reseach says satellites in ‘low earth orbit’ (LEO), with an altitude of 2,000 kilometres or less, will be the foundation for a “new wave of IoT investment”, provide a complement to terrestrial cellular and non-cellular networks in remote locations.

IoT communications based on LEO satellites will find success in agriculture and asset tracking, notably in aritime and aviation tracking, it reckons. This is because of the lack of terrestrial infrastructure for IoT communcations for such remote use cases.

Indeed, terrestrial cellular networks only cover 20 per cent of the Earth’s surface, while satellite networks can, potentially, cover the entire planet. And LEO satellites will afford an alternative even where coverage exists from LoRaWAN, Sigfox, NB-IoT, and other LPWA technologies.

But what is an LEO, satellite, and why the excitement in the IoT industry?

A low earth orbit is an earth-centred orbit that extends to an altitude of between 160 kilometres and 2,000 kilometres from the earth. LEO satellites move quickly – with an orbital period (the time to complete one orbit of the earth) of 128 minutes or less (11.25 periods per day), and an orbital eccentricity (how much the Kepler orbit deviates from a perfect circle) of 0.25 or less, defined as an elliptical orbit.

They require less energy for placement and less power for transmissions, than higher-altitude equivalents; they also provide higher bandwidth and lower latency communications. Because they move, they can provide global coverage; interconnected LEO satellites create a space-based optical mesh network, where data can be routed between, satellite to satellite.

Low earth orbit should not be confused with medium earth orbit (MEO), supporting satellites at between 2,000 kilometres and 35,786 kilometres above Earth. MEO satellites are visible for longer orbital periods, usually between two and eight hours. They also have a larger coverage area, meaning fewer are needed in an MEO network.

LEO should not be confused with geosynchronous equatorial orbit (GEO), either, used for delivering radio and television. GEO satellites, or geostationary satellites, appear fixed as they move at the same angular velocity as the Earth and orbit, at (exactly) 35,786 kilometres above the Earth’s surface, along a path parallel to Earth’s rotation, providing coverage to a specific area.

Because they appear fixed in relation to the Earth, and because of the curvature of the Earth at such altitudes, GEO satellites provide neither global coverage nor continuous service above or below about +/- 70 degrees latitude. And their distance means far longer time delays and much weaker signals than MEO-based satellites – which, in turn, are limited in terms of throughput and latency, compared with LEO satellites.

For many, LEO satellites present a means to connect machines, or ‘things’, on a global scale, in every terrain, for the first time. Lower orbits also aid remote sensing because of the added detail that can be gained.

The International Space Station orbits at between 350 kilometres and 420 kilometres above the Earth. The Hubble Space Telescope orbits at about 540 kilometres. The two biggest LEO constellations are from Iridium and Globalstar, which have launched 66 and 24 satellites, respectively. Iridium orbits at about 780 kilometres.

But traditional satellite providers are facing competition from “start-up constellations” from Amazon and SpaceX, among others, launching LEO satellites.

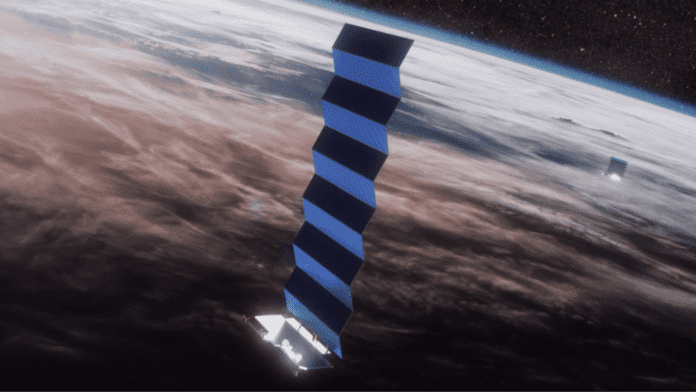

Amazon’s so-called Project Kuiper sets out a plan to launch a constellation of 3,236 LEO satellites to provide connectivity to “unserved and underserved communities around the world”, according to reports. SpaceX, Elon Musk’s “aerospace manufacturer and space transportation services company”, has already at least 60 so-called Starlink satellites.

ABI Research comments: “The conventional satellite providers will not only have to consider driving their prices down to become more competitive than the newcomers but also be sure they stay relevant within the market. Once the market becomes more successful and has matured, the pricing strategies will drop overall, allowing the satellite IoT connectivity options to compete against terrestrial connectivity options.”

Among recent initiatives, Semtech, author and owner of the LoRa technology, has said the first phase of testing of satellite-connected LoRa comms has finished. Semtech has collaborated with UK and Netherlands satellite IoT company Lacuna Space for two years to extend LoRa connectivity to the whole planet.

The pair have been working to evolve LoRa to enable direct communication from LoRa devices to satellite gateways utilising the LoRaWAN protocol, they said.

Meanwhile, LPWA rival Ingenu has announced deals with global satellite operators to install its RPMA technology in LEO satellite systems, to enhance coverage for rural and out-of-reach areas, notably for the mining, oil and gas, maritime, and agircultural sectors. The use of DSSS with RPMA technology makes RPMA the ideal IoT technology for LEO systems by mitigating the doppler efect, it said.

As well, Iridium has been working with Amazon Web Services (AWS) to develop a new service dubbed Iridium Cloud Connect, a satellite cloud-based solution offering global coverage for IoT applications.

Iridium IoT services are available with AWS IoT, extending the reach of AWS’s suite of services to the more than 80 per cent of the planet that lacks cellular coverage, Iridium said. Iridium customers will be able to take advantage of AWS IoT, while existing AWS customers will have a new way to expand their geographic IoT footprint globally.

Finally, Swiss space start-up Else continues to receive funding for its so-called Astrocast LEO constellation for IoT communications, from the likes of Airbus Ventures. Else is planning to launch 64 nanosatellites by 2021. The Astrocast constellation will drive cost advantages for various sectors looking to take advantage of sensor-basec communications, including retail, agriculture, automotive, transportation, logistics, utilities, maritime, oil and gas, among others.