The radio frequency environment in which wireless networks and devices operate is incredibly complex — and completely invisible. But what if instead of sending out teams for drive-testing to get a snapshot of that RF environment on a given day in a given place, you could pull up a dynamic map that showed links, congested areas, coverage holes and other features as layers of information, down to moment-by-moment changes?

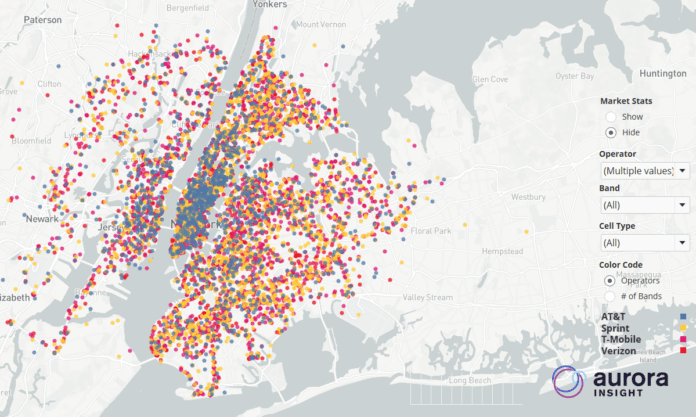

Aurora Insights is a start-up that began with the idea of better information for RF planning through “dynamic mapping” for RF and RF links, according to CEO and co-founder Brian Mengwasser. He compares traditional drive-testing to having a “camera” on the roads each day, taking pictures of specific areas and situations that are of interest to individual customers. Aurora Insights wants to provide a broader and more dynamic map of the RF environment.

The company says it is already providing RF environment and spectrum utilization information in four countries, via a network of automated sensors. Mengwasser told RCR Wireless News that his company aims to map the “entire useful range of radio spectrum,” and that currently it covers spectrum through 6 GHz, and will be including millimeter wave frequencies from 24 to 40 GHz.

He says that the base layer of Aurora Insight’s Ion product is “analogous to Google Maps” for wirelessconnectivity, providing dynamic visualization of the radio frequency environment and how it is being utilized, and that additional layers of information can be added on for more insights.

Aurora Insights gets that information via a network of fixed and mobile automated sensors, which Mengwasser says are about the size of an external hard drive, but “more powerful than most test and measurement equipment that you could put in the back of a car.”

In October, Aurora Insights announced that it had raised $18 million in funding from a series of venture groups, with the round led by Alsop Louie Partners and True Ventures and with Tippet Venture Partners, Revolution’s Rise of the Rest Seed Fund, Promus Ventures, Alumni Ventures Group, ValueStream Ventures, and Intellectus Partners participating. The company plans to use the funding to scale deployment of what it’s calling a “data-as-a-service offering,” and Mengwasser said that much of it will go into research and development as well.

“The boundaries of wireless are being redrawn,” said Mengwasser, Aurora Insight co-founder and CEO, in a statement at the time of the funding announcement. “It’s not just about phones anymore. Buildings have become base stations, factories operate their own LTE and 5G networks, and connected cars have five integrated receivers for different networks. Our customers don’t have the time or money to deploy fleets of trucks and spectrum analyzers to determine if their wireless solutions are going to work. We enable more companies to design-to-reality and get more out of limited spectrum, which is part of everyone’s technology stack now.”

Aurora currently works mostly with stakeholders such as companies which are investing in infrastructure or companies which are building applications on top of such infrastructure, Mengwasser said. He went on to say that in a world of 5G, CBRS and other new wireless technologies, it is becoming increasingly important to application companies to know whether or not their app will perform well, and where. But those companies often can’t afford, or don’t have the know-how, to tackle traditional drive-testing.

Meanwhile, he added, CBRS is offering up an alternative value proposition and way for enterprises to think about wireless networks. Businesses, too, may not be willing or able to conduct typical drive-testing on their own private networks, but they will still need a source of information about the local RF environment as they do the necessary planning or decide whether to deploy a private network at a particular location, or consider just how far the network edge of available connectivity extends currently versus their needs. Aurora Insights hopes to be a source for that data.

Thirdly, Mengwasser said, current information about the the local RF environment is likely to become even more important as spectrum sharing becomes a more dominant paradigm, and as deployed network technologies become more complicated. For instance, he said, network operators will want to know more about how multi-path is playing out as 5G deployments move into higher frequency bands, and how effectively multiple-input-multiple-output (MIMO) is working in a given area. Something as routine as a new building going up could have major impacts on the Radio Access Network. And in a world of new, 5G networks going up, where does coverage actually exist? (Aurora used its sensor network in the very early days of Verizon’s 5G Home deployment in Sacramento in the fall of 2018 to pinpoint some of the available coverage.) Additionally, new types of end-points such as connected cars will have to figure out how to operate across multiple networks available in a given place, with performance needs taken into consideration. In addition to new players coming into the wireless space to take advantage of emerging connectivity types and use cases, he noted, there are also going to be more companies which have operated in their own spectrum, who will have to figure out how to deal with each other in a world of shared spectrum operations — such as both satellite and terrestrial operations in the C Band, and LTE operating in unlicensed frequencies.

“We’re seeing more and more convergence,” Mengwasser said. “We’re blurring the lines a little bit, which is ultimately going to be a healthy thing, but a lot of the companies don’t know a lot about each other.” That is another area which Aurora aims to impact, he said: becoming a common reference point for the wide, and increasing, variety of companies who must share the RF environment.