LTE’s introduction a decade ago and its development as the definitive 4G mobile communications standard which predominates in smartphones is an outstanding accomplishment. Competition has served technology innovators, manufacturers, mobile network operators, over-the-top service providers and end-users extremely well. Markets have functioned and advanced superbly with a vibrant supply ecosystem and providing 4.1 billion LTE connections out of 9.4 billion in total worldwide. In the U.S., 63 percent of the nation’s 479 million mobile connections use LTE.

Despite overwhelming evidence of this extraordinary and widespread success, some allege that illegal and anticompetitive practices have caused significant harms including suppressed innovation, market exclusion and excessive pricing. While legal arguments and economic theories are extensively articulated by the parties and their amici in the US Federal Trade Commission’s antitrust action against Qualcomm—with this case still on appeal following the Northern California District Court’s ruling against the latter—my analysis here focuses on market and economic facts and figures in innovation, competition and consumer welfare over the last decade with LTE. While there is no evidence of those negative effects, there is proof of commercial failure by the alleged principal injured party, Intel, due to its poor strategic judgment and inability to keep up with the exacting technical pace of a most fiercely competitive marketplace in smartphone chips.

Antitrust law is to ensure competitive processes are preserved, not that competitors are protected. High prices are not per se illegal because they provide incentive for increased competition, such as from new market entrants and lower-cost innovations. Suppliers that are inefficient in terms of costs, quality or speed-to-market versus competitors should not be protected from their failings.

Every new decade, a new G

A new generation of mobile technology is introduced approximately every 10 years. As the new decade turns, it is most opportune to assess how well LTE has exceeded all expectations, and what has made this possible, since its first introduction around the turn of the previous decade. Were concerns about introduction of yet another new G—including the need to invest in a network overlay, more spectrum, replace devices and pay additional patent license fees—well founded or needless?

Many MNOs, particularly in Europe, were very disappointed with their transitions to 3G in the early 2000s, due to high spectrum costs and initially disappointing demand for new data services. Conversely, in the US, AT&T waited until availability of mobile broadband with HSDPA in 2005 and deployed this on its existing spectrum. With exclusivity over iPhones in the US, its network became overloaded and in dire need of capacity expansion by around the end of the decade.

The very first commercial launches of LTE were in Scandinavia by TeliaSonera in late 2009. Following several more launches in 2010, the new standard was most significantly established with its introduction by Verizon at the end of that year and by AT&T in 2011. Both of those MNOs largely deployed LTE initially in new spectrum at 700MHz. It provided great coverage, together with much improved data speeds and network capacity. That was just the beginning for LTE.

Consumer demand surges with smartphones and LTE

While press and consumer attention in the smartphone and mobile broadband revolution over the last decade or so is mostly with device OEMs including Apple and Samsung, the increases in communications performance have largely been down to others in their technology development and through chip component and network equipment supply, together with network deployments by the MNOs.

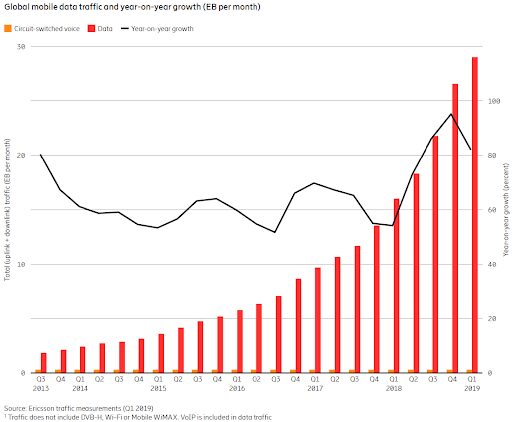

While mobile broadband data initially grew from a low base at a fast rate using 3G technologies CDMA EV-DO and HSDPA from the mid 2000s—with most demand from PC data cards and dongles— that exponential trajectory has been maintained with data growth compounding at around 60 percent or more annually for the last decade.

Mobile broadband data consumption has grown enormously in recent years

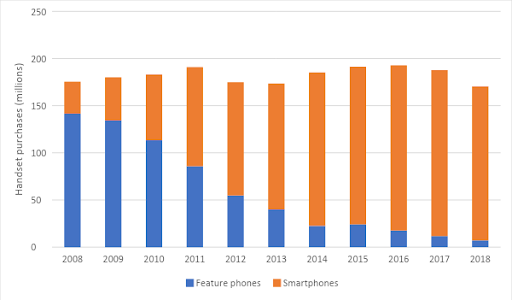

This was significantly due to the rapid adoption of smartphones following the introduction of the iPhone 3G and the first Android device in 2008. Smartphones embodied a variety of innovative new technologies including applications processing, displays and sensors. Improved communications with LTE, in conjunction with an increasing supply of licensed spectrum for mobile, were perfectly placed to accommodate demand growth. The first Android smartphone with LTE was launched in 2010 and Apple’s first LTE smartphone was the iPhone 5 in 2012. It took less than a decade for smartphones to overwhelmingly substitute for featurephones.

Smartphones predominate in U.S. handset purchases since 2011

Market dominance and concentration in supply

Other measures commonly used to assess economic efficiency in antitrust investigations also indicate that mobile technology markets are healthy and dynamic.

Some industries are inherently and necessarily highly concentrated. For example, Boeing and Airbus have a duopoly in supply of large commercial aircraft. The number of suppliers and the relative positions among them reflect industry economies of scale, barriers to entry, strategic focus and competitive strengths in execution with customers purchasing largely based on technical specifications, cost and delivery performance. Trends in market concentration over several years are very informative about how market competition is developing.

The supply of mobile handsets including smartphones has remained unconcentrated for many years because merchant supply of highly standardized components and open standards in cellular technologies have reduced barriers to market entry to low levels. In the 2000s, Nokia dominated with a vertically integrated supply chain, up to 40 percent market share in handsets and even higher in the high-end devices that were precursors to modern smartphones. Since smartphones became mainstream in the 2010s, there have been many new market entrant OEMs and the positions of some leading incumbents including Nokia and BlackBerry have collapsed due to competition.

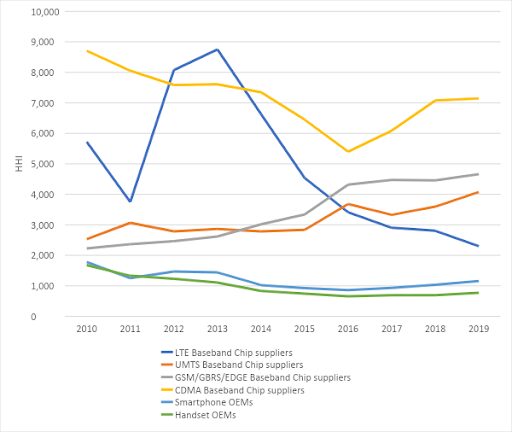

Concentration is inevitably rather higher in baseband modem chips than in mobile phones, because supply is rather different than in handsets including much higher barriers to entry with R&D requirements and economies of scale in product design and production. While some modem chip vendors have exited the marketplace in the last decade, MediaTek’s share of LTE modem chip sales rose to 24 percent in 2016 before falling with significantly rising shares for vertically integrated suppliers Samsung and Huawei with its HiSilicon division. Large shifts in market share away from leaders and rapid reductions in concentration indicate intense competition.

The extent of concentration in supply can be quantified by reference to the Herfindahl-Hirschman Index, a widely accepted measure of market concentration in competition analysis. The HHI is calculated by summing the squared market shares of all firms in any given market. U.S. antitrust authorities generally classify markets into three types: Unconcentrated (HHI < 1,500), Moderately Concentrated (1,500 < HHI < 2,500), and Highly Concentrated (HHI > 2,500).

High concentration in LTE modem chip supply was very transient. Concentration in new market segments is likely to be high as the first few suppliers enter. Between 2013 to 2016, LTE modem chip supply concentration trended down to lower levels than in the UMTS, GSM/GPRS and CDMA chip segments. LTE supply concentration has fallen to a Moderately Concentrated level and Qualcomm now accounts for less than 40 percent share. In contrast, UMTS (i.e. WCDMA/HSDPA) and GSM/GPRS/EDGE modem chip supply concentration has increased as MediaTek’s shares have grown to exceed 50 percent in each of these market segments while Qualcomm’s shares have diminished to only a few percent in UMTS and zero percent in GSM/GPRS/EDGE. While the FTC also alleges that Qualcomm has illegally dominated CDMA chip supply, since 2017 it is VIA Telecom (acquired by Intel in 2015) that has the highest share of this market segment and largely accounts for the high and increasing HHI in this market segment.

Market concentration in supply of baseband modem chips and handsets including smartphones

Qualcomm has excelled in bringing the latest advanced features to market most rapidly, as has MediaTek with mid-range, low-cost solutions and VIA Telecom has focused on CDMA.

A lot more bang for your buck

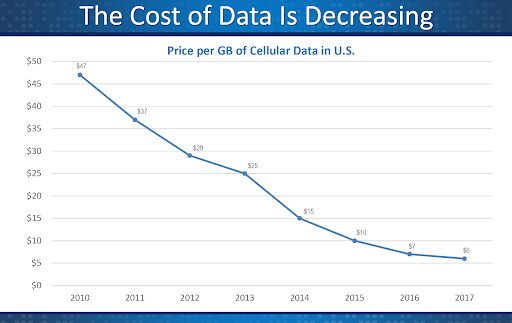

Meanwhile, consumer prices—measured in dollars or whatever currency prevails nationally per gigabyte of data—have fallen dramatically to a small fraction of levels around the turn of the last decade, as is evident in the US. This has been due to the low costs of LTE technology and fierce competition throughout the value chain.

Source: Qualcomm’s Opening Statement presentation, p29, at trial on April 16, 2019. In Re: Qualcomm litigation Case No. 3:17cv0108-GPC-MDD (S.D. Cal.)

“I skate to where the puck is going to be, not where it has been”—Wayne Gretzky

Surviving, let alone winning in industry sectors with rapid technological change and major investment requirements is not easy. Sound strategic and commercial judgment as well as a modicum of good luck are as important as technical competence. Intel’s various incoherent forays in cellular chips make a pertinent case study in strategic failure, not of abuse by a much smaller company.

Each generation of mobile technology is commonly portrayed and perceived—particularly in hindsight—as a single entity. However, with a new 3GPP standard release every year or two, LTE was first specified in Release 8 (2009) and then improved with increased functionality and performance six times before 5G was first standardized in Release 15. Whereas LTE and 4G are now universally regarded synonymous, it was only with Release 10 (2011) that LTE became compliant with ITU’s IMT Advanced specifications which are generally regarded as defining 4G. LTE Advanced Pro in Release 13 (2016) was another significant performance upgrade milestone.

Numerous technological improvements in LTE’s introduction and continuous development have increased spectral efficiency, spectrum reuse, data speeds, network capacity, reduced latency and also provided entirely new capabilities. Improvements include the OFDMA waveform, carrier aggregation, MIMO, advanced channel coding, higher order modulation, use of unlicensed spectrum and improved positioning technologies.

Standards setting organizations map out, for all to see, which new features will be introduced in each new standard release. That is very helpful for product developers, but so much resulting from the collaboration among SSO participants and appearing in the standards means chip and network equipment vendors are chasing multiple moving targets. The general direction of travel might seem obvious in hindsight, but fast pace and good judgment with selection and commitment to the most important improvements are essential. Some features turn out to be much more important than others. While device OEMs design and manufacture smartphones, it is largely the modem chip vendors and network equipment OEMs that have developed and supplied the technologies and products that implement or enable MNOs and users to benefit from latest standard-based improvements.

Leaders must not only be the fastest to invent and bring to market, they must also know where and when to place their big bets. Those that make the wrong call will suffer significant adverse consequences with exacting requirements from OEMs and their MNO customers.

Self-harm

While Intel its portrayed as the major injured party in the FTC’s case against Qualcomm, Intel failed in modems for several significant reasons at Apple and elsewhere, despite its deep pockets, position as a leading semiconductor chip designer and silicon fabricator. It even squandered the advantages of its incumbency as the sole modem chip supplier to Apple for iPhones and iPads from 2007 until 2011, while also being, in that period and continuing to be ever since, Apple’s sole supplier of CPUs for its Mac computers.

Intel failed to recognize the (mis)match between what it was pushing and what OEMs wanted. It foreclosed itself from all but a relatively small proportion of the LTE modem chip market segment. Most smartphones include chips that integrate the baseband modem processor with an application processor that is based on the ARM instruction set and architecture. There was never a distinct “thin modem” market—in the sense of defining a relevant market for competition purposes. Modem suppliers need to address the entire market segment of modem supply—including thin and integrated modems—to be efficient in development and production of technologies and products. The proportion of thin versus integrated modems in smartphones has fallen from around 40 percent in 2011, when most smartphone OEMs were just getting started, to only teens of percent in the last few years.

Intel has offered no ARM-based application processor since it sold its XScale business to Marvell in 2006. It failed in its alternative strategy with attempts to get its “Intel Architecture-based [X.86] processors” adopted in smartphones and tablets. Its x.86-based Atom application processor was uncompetitive for many reasons including higher power consumption and its inferior supply ecosystem with higher costs for the associated components needed to support the chip. Intel fared poorly despite spending billions on subsidies in its attempts to build a mobile device beachhead in tablets. It never achieved any more than a small share of supply to tablet OEMs and no more than a trivial share of supply to smartphone OEMs.

Intel captured Apple, as Apple’s sole 3G modem supplier for iPhones, when Intel re-entered the market with its acquisition on Infineon’s cellular chip division in August 2010. However, Infineon would have known by then— as Intel should have also known through its acquisition due diligence, if that had been carried out thoroughly and competently—that modem business was about to be lost with the upcoming February 2011 launch of an iPhone 4 model based on a Qualcomm chip. Intel’s other 3G thin modem customers included Samsung and Huawei that subsequently have significantly switched to vertically integrated supply. Apple aside, Intel’s share in LTE supply was never more than a percent or two. Bad luck or poor market intelligence, judgment and execution?

Intel was too late in finding its voice

Having been ejected from Apple in 3G, Intel was very anxious to get back in there with LTE. But it failed to keep up with the pace of standard-based developments in LTE. Intel was late with LTE-Advanced (i.e. actual 4G) improvements and was at least two years late in being able to offer voice over LTE. LTE had no voice capability before VoLTE was standardized. Leading mobile operators—including AT&T and Verizon in the US—demand certain features in devices to exacting schedules. For example, with major operators including T-Mobile US and Verizon launching VoLTE services by 2014, they were insisting on VoLTE in new phone models beforehand. This was significantly driven by their desires to seed the market for use of the new service and so that they could shut down older-generation networks, such Verizon’s CDMA network by the end of 2019. Despite the above efforts, this date has slipped to 2020 to avoid leaving customers with phones that cannot make phone calls.

Many devices are used on networks for more than five years following new model introduction. Popular models are commonly sold for more than three years before being withdrawn from sale. For example, Verizon is still selling the iPhone 6s (2015) and Galaxy S7 (2016). The last of those sold are likely to be used for another few years before being retired.

It was not until 2016, with chip supply for launch of the iPhone 7 in September that year, that Intel could meet voice specification requirements of Apple and its MNO customers in LTE. In contrast, Metro PCS launched VoLTE with the LGE Connect 4G in January 2012 and VoLTE was incorporated in the iPhone 6 (September 2014). Qualcomm LTE modems were included in both devices.

What was he smoking?

In addition to strategic conflicts, Intel also suffered from delusions at the highest level. For example, despite Intel not being able even to do voice in LTE, in 2016, former Intel CEO Brian Krzanich proclaimed that Intel was the leader in 5G, including in modem technology. This was way off the mark. In fact, the main reason Intel exited modem supply, announced by replacement CEO Bob Swan in April 2019, and why Apple settled all its litigation with Qualcomm the very same day, was that Intel could not keep up the required pace and schedule in its 5G technology developments. Apple was clearly fearful it would not be ready to introduce 5G iPhone devices in 2020 without switching back to Qualcomm’s supply.

While the period of Qualcomm’s alleged misconduct is only to 2016, the FTC regurgitates the Court’s contention that Qualcomm will remain dominant in the transition to 5G, but without explicitly alleging any abuse there. Qualcomm has clearly competed on the merits in establishing itself as the leader in 5G modem chips. With a new air interface and addition of mmWave bands its astute competitive strategy has included unmatched technology development in modems and acquisition in RF front-end components.

Voodoo economics II

The FTC’s most significant but hotly contested theory of harm, and that the district court has accepted, is that Qualcomm’s royalty charges to OEMs impose a “surcharge” on chip competitors that limits their ability to invest in R&D and makes them unable to compete on the merits such as in technical performance. Why the royalty charge is any different to any other necessary input cost—such as that for the display or battery components—is a mystery. OEMs are charged royalties non-discriminately regardless of modem supplier. According to the FTC’s allegations, and despite evidence to the contrary, Qualcomm’s royalty charges are excessive and are only paid because it supplies “must have” chips and has a “no license, no chips policy.”

That theory suggests that elimination of the alleged surcharge should enable a chip vendor to become competitive. However, Intel still failed despite that supposed relief. It commenced LTE modem chip supply to Apple for the iPhone 7 in 2016 and was the sole modem supplier to Apple for all subsequently launched models, including the iPhone X (2018) and iPhone 11 (2019). By April 2017, royalties paid to Qualcomm on Apple products, including those with Intel’s chips, had ceased and were not resumed until April 2019.

Rather than capitalizing on this window of opportunity, Intel failed on the merits, as indicated by its chip market exit, despite this non-payment of any royalties including the alleged surcharge to Qualcomm. While Intel’s dollar expenditures on R&D had been increased, R&D decreased as a percentage of its rising sales (i.e. including new sales of modems to Apple): $12.7 billion (21.4 percent) in 2016, $13.0 billion (20.8 percent) in 2017 and $13.5 (19.1 percent) in 2018. Based on the FTC’s economic theory, Intel supplying Apple should have had lower costs than other chip suppliers whose customers were still paying Qualcomm royalties. LTE modem chip market segment shares for Huawei (HiSilicon) and Samsung, that also buy Qualcomm chips and pay it licensing fees, have continued to increase since 2016.

Be careful what you wish for and be grateful for what you have

There will always be profits of doom and self-serving interests who predict harms such as market failures if changes are not made. The kinds of accusation made by the FTC about Qualcomm in LTE echo those made against Qualcomm in UMTS, just before mobile broadband with HSDPA took off and before those charges were dropped by the European antitrust authorities.

Prior to the introduction of LTE and for several years subsequently it was alleged that royalty stacking would make the technology prohibitively costly, particularly since LTE royalties would stack on those that had to be paid in multimode equipment including 2G and 3G.

A royalty stack never appeared in 3G and in never appeared in 4G. The only harms are the contentions over patent royalties that are costing a lot in legal fees and are enabling implementers including Apple and others to “efficiently infringe” by holding out from payment while enjoying the benefits of rich standard-based technologies.

As I explained here last month and previously, with patent licensing fees paid less than five percent of handset prices, such costs are dwarfed in comparison with the value that has been created with annual revenues of around half a trillion dollars in handsets, more than a trillion in operator services plus huge revenues to the over-the-top players that have flourished over the last decade in the smartphone and mobile broadband revolution with LTE.

Uber, Instagram, FaceTime and Netflix all launched in 2010 and have, among many other OTT providers, significantly benefitted from LTE’s mobile broadband capabilities. For example, Netflix has enjoyed a 4,000 percent stock rally with its streaming services significantly used on mobile devices. Smartphone OEMs have benefitted from these services because users want devices that can best access these services. Mobile operators benefit because they generate mobile broadband service revenues even from “free” services that are delivered on top. These services are transforming the way we work and play with daily hours of smartphone usage even exceeding TV watching.

Significant ongoing development has been required since introduction of LTE and the first 4G technologies. Whereas coverage and capacity were easily established with the deployment of additional spectrum at 2 GHz and below, there is nowhere near enough spectrum available there to satisfy escalating mobile broadband capacity demands. New technologies including Massive MIMO and HPUE in the latter LTE releases and in 5G are expanding capacity by better exploiting frequencies above 2 GHz. 5G has been designed to access mmWave bands with orders of magnitude more bandwidth than is accessible with previous generations of technology. All this, yet alone what is yet to come with URLCC and mMTC, would not be possible without major ongoing R&D investments. These should not be taken for granted—particularly in the race to establish and maintain global leadership and national security in 5G.