Greetings from Atlanta, GA (Dwarf House, a.k.a. the Original Chick-fil-A restaurant pictured), and Charlotte, NC. This week’s issue will be entirely devoted to the implications of Judge Marrero’s decision (here) on the telecommunications industry. Because of word constraints, we are going to push several TSB Follow-Ups to next week’s issue.

At around 4:30 p.m. ET last Monday, there were signs that something was happening with respect to the case. Just the previous week in a Colorado Wireless Association (COWA) speech, I indicated that, based on the judge’s previous rulings, if a decision came prior to Valentine’s Day, it would be a “box of chocolates” for T-Mobile and Sprint. When Monday’s after-hours trading indicated Sprint’s stock was up 50+%, it could only mean one thing – the deal was on. The Wall Street Journal and The New York Times confirmed the rumor, and the decision linked above was released on Tuesday morning. Lots of relief, smiles and high-fives especially in Bellevue, Berlin, Tokyo and Overland Park.

There are a few remaining items left prior to formal closure of the merger (Tunney Act review, California PUC approval, possible appeal of Judge Marrero’s decision by New York (see article here) and California, and post-announcement renegotiation of the share exchange), but it’s highly likely that we will have a new T-Mobile company sometime between St. Patrick’s Day (March 17) and Easter Monday (April 13).

In this week’s Sunday Brief, we will begin to recap our many merger analyses (here and here and here and here and here and here and here and here) and start to answer the question “How can we tell whether this merger represents a passing shower or a catastrophic hurricane to the telecommunications industry structure and dynamics?”

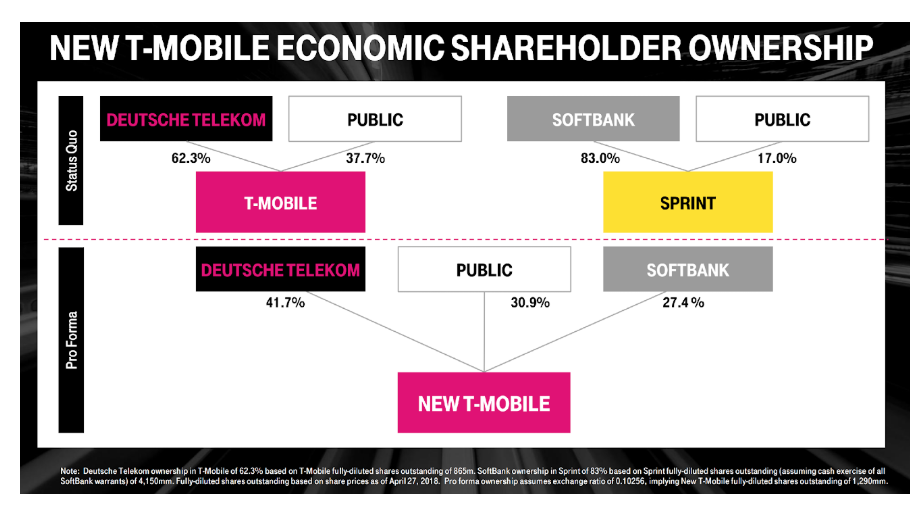

Item #1: T-Mobile’s 2.5 GHz advance prepping

Last September, Braxton Carter, Mike Sievert, and Neville Ray appeared at the Goldman Sachs Communicopia conference (link here – registration required – quote below from Neville Ray begins just after minute 9). It was held at an awkward time (Sept 17, just a few weeks before end of the quarter), so, in lieu of asking questions that Mike or Braxton would have had a hard time answering, the focus turned to the Sprint merger. After a few opportunities to allow Mike and Braxton to reiterate their strong advocacies for New T-Mobile, Brett Feldman, the lead telecom managing director for Goldman, asked the following question: “A key reason for the merger is that by uniting your low-band spectrum with Sprint’s mid-band spectrum, the new T-Mobile is going to be in a position to really aggressively challenge AT&T and Verizon in the 5G market. What are the key ways that you believe new T-Mobile is going to have a 5G network advantage? And how quickly can you factor that into your go-to-market strategy after you close the deal?”

Neville’s response, while lengthy, is quite telling:

“Braxton, Mike and John have authorized me to do some work at risk this year in getting ourselves ready to deploy the 2.5 gigahertz spectrum as soon as the deal closes. Nobody is more impatient for this thing to close than me. I wish I was deploying 2.5 radio on the network right now, but we’ve done work at low cost in terms of securing, permitting, and authorization to deploy 2.5. So as soon as this deal closes, we’re in a position where we can start laying down 2.5 radio on the new T-Mobile network.”

“So, why is that important? Well, one, that allows us to commence and move Sprint customers off of the redundant assets on to the new T-Mobile. That then is the path for us to decommissioning the redundant sites and generating the synergies that have burned the hole in my head. $4 billion run rate on synergies from the network side is a phenomenal opportunity.

“…When we go into that post-close environment, we can start to very rapidly lay down 2.5 gig spectrum and start to deliver a very transformative 5G experience, more sites, a lot more spectrum, and spectral efficiency of 5G. And the combining effect of those three factors allows us to lay down the network that moves from 30 megabits per second today to 400 megabits per second, a transformative increase in speed and capacity, 8x over the term of the program for capacity, 15x for speed. I want to do that as fast as humanly possible.

“…Our intention is, we move ahead of them incredibly quickly, and we start that move ahead in 2020 and it accelerates in 2021. So, this business has been heavily reliant on network brand, the network perception for so long. We still have our work to do on perception. But our opportunity, now we’ve leveled the playing field with those guys on LTE, is in this 5G era with the spectrum assets we have, to rapidly move ahead of AT&T and Verizon.

“And I want those guys to be chasing my network and my team and our execution. And it’s going to be very, very difficult for them to do with the spectrum assets they have in their hands to date to compete with our experience on the network, which is very high speed, and very strong capacity.”

I would highly recommend that you re-listen to the entire interview in the above link to get a perspective on how the New T-Mobile will unfold. What’s important to Neville’s quote above is that the pre-planning moved from a whiteboard to a purchase order (see first sentence in the quote). What was ordered in August has likely been pre-provisioned by today. And it’s likely (just a hunch) that that was not the only purchase order completed.

*? That would certainly increase store and on-line traffic as well as upgrades (ironically, having listened to AT&T and Verizon presentations where they talk about equipment revenue uplift, the real uplift opportunity is at New T-Mobile, at least for low-end Android devices which likely lack Sprint’s 2.5 GHz radio).

*? That would certainly increase store and on-line traffic as well as upgrades (ironically, having listened to AT&T and Verizon presentations where they talk about equipment revenue uplift, the real uplift opportunity is at New T-Mobile, at least for low-end Android devices which likely lack Sprint’s 2.5 GHz radio).

But what good is 400 Mbps if the plan constrains video speeds to 480p (3-4 Mbps)? That’s like drinking a Chick-fil-A milkshake though a coffee stirrer straw. The next step is (at a minimum) 1080p (5-6 Mbps) or better yet UHD (20-25 Mbps) speeds for all video. And a very generous 100-200 GB allowance for every hotspot (for an extra fee).

But what good is 400 Mbps if the plan constrains video speeds to 480p (3-4 Mbps)? That’s like drinking a Chick-fil-A milkshake though a coffee stirrer straw. The next step is (at a minimum) 1080p (5-6 Mbps) or better yet UHD (20-25 Mbps) speeds for all video. And a very generous 100-200 GB allowance for every hotspot (for an extra fee).

The level of 2.5 GHz advance prepping referred to above will directly determine whether New T-Mobile can meaningfully impact 3Q 2020 net additions. My hunch is that the T-Mobile network team has not been idle and that there’s a lot of 2.5 GHz being deployed very quickly.

Bottom line: Don’t be surprised if T-Mobile’s 2.5 GHz rollout seems to occur unusually quickly after the merger closes. We were warned last September. Also, for most Apple and some Android users, the benefits of T-Mobile’s low-band (to current Sprint customers) and Sprint’s mid-band (current T-Mobile customers) will be apparent shortly after close without clunky roaming changes or costly hardware upgrades. This is a different transition than Metro to T-Mobile because there will be far more firmware-only upgrades than hardware changeouts.

Item #2: Enterprise

T-Mobile inherits not only a trough of spectrum with the Sprint acquisition, but hundreds of seasoned enterprise sales executives. As Mike Sievert recently acknowledged in his appearance at the Citi conference a month ago, T-Mobile is under-indexed in enterprise.

Sprint’s enterprise roots are significant, having commanded close to 20% of the enterprise data market as recently as 2006. There are many sales executives who cut their teeth with fleet management solutions (Nextel and Sprint), wireless access solutions (Clearwire and Sprint) and IP MPLS (Sprint).

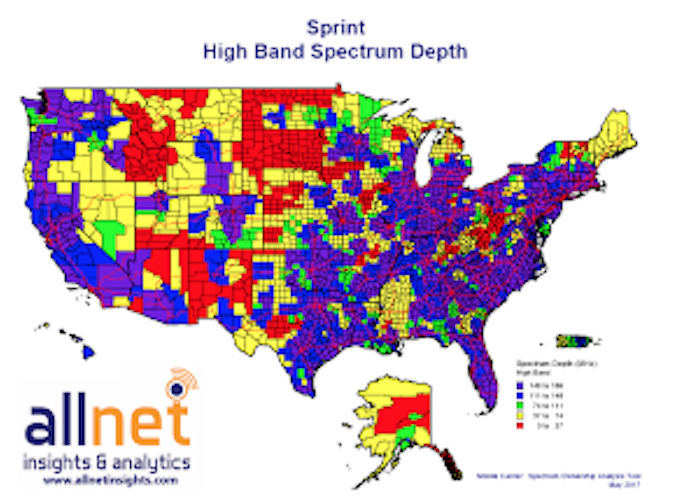

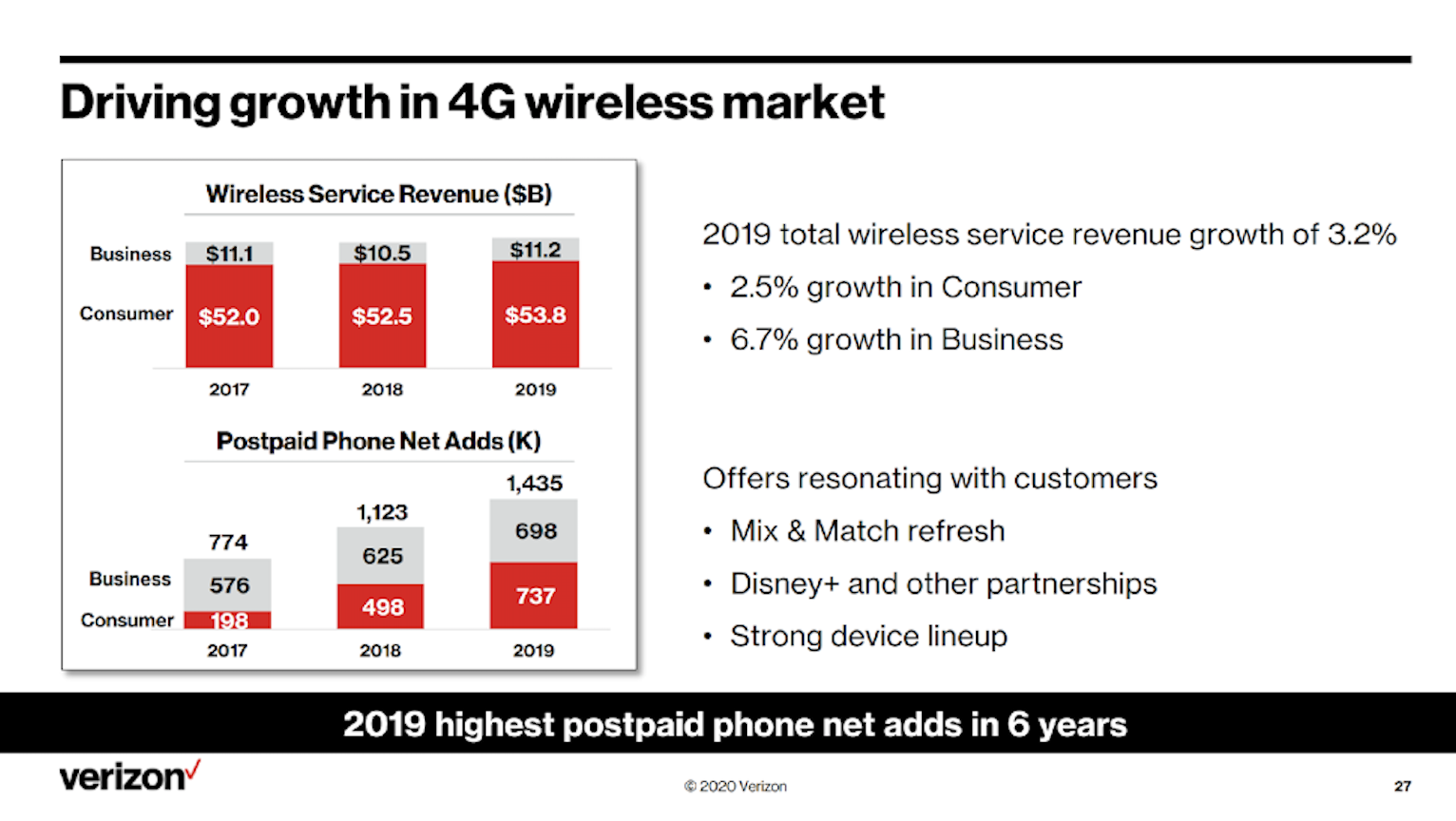

I was reminded of the wireless (and wireline) growth opportunities while I was watching the Verizon webcast. Matt Ellis, Verizon’s CFO, showed this slide during his presentation (we discussed these trends in last week’s TSB):

While service revenues are relatively flat over the 2017-2019 period (re: 2017 was the year Verizon introduced unlimited pricing), Verizon’s Business growth has continued unabated, representing 74% of net additions in 2017, 56% in 2018 and 49% in 2019. And service revenues grew 2.7x faster for the business wireless group than their consumer counterparts. Why? One reason is the business environment has been less competitive than consumer, partly because of the “Sprint jitters” that have started after the Nextel merger integration more than a decade ago. Even with T-Mobile’s gains (largely in the small/ medium business segment), it’s likely that Verizon and a FirstNet-enabled AT&T narrowly beat Magenta in business phone growth in 2019.

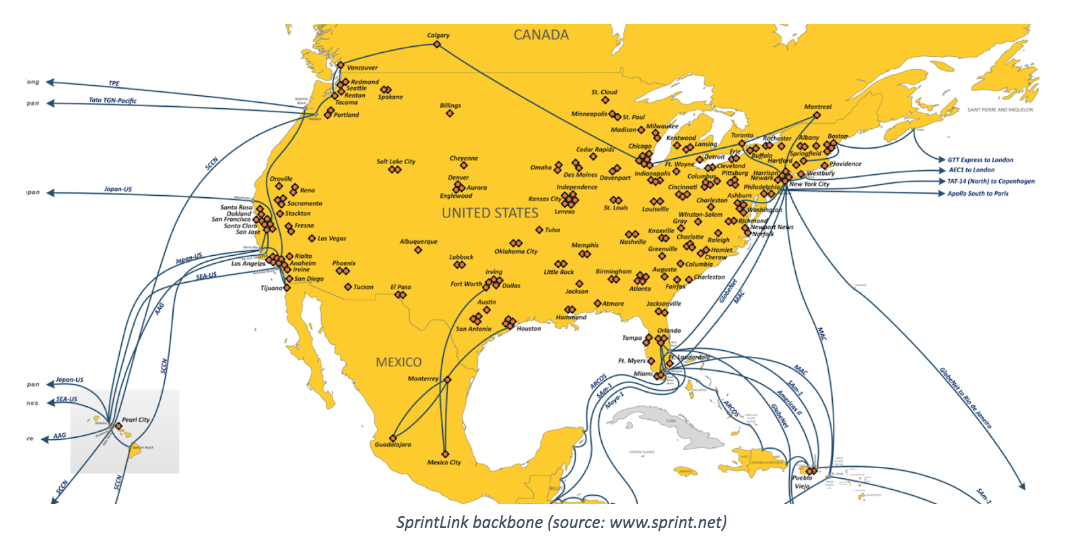

New T-Mobile has healthier balance sheet. They have enough spectrum to truly enable last mile access solutions for branches that, at a minimum, serve as a part of business continuity efforts (especially in rural markets). They now have a Private LTE and IoT story that can, with DT’s and Softbank’s help, add a global dimension. And, while not as strong as in past years, T-Mobile inherits a Tier 1 Global IP backbone called SprintLink (see map below). It’s a big leap for both companies – to a point.

Sprint and T-Mobile lack in-building expertise. One of the cutbacks resulting from the Nextel merger was the extension of Sprint’s Metropolitan Area Network (MAN) infrastructure into office buildings. The presence of in-building fiber (and in-building wireless for Private LTE) would put T-Mobile on the same stage with Verizon and AT&T. This is not going to happen without partnerships (Zayo, Level3, others), some of which might need to come with equity stakes. But in-building and data center expertise is not as robust at the New T-Mobile as it is at their larger peers.

Verizon announced at their Investor Day on Thursday that they had already deployed 30,000 route miles of out-of-territory fiber across 60 markets in their first several quarters of their ambitious One Fiber initiative. They indicated that they probably have several more quarters to go. Those fiber providers that just lost their ability to expand in these 60 metros need to quickly partner with New T-Mobile. It would allow them to provide a better private LTE story and hasten the secular declines of their competitors’ cash-generating legacy wireline businesses.

Bottom line: New T-Mobile needs to leverage the existing enterprise relationships (and rekindle some old ones) to keep Verizon and AT&T honest. It’s going to take partnerships to do this, and, thanks to Verizon’s One Fiber initiative, there are near-term opportunities to grow metro fiber quickly. This may be T-Mobile’s greatest remaining Un-carrier opportunity.

Item #3: Managing the board

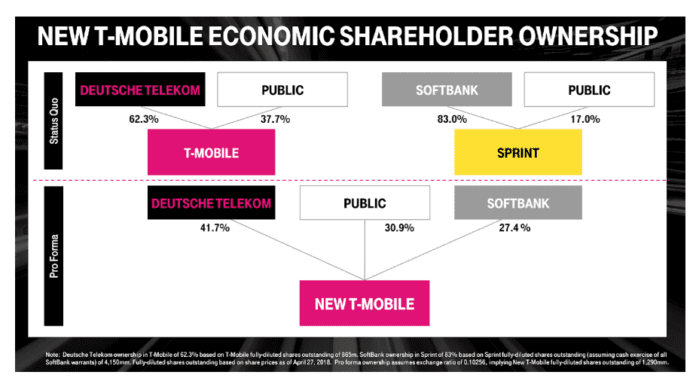

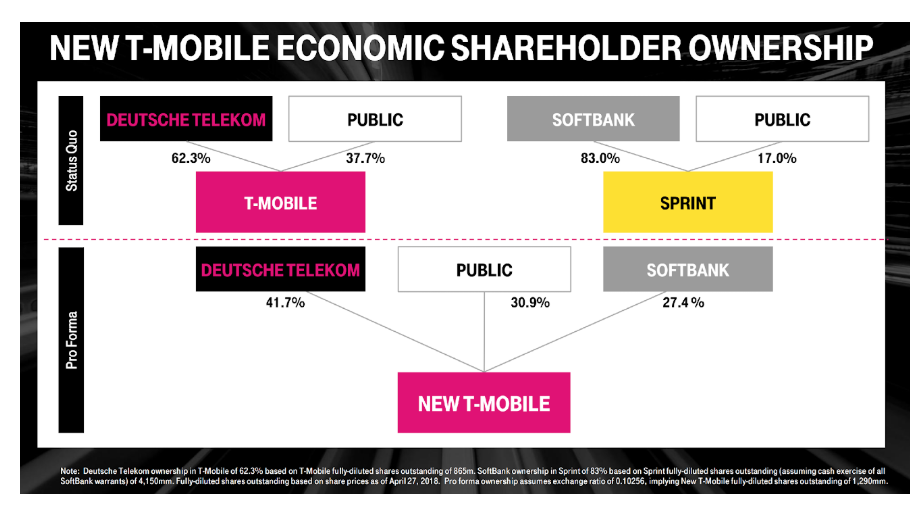

There is no doubt that, even with nearly two years to plan, there will be hiccups, mistakes, and unkept promises. Some of them could be big and create short-term earnings pressure. This is where strong executive leadership including an active and understanding Board comes into play. Just as a reminder, here’s how the structure looks prior to any change in the share exchange terms:

Masa Son is not going away after the transaction closes regardless of the share exchange ratio. He will be the largest shareholder after Deutsche Telekom (DT) and should have the financial capacity to purchase more shares. Clearly, if Softbank and DT are aligned on a strategy for T-Mobile, life will be a lot easier on Mike Sievert and whomever replaces Braxton Carter.

As a background, the new Board will consist of 14 members: Nine from DT (which includes Tim Hottges), Four from Softbank, and Mike Sievert. We have included Tim and Mike below for continuity purposes, but there are plenty to choose from the current T-Mobile USA (TMUS) Board.

From current T-Mobile USA (TMUS) Board, here are the likely candidates:

- Tim Hottges: Current Chairman of TMUS – will remain Chairman of the New T-Mobile

- Mike Sievert: Current COO of TMUS – CEO of New T-Mobile (May 1)

- Mike’s replacement: If the current Board structure holds, Mike’s COO replacement will have a Board seat

- John Legere: Current CEO of TMUS – committed to stay on the New T-Mobile Board

- Braxton Carter: Current CFO of TMUS – hopefully takes a short-term New T-Mobile Board role

- Dr. Christian Illik: Current DT CFO

- Srini Golopan: Joined the TMUS Board last June – Head of DT Europe

- Teresa Taylor: Current TMUS Lead Independent Director

This would leave three additional appointments from the current board (see list here).

From the current Sprint Board, here are the likely candidates:

- Masayoshi Son: Current Chairman of Sprint and Softbank, will be on the Board

- Marcelo Claure: Current non-executive Chairman of Sprint – likely Board member

- Ron Fisher: Current Vice-chairman of Sprint and 25-year Softbank employee

- Stephen Kappes: Former Deputy Director of the CIA, likely needed for NSA designation

- Julius Genachowski: Former FCC Chairman, and current Carlyle Group partner

It’s highly likely that the first four names will be the designees from Softbank. For the rest of the current Sprint board, click here.

Fourteen members that span multiple continents can make for interesting Board dynamics. Hopefully the closing process ends gracefully for both parties, especially since TMUS has already gained $15.5 billion in market capitalization since the beginning of the year ($18.06 per share * 855 million shares), more than all of 2019.

Bottom line: While “Managing the Board” seems like an esoteric (and perhaps academic) topic, business history is filled with examples where boardroom froth results in short-sighted and poorly formulated management performance. Given the four-year share lockup on both DT and Softbank, it’s unlikely that there will be a lot of disagreement, but it’s worth mentioning given the personalities involved.

New T-Mobile could be the biggest telecom event of the decade, and it appears that some pre-planning has set the company up for some quick wins. To best AT&T and Verizon, a balanced business/ consumer strategy is needed which will require new partnerships and potential investments. A united Board + quick wins + business balance = hurricane status for New T-Mobile. AT&T and Verizon missteps will determine the hurricane category.

Next week, we will pick up the remaining uncovered events of this week, including Altice USA and CenturyLink earnings and the Samsung Galaxy G20 announcement (hint: every wireless carrier engineering staff changed their upload requirements when they saw the G20 64/128 MP camera!). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list.

Have a great week – and Go Davidson Wildcat Basketball!

*Without going through all of the details it’s important to note that the Apple iPhone 7 and iPhone 8 (and their variants) have the 2.5 GHz band already installed in the GSM (T-Mobile) version, and that the CDMA (Sprint) version of these devices already has T-Mobile’s Low Band 700 MHz spectrum, a.k.a. Band 12 (and Band 66 in the case of iPhone 8) already enabled. The CDMA version of the iPhone SE also has Band 12 enabled. Bottom line: there is the potential for backwards compatibility within the current handsets. And the iPhone XS (and variants) and iPhone 11 (and variants) are universal devices and include T-Mobile’s 600 MHz band which will be have a big benefit for Sprint customers.