How are we best? In every way, says Huawei, on back of flurry of new innovations for radio, core, and transmission networks to make 5G deployments easier and cheaper.

Huawei’s perceived 12-18 month lead over rival 5G kit vendors stands, the Chinese firm said at at partner and media event in London today, as it unveiled a rush of innovations in its radio, transmission, and core network offers that make new 5G deployments easier, cheaper, and quicker.

Huawei said it has 91 commercial 5G contracts to date, making clear its count is for RAN deals, by operator by region, and there is no double counting for other supply arrangements in the network. Three contracts for the three operators in China, it explained, and three contracts for three operators in the UK. It likes its chances of gaining a fourth in China, as soon as new operator China Broadcasting Network settles on a provider to rollout standalone 5G in 16 cities using in the 4.9GHz band.

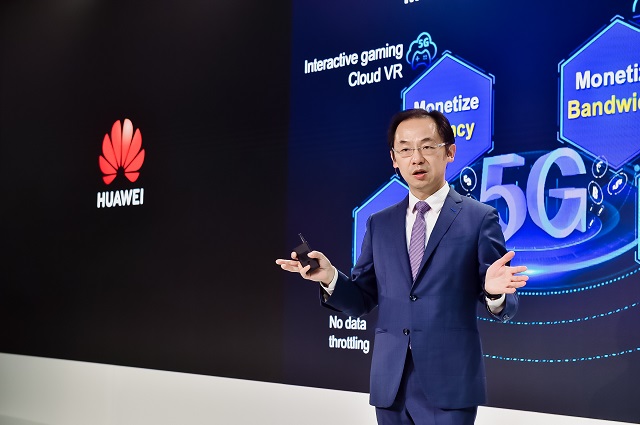

The company has shipped over 600,000 5G Massive MIMO active antenna units (AAUs), it said. “Last year, at this event, I said Huawei is 12-18 months ahead of its competitors,” Ryan Ding, executive director of the board and president of Huawei’s carrier business group, told a room of partners, analysts and media at the London showcase.

“Today, I can say Huweai has still got this leadership,” he said. In a media roundtable, later, in response to a question about where in the network stack Huawei’s lead is strongest, he said simply: “In technology.” Asked to expand, he stated: “In all technology.”

Last week, at its own press event in London, rival firm Ericsson was asked to respond to the same claims, that Huawei leads the 5G network market in terms of hardware and software. It talked about “myth busting”, and maintained no vendor is ahead of it in terms of 5G deployments. It cited 81 commercial 5G contracts, along with 25 live 5G standalone core networks, and over 70 proofs and trials.

But Huawei said it is not alone in trumpeting its technology leadership. “It is not self claimed,” said Ritchie Peng, the company’s chief marketing officer for wireless products, in the same roundtable session. “We are told by customers that, in some markets, our solutions are 12-18 months ahead. And the reason they say that is because we provide the products they want.”

Ding said the company put in around $18 billion into research and development in 2019, up from closer $15 billion in 2018. The point, he said, is it is about as much as most of the company’s rivals combined. Huawei’s new innovations appear comprehensive, across the radio, core, and transmission networks. The London session sought to clear the daylight between the firm and its rivals.

Summing up the company’s strides forward on 5G gear, Ding remarked: “We can just lay these features on the table, and wait to see when others can match [them]. We will be happy to see if any of our competitors is ahead in terms of features and products. I would welcome such healthy competition.”

The new 5G products include the industry’s lightest Massive MIMO antenna, the most highly-integrated AAU, plus a 400 MHz ultra-wideband AAU. The innovation is to simplify 5G RAN deployments, and to make kit installations and site acquisitions easier and cheaper, and also to help operators, particularly in Europe, to manage fragmented spectrum allocations.

The new third-generation Massive MIMO antenna, supporting 64T64R, is the industry’s lightest, at 25kg, said Huawei. “Operators don’t need cranes [anymore] to install base stations. A healthy man can bring these [to the site],” said Ding in the conference session.

Peng Song, president of marketing and solution sales in Huawei’s carrier group, said in a keynote: “It only takes two hours to install one AAU; the record is 3,000 sites in one month in South Korea. No crane is needed, no additional manpower. It will save $300 per site.”

As well, the new Blade AAU supports active and passive integration under all sub-6 GHz frequency bands, from 700 MHz to 4.9 GHz, to support all generations of cellular, from 2G through 5G, and significantly shorten the time required for site acquisition. “One product, one box,” remarked Ding. “[It is] very valuable for operators, especially for big cities, in metropolitan areas.”

He said later: “We are the only vendor that has this as a solution to this problem. We are the only vendor that has this 25 kg product, to [be able to] deploy 5G conveniently and with low installation cost.”

Besides, Huawei showed a new 400 MHz ultra-wideband AAU, with support for carrier aggregation and the largest output power, of up to 320 watts, of any antenna unit, boosting cell coverage by 35 per cent, compared with previous products. “[It] is an entire generation ahead of the rest of the industry,” the company stated in its press announcement.

Ding commented: “Resources are fragmented, especially in Europe; operators are looking to do RAN sharing. So 400 MHz will become the most valuable solution. It won’t just save costs; [where] most operators need two or three AAUs from competitors, they only need one from us, with support for all 400 MHz of spectrum.”

Its new 5G radio units utilize 15 per cent less power than rival products, plus AI power-saving for multi-standard, multi-frequency-band coordination to save another 15-20 per cent. Huawei is offering self-learning power consumption, too, which switches between grid power and on-mast solar and wind generators, depending the weather. Vodafone Greece has claimed a 50 per cent energy reduction using the weather-reading AI, it claimed.

There was more from the Chinese firm, too. Its new FlexE-based 5G slicing solution affords the industry’s highest slicing precision, at 1 Gbps, it claimed. “This is five times the industry average,” it said. It means best-effort IP networks can be transformed into “committable IP networks”, which cut independent slices for high value services – “like dedicated lanes on the road, so emergency vehicles can pass traffic jams”, said Song.

In effect, critical communications and high-value industry can, now, rely on operators to underwrite slices of their public networks. “Because today’s IP networks cannot meet the requirements of vertical industries. And vertical industries cannot rely just on best-effort [networks]. They need service-level agreements to be committed,” he said.

The solution also utilizes in-situ Flow Information Telemetry (iFIT), meaning faults can be located in minutes and the network is highly available. Song described the mechanism as “like Google Maps”, where network data, like networked devices, is tagged to report latency, traffic status, and any blockages on the road.

The last big reveal in London was the company’s 800G optical module from Huawei-owned Hi-Silicon, providing a transmission capacity of 48 Tbps on a single optical fiber, 40 per cent higher than the industry average, according to its author. “This will ensure the transport network can evolve smoothly over the next 10 years,” it said in a statement..

Song commented: “In 2023, forecasts say overall [cellular] traffic will be three times higher than in 2019. Traditional transport networks cannot support the ultra-high rise from 200 Mbps to 800 Mbps – just like traditional railways can’t support high-speed trains. And in terms of high speed trains, we are first to launch an 800G optical module, which can provide industry’s largest single fiber capacity – which means downloading 100 4K movies in one second.”